Welfare Effect of Closing Loopholes in the Dividend-Withholding Tax: The Case of Cum-Cum and Cum-Ex Transactions

Banks’ country-by-country reporting

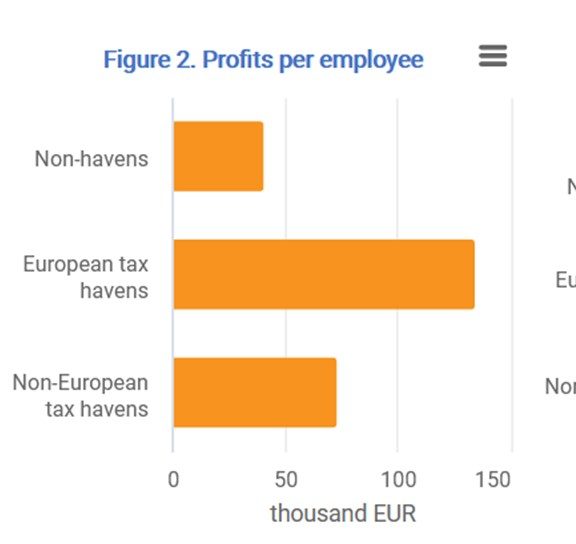

According to the Capital Requirements Directive IV of the European Union, all EU banking groups with a consolidated turnover above €750 million are required to publicly disclose tax payments, profits, and economic activity consolidated for each country in which they operate. The resulting public Country-by-Country Reports (CbCRs) of banks provide an unprecedented data source to study banks’ use of tax havens and their effective tax rates worldwide.

Barake (2022), Aliprandi et al. (2021) and Barake (2020) collected these CbCRs for 36 multinational banks headquartered in 11 EU countries and operating in up to 90 jurisdictions worldwide. The dataset covers the period 2014 – 2020 and includes, for each bank: the turnover, the number of employees, the profit or loss before tax, tax on profit or loss, and public subsidies received.

About the dataset

- Number of observations by country

- Reporting banks and their total global earnings

- Banks' global effective tax rates

Access to the data

Download the full banks’ CbCR dataset [xlsx].

Download explanatory notes [PDF].

Recent studies based on Banks’ CbCR

Aliprandi et al. 2021 (read more); Fatica & Gregori 2021 (read more); Bouvatier, Capelle-Blancard and Delatte 2020 (go to original article); Janský 2020 (go to original article), Dutt et al. 2019 (read more)

Explore more data visualisations at Transparency International’s Corporate Tax Tracker.

This might also interest you

Assessing Profit Shifting Using Country-by-Country Reports: a Non-Linear Response to Tax Rate Differentials

Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data

How large is corporate tax base erosion and profit shifting? A general equilibrium approach