Global distribution of revenue loss from tax avoidance: re-estimation and country results

Big and ‘unprofitable’: How 10% of multinational firms do 98% of profit shifting

Summary

In this working paper, Wier and Reynolds rely on tax administrative data from the South African Revenue Service to analyse profit shifting behaviour by firm size. Starting with a simple descriptive analysis of the data, they highlight a strong difference in the profits-to-wage ratios of foreign-owned firms depending on whether their parents are headquartered in a tax haven or not. They examine the contribution of each firm to this macro-level discrepancy in profitability ratios and show that profit shifting is very concentrated among the largest firms.

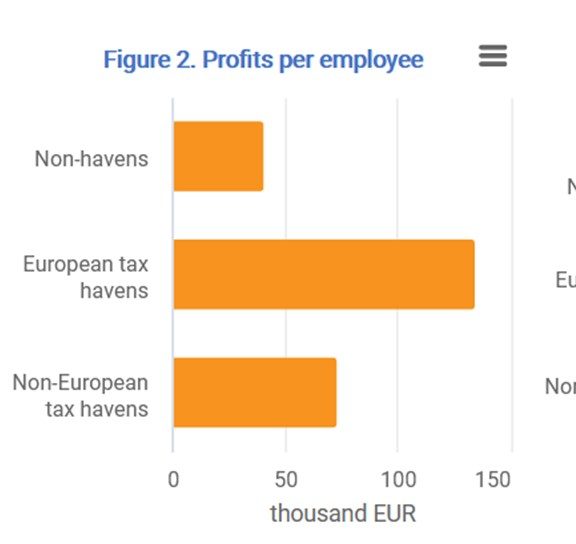

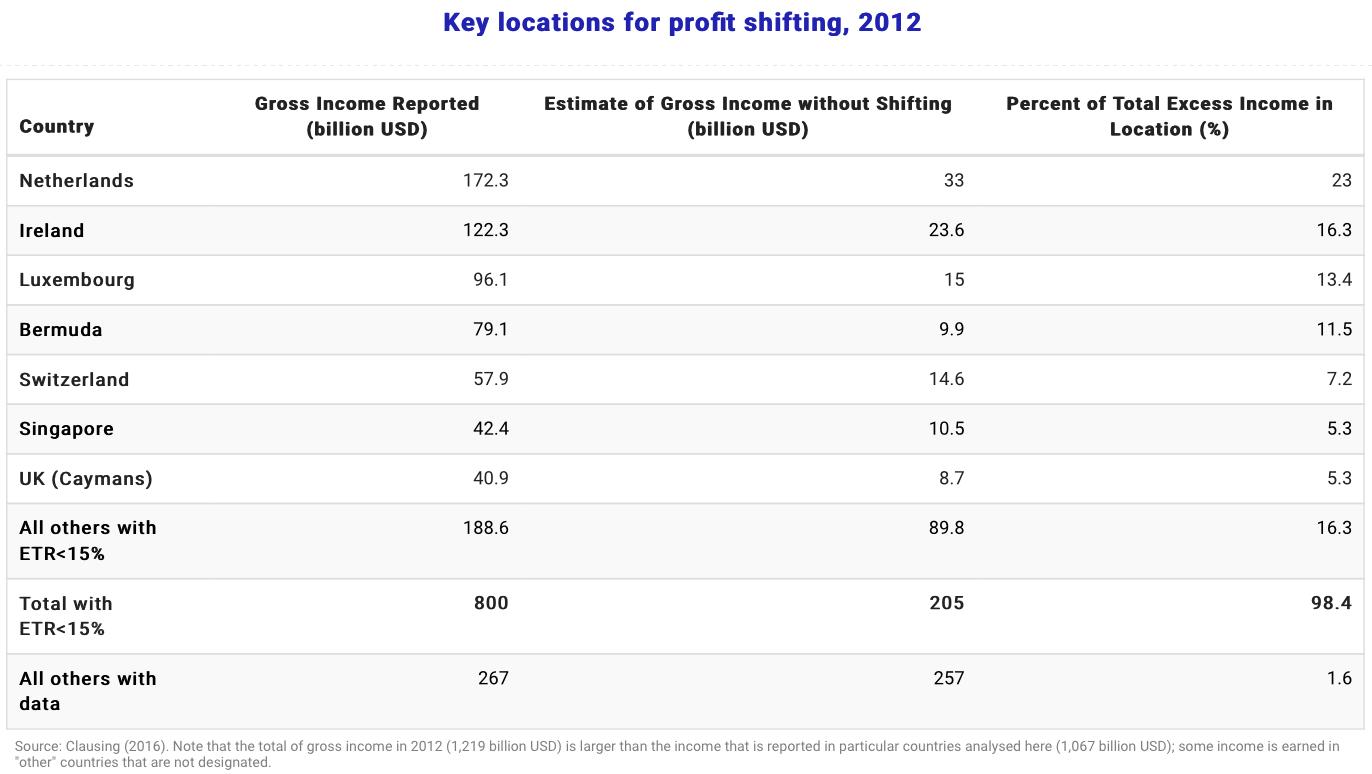

The authors argue that the researchers might underestimate the scale of profit shifting if they fail to take into account a higher propensity of big firms to shift profits. Based on South African data, they estimate the impact of being owned by a parent company in a tax haven on reported profits of the affiliate. They repeat this estimation for sub-groups of affiliates by firm size. Their results suggest that firms owned by a parent in a tax haven report on average 35% lower taxable profits than the others. However, among the largest 10% of companies, affiliation with a tax haven is associated with nearly 80% lower taxable income. Reweighting the initial regression by the wage bill to account for heterogeneity across firms leads to a higher average estimate of 58%. In order to demonstrate that company size also matters for profit shifting in other countries, the authors revisit an OECD profit shifting estimate based on Orbis data. They show that profit-shifting responses are largest in the largest firms which might cause a downward bias of unweighted average estimates.

Key results

- Subsidiaries of haven-owned firms in South Africa appear to be 80% less profitable than their non-haven-owned counterparts. Roughly 80% of their income could thus be lost to tax havens.

- 28% of the discrepancy is driven by companies in the extractive industry, although they only constitute 2% of foreign-owned firms in South Africa.

- The largest 10% of companies account for 98% of lost taxes as they are more prone to shifting profits out of South Africa and at the same time, concentrate most of corporate profits.

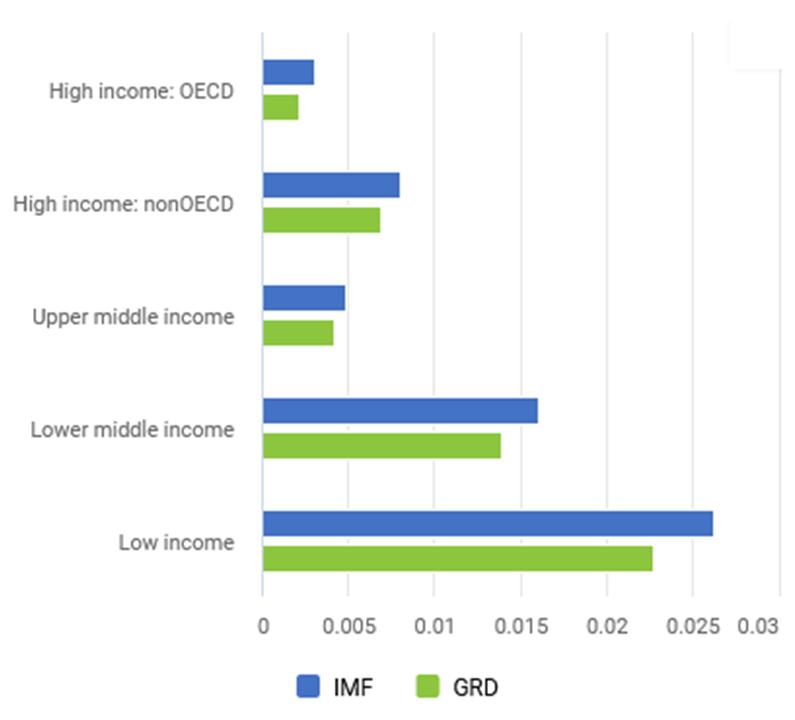

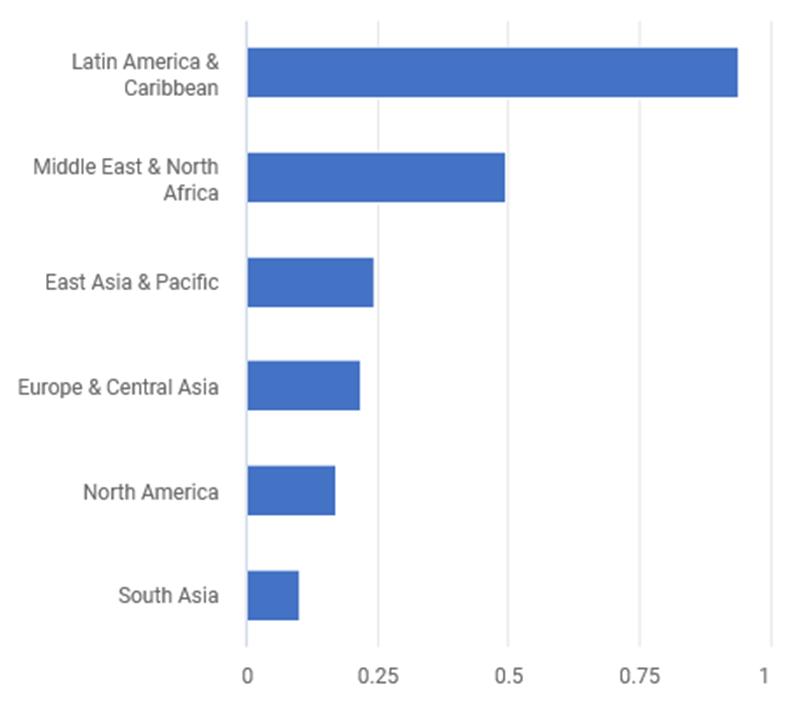

- Revisiting earlier BEPS estimates by Johansson et al. 2017 (read more), they show that also in other countries, the propensity to shift profit is larger for the top 5% largest subsidiaries than for the average firm.

- As a consequence, omitting firm-level size heterogeneities, global profit shifting could be underestimated by up to 40%.

Policy recommendations

- The unequal access to tax evasion opportunities and practices creates competitive distortions and, therefore, regulation should prioritise tax avoidance practices of the largest players.

- The authors call for a wider access to tax return statistics of national administrations for research purposes, similar to the South African data utilised in this study.

Data and methodology

Wier and Reynolds rely on tax return data provided by the South African Revenue Service for the purpose of the study. They also use the ORBIS database to propose a revision of the OECD’s BEPS estimates. [read more]

Methodology

The authors present descriptive statistics and regression analyses to show that having a parent company in a tax haven is associated with lower reported profits. To underline the importance of firm-level heterogeneities, the authors divide the sample into decile groups according to companies’ wage bills and estimate the same model within each group. Alternatively, they run a sample-wide regression, weighted by wage bills at the firm level.

Go to the original article

The original paper was published by the UNU-WIDER. It can be downloaded from the institute’s website.

This might also interest you

Estimating the Scale of Profit Shifting and Tax Revenue Losses Related to Foreign Direct Investment

Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data

The Effect of Profit Shifting on the Corporate Tax Base