Our purpose

The EU Tax Observatory conducts innovative research on taxation, contributes to a democratic and inclusive debate on the future of taxation, and fosters a dialogue between the scientific community, civil society, and policymakers in the European Union and worldwide.

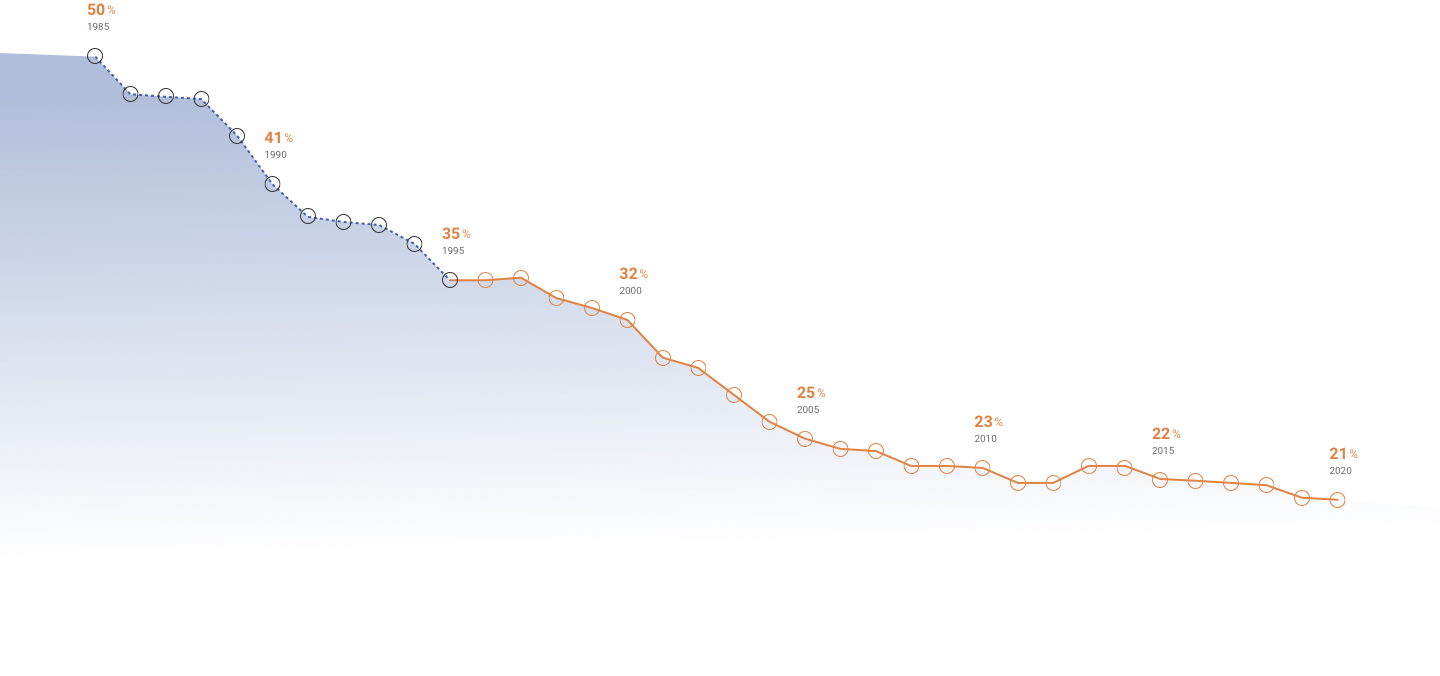

Average statutory corporate

income tax rate in the European Union

The average corporate income tax rate in the European Union has been more than halved since 1980, according to statistics compiled by the OECD and the European Commission

Recent publications

22.10.2023

Global Tax Evasion Report 2024

An unprecedented research collaboration investigating the successes and failures of the fight against tax evasion over the last decade, building on the work of more than 100 researchers globally.

21.12.2023

Mapping the global geography of shell companies

This note examines the global prevalence and distribution of shell companies, which are often used for

illicit financial activities like tax evasion.

15.12.2023

Consumption Taxes and Corporate Income Taxes: Evidence from Place-Based VAT

This working paper looks at the responses of corporations in the Greek Islands to an increase in the VAT rate from 16% to 24%. Declared profits decreased by 28% and corporate income taxes by 34%. Tax evasion opportunities offer a plausible explanation of the response.

News

25.10.2023

Announcing the Atlas of the Offshore World

The Atlas of the Offshore World is a new effort by the EU Tax Observatory to inform the global debate around international tax evasion and avoidance. It offers up-to-date information about the dynamic of profit shifting by multinational companies and offshore wealth.

21.08.2023

Daniel Cohen will be missed

We are deeply saddened by the passing of Daniel Cohen, brilliant economist and passionate researcher, as well as a kind observer of the evolution of society.

12.05.2023

EU Tax Observatory’s Director Gabriel Zucman wins 2023 John Bates Clark Medal

The American Economic Association awarded Gabriel Zucman the 2023 John Bates Clark Medal. This medal is awarded annually to an economist under the age of 40, for their outstanding research accomplishments. It is second in prestige only to the Nobel Prize in economics.

EU Tax Observatory in the media

24.10.2023

The New Yorker

Yes, We Can Tackle International Tax Evasion, If We Really Try

A new report finds that the amount of offshore wealth shielded from tax authorities has fallen dramatically since the Obama Administration, which pioneered efforts to make countries share banking information.

23.10.2023

Il Fatto Quotidiano

L’intervista – Gabriel Zucman: “Per aiutare la classe media serve una patrimoniale equa”

FISCO EQUO - “I miliardari sono abili a strutturare la ricchezza riducendo l’imponibile al minimo: partire da lì”

22.10.2023

The Hindu

To curb evasion, EU report calls for 2% global wealth tax on billionaires

This will both address evasion and ‘generate nearly $250 billion from less than 3,000 individuals,’ it says

Our Tools

To widen access to knowledge, the EU Tax Observatory provides interactive tools, including a simulator of the tax deficit of multinational companies, and an explorer of country-by-country data on the activities of multinationals firms.

Our events

Paris 23.01.2024

How do we fight against tax evasion on a global scale?

Event in French as part of Le Grand Continent's "Mardis du Grand Continent" debate series at ENS

Paris School of Economics 19.01.2024

Lunch Seminar at PSE

Twice a month, the EU tax holds a seminar to discuss the challenges posed to national tax systems by the increased global mobility of capital and labour.

Rome 13.11.2023

Tax Evasion: How Big Is It? How Can We Stop it?

The EU Tax Observatory, Oxfam Italy and Milano-Bicocca University organize this event to discuss how to tackle tax evasion and tax avoidance and what is left to do both at international level, EU level, and in Italy.

Join Us

Please contact us for further information.

Newsletter

Subscribe