Hide-seek-hide? The effects of financial secrecy on cross-border financial assets

The state of tax justice 2021

Summary

The report presents global estimates of the tax revenue losses due to corporate tax avoidance and personal income tax evasion. Estimates are broken down to a large number of countries including many low-income countries and set in relation to each country’s GDP.

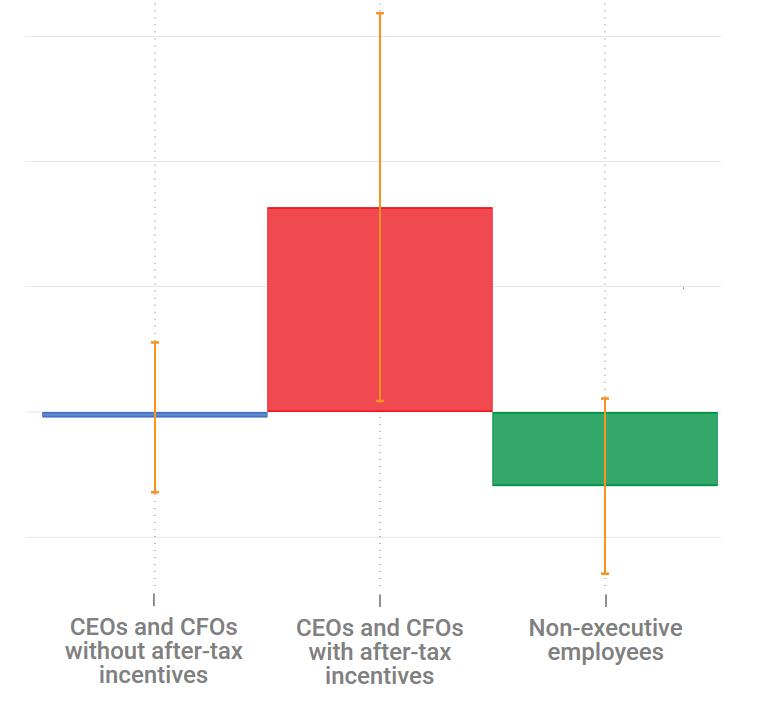

The authors estimate the amount of shifted profits by calculating the difference between reported profits in each country and the counterfactual distribution of profits that would prevail if profits were aligned with economic activity. To do so, they use aggregate country-by-country data published by OECD in 2021 and proxy economic activity by the location and estimated compensation of employees. To account for the incompleteness of the dataset, they extrapolate data for non-reporting countries based on additional data sources. In contrast to the 2020 report, the tax revenue losses are estimated by applying the statutory rate instead of the existing effective rate, which increases the estimated revenue losses. The authors argue that shifted profits would normally be taxed at the statutory rate because the tax-optimizing multinational enterprises (MNEs) would have taken advantage of all tax base narrowing reliefs already.

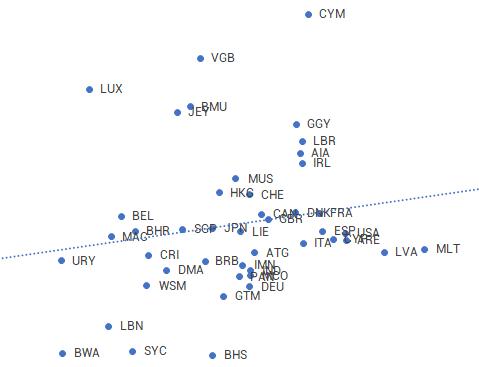

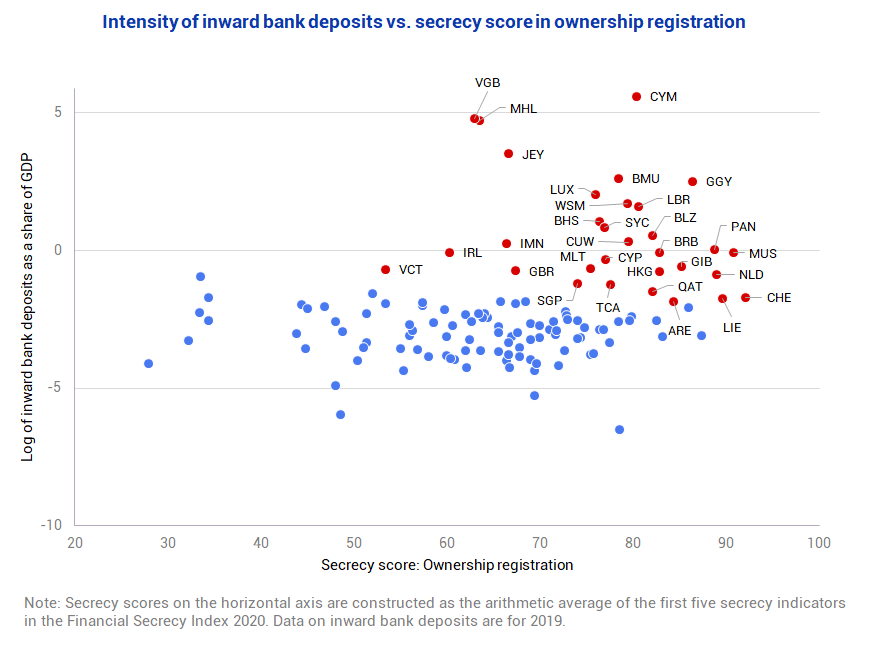

As for tax evasion by individuals, the TJN uses a four-step approach, building on the existing literature using discrepancies in macroeconomic statistics (read more about the discrepancy approach in our summary of Pellegrini et al.). The authors first identify what they call “abnormal deposits” in countries offering some financial secrecy, which is the share of foreign deposits in such countries that is incommensurate to the size of their GDP. The countries of origin of these abnormal deposits are then estimated based on the BIS locational banking statistics. The authors assume that ownership of portfolio assets held offshore is distributed in the same way as the ownership of deposits. Thirdly, they apply the estimated origin country shares to existing estimates of total global offshore financial wealth, to derive the absolute amount of offshore wealth originating from each country. Finally, they derive the tax revenue losses by applying the top bracket personal income tax rates to the offshore assets.

Key results

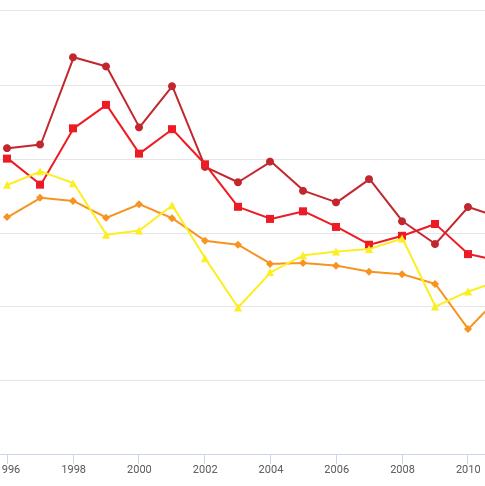

- TJN estimates that the world is losing over $483 billion a year due to international tax abuse of which $312 billion are due to corporate tax avoidance and $171 billion are due to tax evasion by individuals.

- Higher income countries are responsible for facilitating 99.4% of corporate tax losses.

- Higher income countries lose more tax revenues in absolute terms. However, lower income countries lose a higher share of their collected tax revenue.

- The tax lost in a single year to cross-border tax abuse equals the cost of fully vaccinating the world’s entire population more than three times over.

Policy recommendations

The Tax Justice Network advocates a comprehensive rewriting of the international rules and tax transparency measures to collect more tax revenues from multinational companies and high-net-worth individuals to ensure the vaccination of the world’s entire population and finance the social cost of the Covid-19 pandemic. Their proposals include a pandemic excess profits tax on MNCs in the short term and a shift to unitary taxation of MNE in the long term. With regard to personal wealth, TJN demands improvements of transparency rules to make the automatic exchange of information and beneficial ownership registries more effective and suggests wealth taxes to increase the progressivity of tax systems. To better represent the interest of poorer countries, negotiations about new international tax rules should take place at the UN.

Data

Profit shifting: OECD CbCR data, Orbis (read more about these data sources in our data section on MNEs), Corporate Tax Haven Index (read more in our tax rates and rankings section), and other economic data sources.

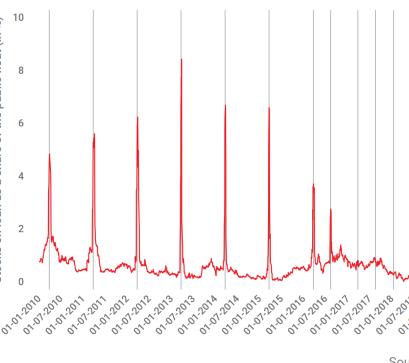

Offshore wealth: BIS Locational Banking Statistics (read more in our data section on cross-border wealth), offshore wealth estimates by Zucman (2017), Financial Secrecy Index, and other economic data sources.

Methodology

The report combines information from many different data sources in descriptive statistics, regressions, and extrapolations. Shifted profits are estimated based on the misalignment approach. This approach assumes that in the absence of profit shifting each country’s share of global profits would be in line with its share of global economic activity. Economic activity in each jurisdiction is proxied by the number of employees and wages each with an assigned weight of 50%.

The tax revenue losses due to cross-border tax evasion by individuals are estimated based on the estimate of global offshore wealth by Zucman (2017). To allocate offshore wealth to the countries of origin, the authors use a different methodology. According to the TJN, many countries offer some financial secrecy that can attract foreign bank deposits not declared in their owners’ respective home countries. For this reason, they replace the term offshore deposits with ‘abnormal’ deposits which is the share of foreign deposits in a country that is incommensurate to the size of a country’s GDP. The countries of origin of these abnormal deposits can be estimated based on the BIS locational banking statistics. It is assumed by the authors that ownership of portfolio assets held offshore is distributed in the same way as the ownership of deposits.

Go to the original document

The original report can be downloaded from the website of the Tax Justice Network. [PDF]

More details about the methodology can be found in the methodological note on the same website. [PDF]

This might also interest you

Tax deficits and the income shifting of U.S. multinationals

Profit shifting, employee pay, and inequalities: evidence from US-listed companies

Welfare Effect of Closing Loopholes in the Dividend-Withholding Tax: The Case of Cum-Cum and Cum-Ex Transactions