Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data

Tax Planning by Multinational Firms: Firm-Level Evidence from a Cross-Country Database

Summary

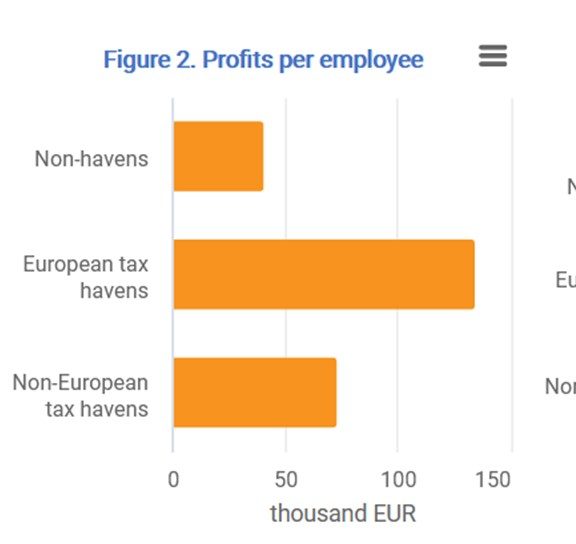

Johansson et al. rely on micro-data from the ORBIS database to estimate the scale of multinational enterprises’ (MNEs) tax avoidance and explore the relative contribution of different channels of profit shifting. Firstly, they test the sensitivity of MNEs profits with regard to statutory corporate tax rates. The regressions suggest that MNEs make significantly more profit in low-tax countries than in high-tax countries, which cannot be explained by different firm’s characteristics or macroeconomic variables and is thus likely due to profit shifting. The authors argue that profit shifting to exploit tax rate differences between countries is driven by transfer price manipulations, the strategic location of intangible assets or internal and external debt concentration.

In a second step, Johansson et al. focus on further tax avoidance channels, namely MNEs’ exploitation of mismatches between national tax systems (e.g. differences in the tax treatment of certain entities, instruments or transactions) and of preferential treatment opportunities. The latter include preferential tax rates for patent income or preferential agreements as a result of negotiations with tax authorities. Arguing that these types of tax avoidance do not necessarily depend on differences between statutory tax rates between countries, they use an additional identification strategy and compare effective tax rates of domestic companies and MNEs. Their findings show that large MNE entities have a significantly lower effective tax rate than entities in non-MNE groups in the same country. Thus, they conclude that large MNEs exploit mismatches and preferential regimes to a significant extent. In contrast, smaller MNEs seem to use these channels less due to relatively high fixed cost.

Key results

- The net tax revenue loss from tax planning is estimated at 4-10% of global corporate tax revenues.

- Tax planning reduces the effective tax rate of large MNEs by 4-8½ percentage points on average. Large firms and firms intensive in the use of intangible assets reduce their effective tax rates even more.

- Small MNEs also engage in tax planning but to a lesser extent.

- The debt-shifting is estimated to account for at least 20% of MNEs’ profit shifting to low-tax countries.

- In addition to profit shifting, large MNEs exploit mismatches between tax systems and preferential tax treatment to reduce their effective tax rates.

- Strong anti-avoidance rules are associated with a significant reduction in profit-shifting.

Data

The empirical study presented in this paper is based on the ORBIS database compiled by Bureau Van Dijk (read more) and processed by the OECD Statistics Directorate (Pinto Ribeiro et al., 2010). The period covered is 2000-2010; the final sample includes the unconsolidated financial accounts of 1.2 million multinational entities in 46 countries: all OECD and G20 countries, Colombia, Latvia, Malaysia, and Singapore.

Go to the original article

The original working paper was published by the OECD Economics Department. It can be accessed on the OECD’s website. [pdf]

This might also interest you

Flexibility in Income Shifting under Losses

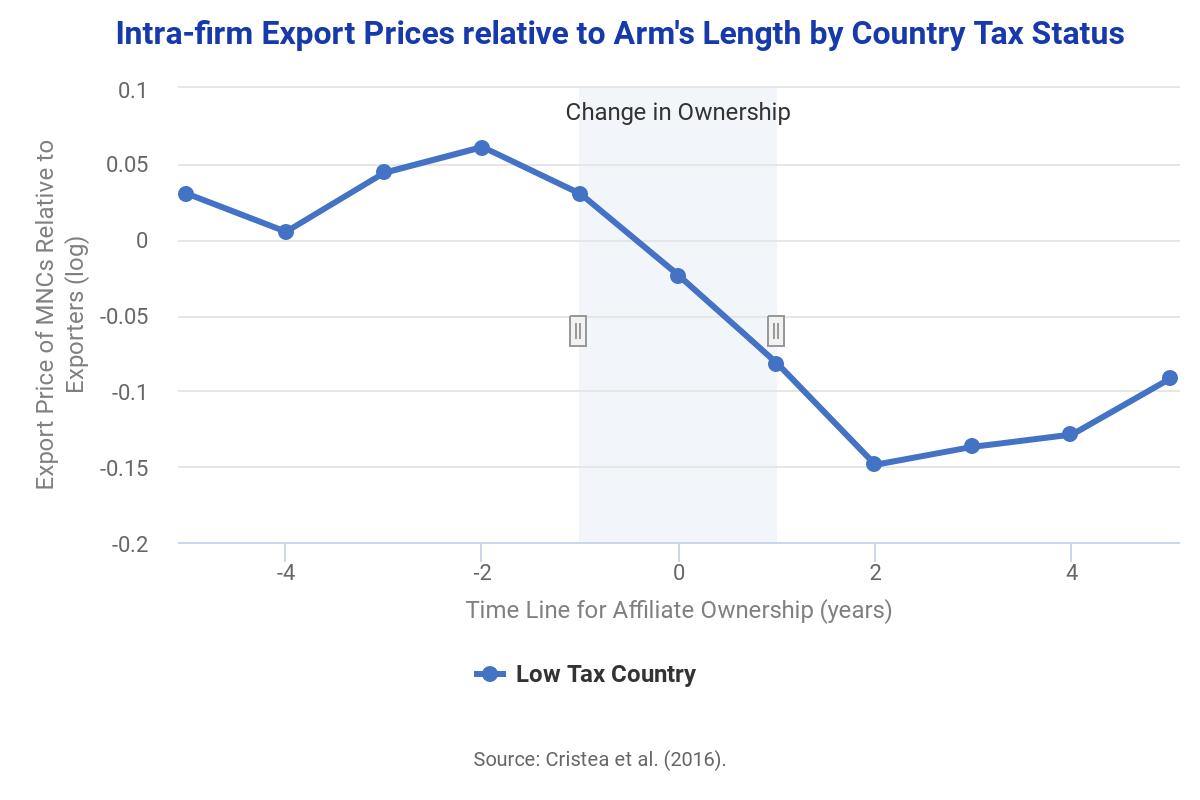

Transfer Pricing by Multinational Firms: New Evidence from Foreign Firm Ownerships

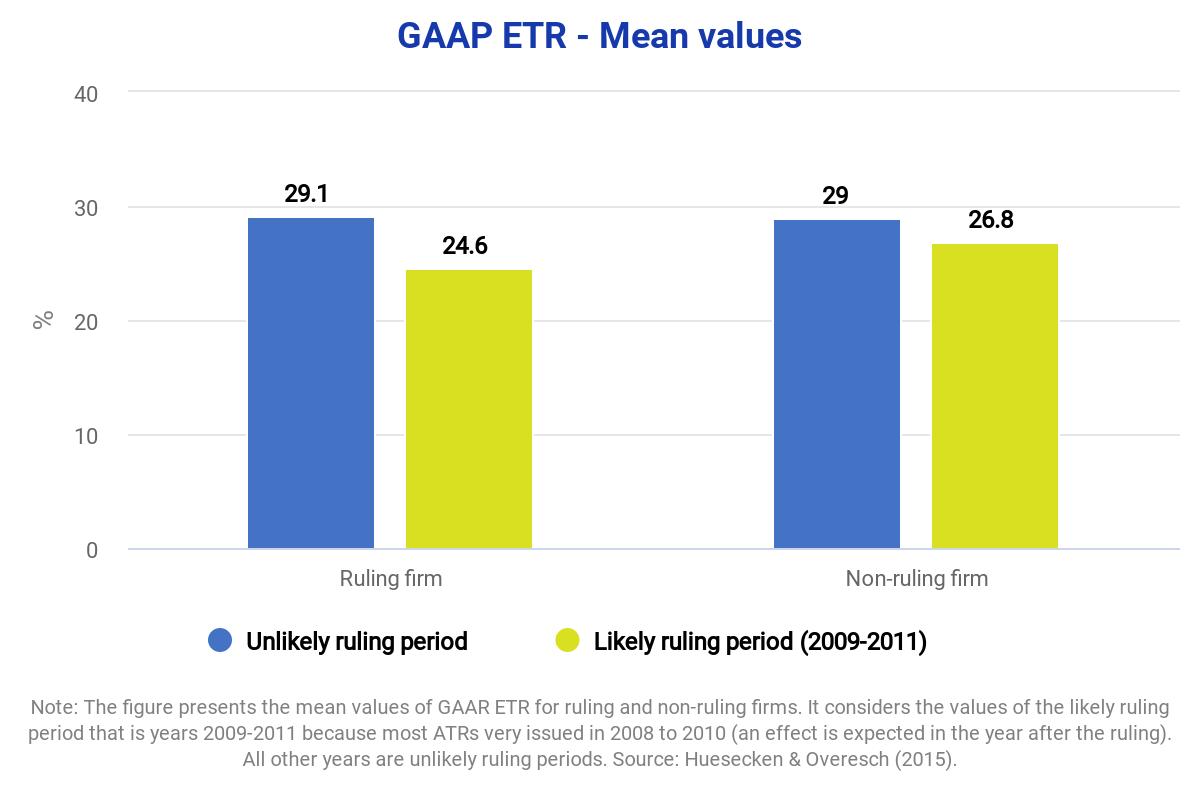

Tax Avoidance through Advance Tax Rulings: Evidence from the LuxLeaks Firms