The state of tax justice 2021

Base Erosion, Profit Shifting and Developing Countries

Summary

Crivelli et al. assess to what extent developing countries are affected by corporate tax base erosion, profit shifting, and tax competition. In different regression analyses they test whether the corporate tax base of a country reacts to changes in the domestic and foreign corporate income tax (CIT) rates. They find that an increase in a country’s CIT rates has a negative effect on the country’s tax base. Similarly, they find that decreases in foreign CIT rates also have a negative effect on a country’s tax base. They refer to this effect as “base spillovers” as the country’s tax base reacts to changes in foreign tax policy.

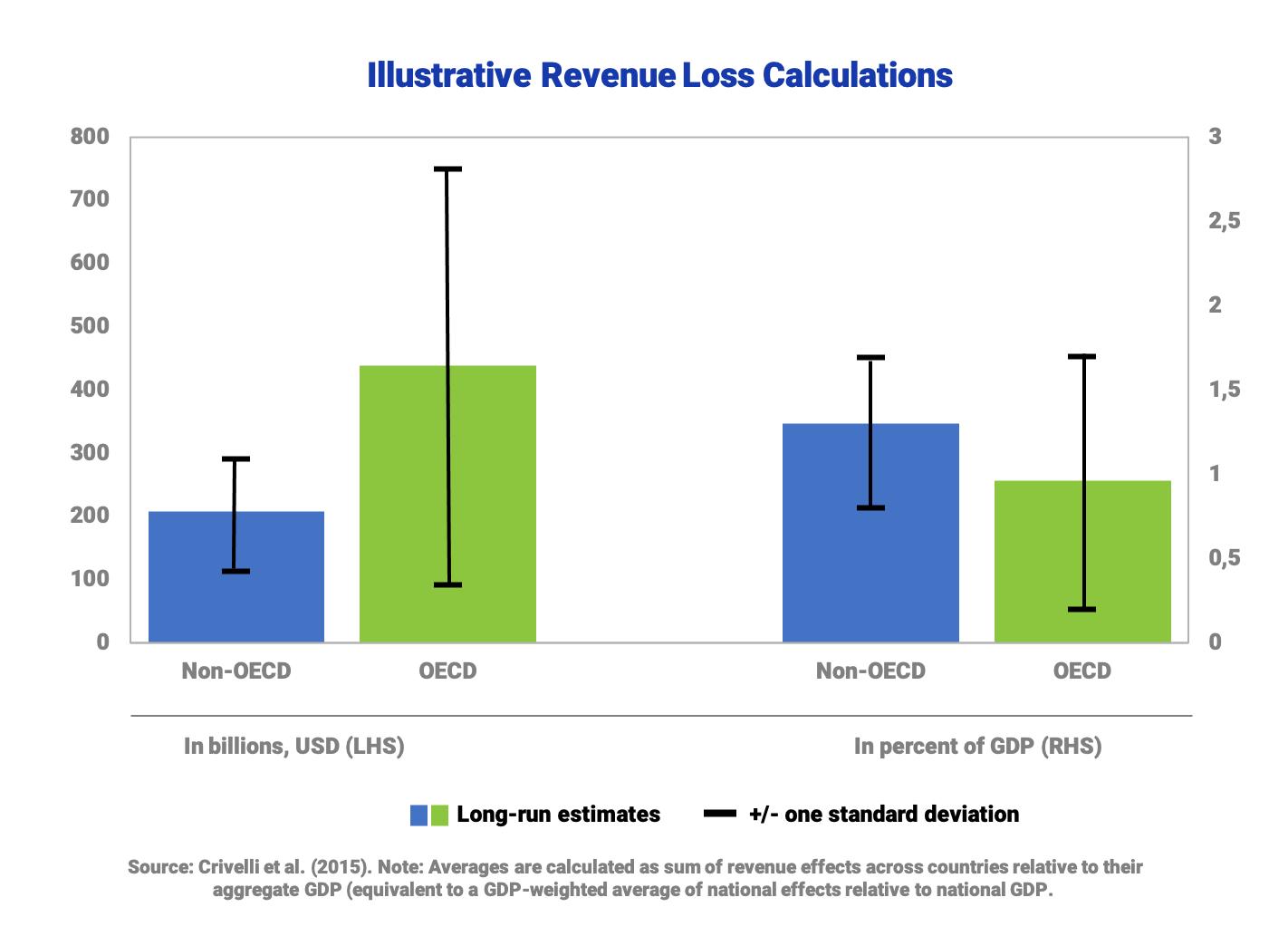

Arguing that base spillovers may be caused by real capital flows but also by profit shifting, they show that changes in the CIT rates of tax havens have a strong negative effect on corporate tax base which they attribute to profit shifting activities. The authors find that non-OECD countries are affected by base spillovers to a similar extent as OECD countries or even more. However, spillover channels differ between the two: while real capital flows seem to dominate for OECD countries, profit shifting seems to dominate the spillover effects for the non-OECD countries. In terms of estimated tax revenue losses, OECD countries lose larger absolute amounts but developing countries seem more severely harmed relatively to GDP. In addition, Crivelli et al. find that countries respond to tax rate reductions abroad by cutting their own tax rate which the authors term as “strategical spillovers”. They show that this effect is particularly strong among OECD members.

Key results

- The results suggest that corporate tax base erosion, profit-shifting and tax competition are as much of a concern for developing countries as it is for OECD countries.

- Profit-shifting seems to dominate the base spillovers for developing countries rather than real investment decisions.

- Relatively to GDP, tax revenue losses are larger for non-OECD countries than for OECD members amounting to 1% and 1.3% of GDP respectively. However, the authors highlight the tentative nature of their estimates.

- Countries respond to tax rate reductions elsewhere by cutting their own tax rates. This response is particularly strong among OECD countries as a one percentage point cut in the average CIT rate abroad is associated with a one percentage point cut in the domestic rate.

Policy implications

The paper underlines the importance of base erosion, profit shifting, and tax competition for developing countries and thus stresses their stake in the policy debates on international tax reforms.

Data

The authors rely on county-level panel data covering 173 jurisdictions from 1980 to 2013. CIT revenues and statutory rates are drawn from the database of the IMF’s Fiscal Affairs Department, with full country coverage but unbalanced in terms year coverage. Their tax haven definition follows the list of Gravelle (2013). Countries are also classified as OECD or non-OECD, based on their membership (or lack thereof) at the end of the sample period.

Methodology

The authors estimate several regression models. For the analysis of base spillovers, they estimate the semi-elasticity of the tax base with regard to the weighted average foreign tax rates. For the analysis of strategic rate spillovers, they use the local CIT rate as dependent variable.

Go to the original article

The working paper was published by the IMF and can be downloaded from the website of the IMF.

This might also interest you

The scale of corporate tax avoidance

How large is corporate tax base erosion and profit shifting? A general equilibrium approach

Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data