Monitoring the amount of wealth hidden by individuals in international financial centres

The missing profits of nations

Summary

Tørsløv, Wier and Zucman estimate the scale of profit shifting to low-tax jurisdictions by multinational enterprises (MNEs) based on macroeconomic data, namely Foreign Affiliates Statistics (FATS) and bilateral balances of payments. The data reveal that MNEs’ affiliates in tax havens are much more profitable than local firms. This cannot be explained by the fact that MNEs are in general more profitable, since MNEs in non-haven countries are less profitable than local firms. In addition, the average profitability of local firms is similar in tax havens and non-havens. This suggests that economic activity is not generally more profitable in tax havens but that the disproportionate profits of MNE in tax havens can be explained by profit shifting.

Based on the observed discrepancy of profitability, the authors estimate that in 2015, 616 billions USD out of 1.7 trillion USD of multinational profits (or 36%) were artificially shifted to tax havens. This result is consistent with the abnormal level of cross-border payments conducive of profit shifting received by tax havens. Such high-risk cross-border transactions include royalty payments, intra-group interest receipts and certain services (financial, headquarter and communication technology etc.). Bilateral data on the origin of these high-risk payments allows the authors to propose a geographical distribution of shifted profits and associated corporate income tax revenue losses. For example, if 30% of high-risk payments received by the Cayman Islands come from the US, the US is allocated 30% of profits found to be shifted to this tax haven.

The results identify EU countries as the most severely harmed, with about 35% of profits shifted globally. Besides, relatively to the size of their economy, tax havens generate much more fiscal revenue than higher-tax countries, despite low statutory and effective corporate income tax rates.

Key results

- 616 billions USD out of 1.7 trillion USD of multinational profits or 36% were artificially shifted to tax havens or low-tax jurisdictions in 2015.

- About 35% of profits shifted globally come from non-haven EU countries, while 30% come from developing countries and 25% from the US.

- 80% of profits shifted out of the EU are directed towards EU tax havens (Ireland, Luxembourg and the Netherlands), whereas profits shifted from the US are mostly driven towards non-EU havens.

- Considering corporate income tax losses, EU countries are the most severely harmed, with a reduction of these fiscal revenues by around 20%.

- The authors correct macroeconomic statistics for the impact of profit shifting and show that Japan, the UK, France or Greece would actually display trade surpluses in 2015.

Policy implications

- The authors question the efficiency of corporate income tax rate cuts, because expected positive effects on real investment do not materialize if MNEs merely react by shifting paper profits instead of relocating tangible assets.

- Profit shifting has distortionary effects on competition because the effective tax rates of MNEs are potentially much lower than those of local companies.

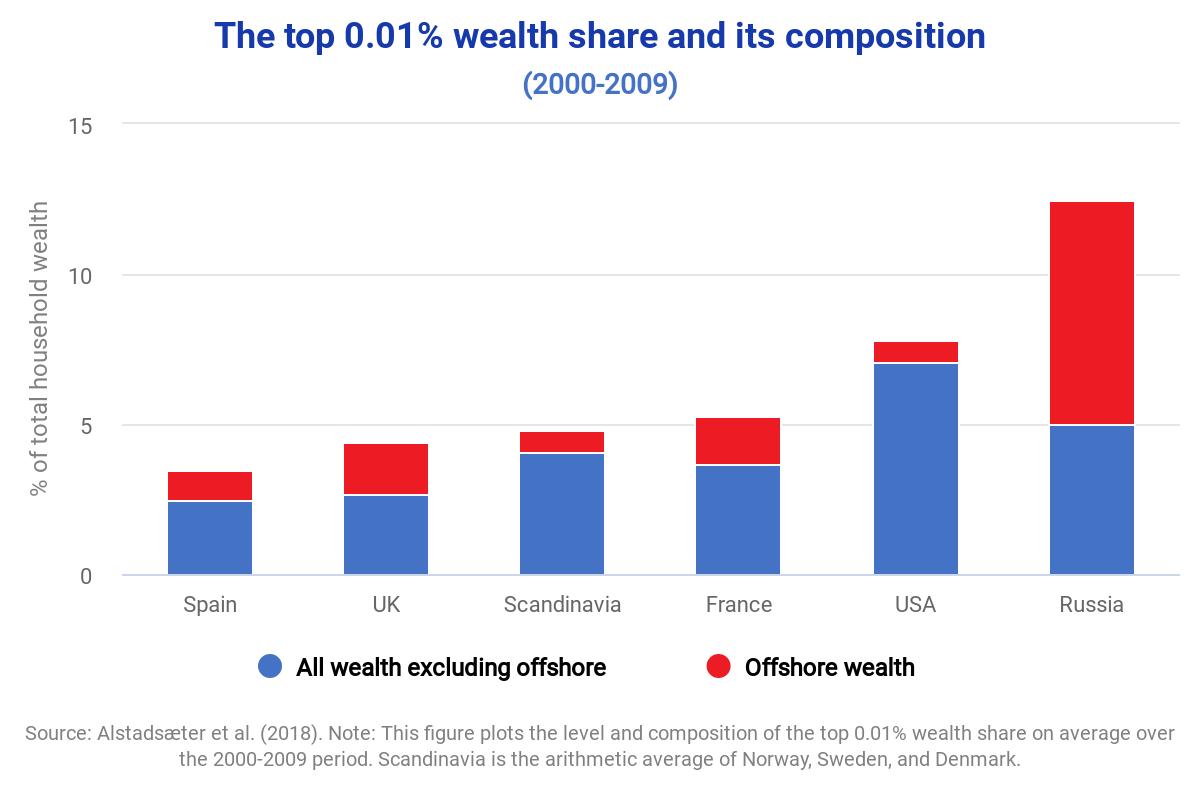

- Profit shifting reduces the tax burden for wealthy individuals, who concentrate the ownership of MNEs and thus benefit from the lower effective tax rate imposed on profits.

- National statistical authorities should be authorized to exchange micro-data on MNEs in order to address existing data limitations. The coverage of FATS should be expanded, and national accounts of Caribbean low-tax jurisdictions should be more exhaustive. Public corporate registries should include all firms with profit information made public at the subsidiary level.

Data

The authors use different macroeconomic datasets including:

- National accounts data from the OECD’s national accounts detailed by sector which they extend by manually collecting the official national accounts of non-OECD tax havens.

- The foreign affiliate statistics (FATS) published by the main OECD economies. [read more]

- Bilateral balances of payments provided by the IMF and Eurostat.

- Bilateral direct investment statistics on an ultimate ownership basis by Damgaard and Elkjaer (2017). [read more]

Go to the original article

The original paper, data sources, and computations can be downloaded from the missingprofits.org website. [pdf]

This might also interest you

Estimating International Tax Evasion by Individuals

Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality

The state of tax justice 2021