How large is corporate tax base erosion and profit shifting? A general equilibrium approach

The Effect of Profit Shifting on the Corporate Tax Base

Summary

Clausing analyses the discrepancy between the location of MNEs’ booked profits and their real economic activity based on aggregated survey data on MNEs headquartered in the U.S. She finds that seven tax havens with effective tax rates (ETRs) below 5% attract 50% of US MNEs’ foreign income, while accounting for only 5% of foreign employment. She finds that gross income and earnings are negatively related to the corporate ETR while real activity indicators (employment and PPE) are not.

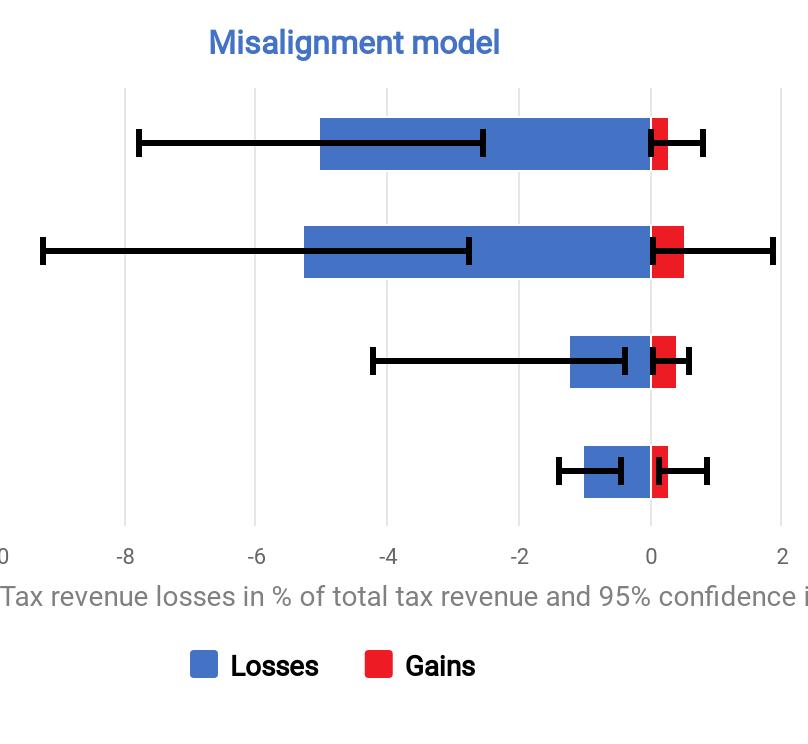

The author suggests that in the absence of profit-shifting, the location of MNEs’ profits should be explained by macroeconomic variables such as GDP per capita or production inputs such as capital and labour use. However, using regression analyses she finds that MNEs’ profits are sensitive to differences in effective tax rates in between countries or to changes of effective tax rates over time, which can be interpreted as evidence of profit shifting. Based on these regression results, she estimates that profit shifting by U.S. and foreign MNEs has cost the US government between 77 and 111 billion USD of corporate income tax revenue in 2012, and that these losses have increased very sharply since the early 2000s.

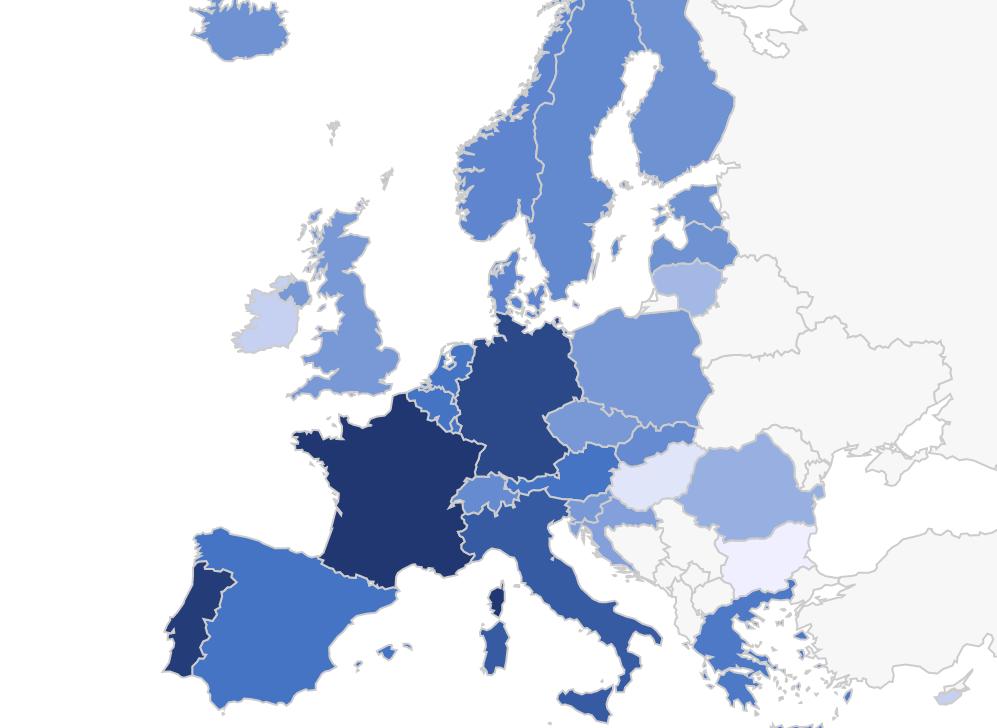

Clausing proposes a simple extension of US-based computations to other countries and estimates that MNEs from big and high-tax headquarter countries shifted 1,076 billion USD of profits to low-tax jurisdictions in 2012. On average, these countries would have lost 20% of their total corporate income tax revenue from these practices.

Key results

- Seven tax havens with ETRs below 5% attract 50% of U.S. MNEs’ total foreign income but only 5% of their foreign employment.

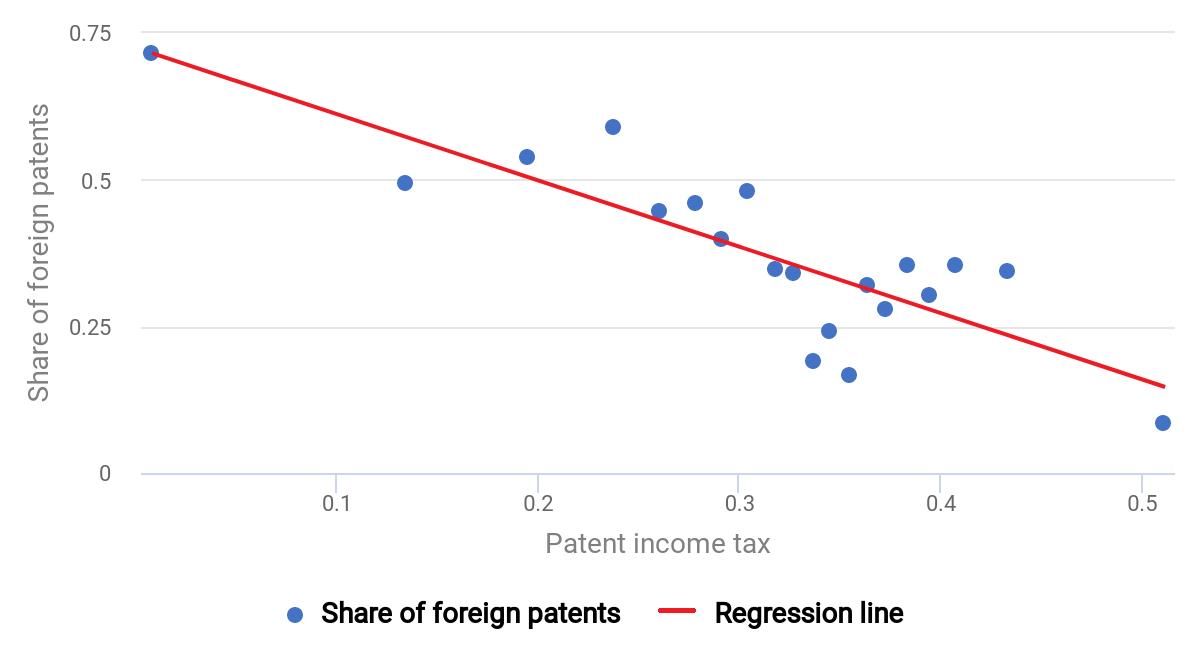

- Real activity indicators such as employment and tangible assets do not display any statistically significant relationship with the local ETR.

- Clausing estimates that profit shifting by U.S. and foreign MNEs costs the U.S. between 77 and 111 billion USD or 45% of federal corporate tax revenue in 2012.

- An extension of results to other countries would suggest that revenue losses due to profit-shifting amounted to 279 billion USD or 20% of corporate tax revenues in big and high-tax headquarter countries.

Policy implications

- Clausing suggests worldwide consolidation to reduce MNEs’ incentives for profit shifting. Under worldwide consolidation, a MNE would report its global income as a whole, summing the profits and losses registered by the parent company as well as its foreign affiliates. This consolidated tax base would then be taxed, and a credit could be granted on foreign taxes.

- Formulary apportionment: Clausing advocates for a formulary apportionment of the resulting worldwide income, which would be distributed to the different countries based on real economic activity indicators, such as sales, assets and payroll.

Data

For the bulk of her analysis, Clausing relies on aggregated data from annual surveys of US-headquartered MNEs run by the Bureau of Economic Analysis (BEA). Most estimates are based on 2012 data but the whole sample under study covers the 1983-2012 period.

The gross profits of US MNEs’ foreign affiliates are recalculated by summing net income and foreign income tax payments. Noticing that these net income series have sometimes been questioned for potential double-counting issues because of the inclusion of income from equity investments, the author proposes the use of direct investment earning series as an alternative. Although less problematic from the perspective of equity investment income, these data are also incomplete and Clausing therefore uses the two sources throughout her study.

Methodology

After a brief descriptive analysis of the data, the author estimates several regression models at country-level, alternatively based on the net income and direct investment earning series of the BEA. Profit-shifting estimates are based on the semi-elasticity of profits with regard to effective tax rates. Models vary depending on the inclusion of country-specific fixed effects and on the set of control variables retained.

Go to the original article

The article was published by the National Tax Journal and can be downloaded from the journal’s website.

This might also interest you

Tax rates and rankings

Profit shifting of multinational corporations worldwide

Corporate taxes, patent shifting, and anti-avoidance rules: empirical evidence