Avoiding taxes: banks’ use of internal debt

Can European Banks’ Country-by-Country Reports Reveal Profit Shifting? An Analysis of the Information Content of EU Banks’ Disclosures

Summary

Dutt et al. explore the annual country-by-country reports (CbCRs) that EU-based banks are required to release publicly since the introduction of the Capital Requirements Directive IV. Compiling a new database which gathers 316 of these reports for the 2014-2016 period, they evaluate what the new data can reveal about banks’ tax avoidance practices.

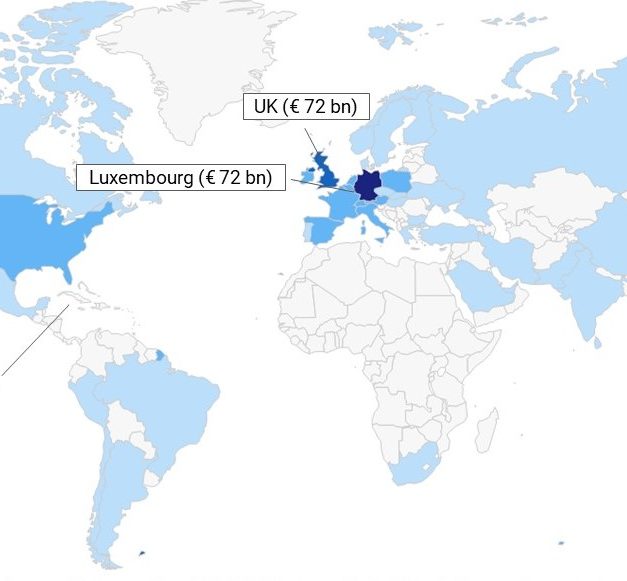

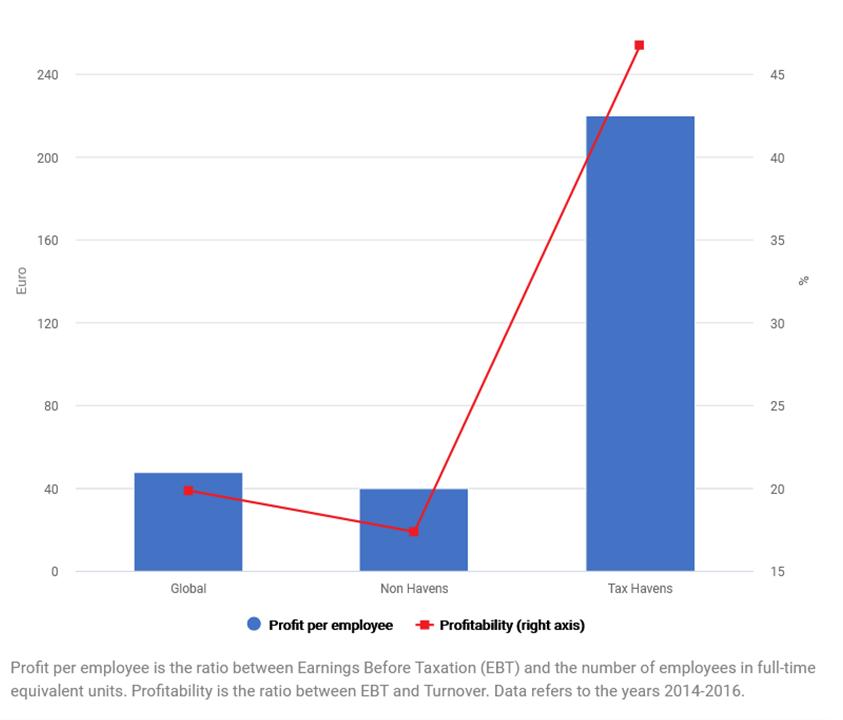

First, the authors compare the new dataset to Orbis and Bank Focus data which are frequently used in profit shifting research. They find that CbCRs uncover sizable profits and real activities, especially in tax havens, that seem not be included in conventional data sources. The data also reveal a striking discrepancy between reported profits and real activity, with tax havens exhibiting a median profit per employee that is 2.5 times as high as in other countries.

Second, combining CbCRs and ORBIS data, Dutt et al. show that standard regression analyses indicate a higher sensitivity of profits to taxation compared to results that would have been obtained based on conventional financial statements. This finding is consistent with more profit-shifting activities uncovered by the CbCRs. However, the authors highlight that the banks’ CbCRs lack important information such as total assets and staff cost. This makes it difficult to identify profit-shifting based on conventional methods.

Key Results

- Dutt et al. compile a database of 316 country-by-country reports released by 114 bank groups headquartered in the EU.

- They find that only 55% of the total workforce of bank groups in the sample appears at the subsidiary level in ORBIS.

- While banks’ CbCRs display a total of 124,000 employees in tax havens, only 21,000 employees are reported in ORBIS.

- Tax havens account for 18% of the worldwide pre-tax profits of the sample bank groups but only 5% of their worldwide workforce.

- Regression analyses that combine both CbCR and previously accessible data, would likely yield a higher tax semi-elasticity of reported profits with regard to tax than what was previously documented.

Policy Implications

The authors stress that CbCR are useful to evaluate profit shifting as they uncover important data not included in other publicly accessible sources of information. They call for a wider introduction of such rules and the reinforcement of reporting requirements. The current framework still lacks economic variables that the authors deem crucial for further analyses.

Data

Data sources include Country-by-Country reports of 114 bank groups headquartered in the EU, for the years 2014- 2016, the ORBIS provided by the Bureau Van Dijk and the Bank Focus, which includes data from Bureau Van Dijk and Moody’s Investors Services. [read more]

Methodology

The authors manually collect a dataset based on bank groups’ individual reports and present descriptive statistics for the resulting sample. They replicate regression analyses by other authors to estimate the tax semi-elasticity of banks’ reported pre-tax profits and refine them to account for the special properties of the CbCR data.

Go to the Original Article

The original paper was published by the ZEW and can be downloaded from the ZEW website. [pdf]

This might also interest you

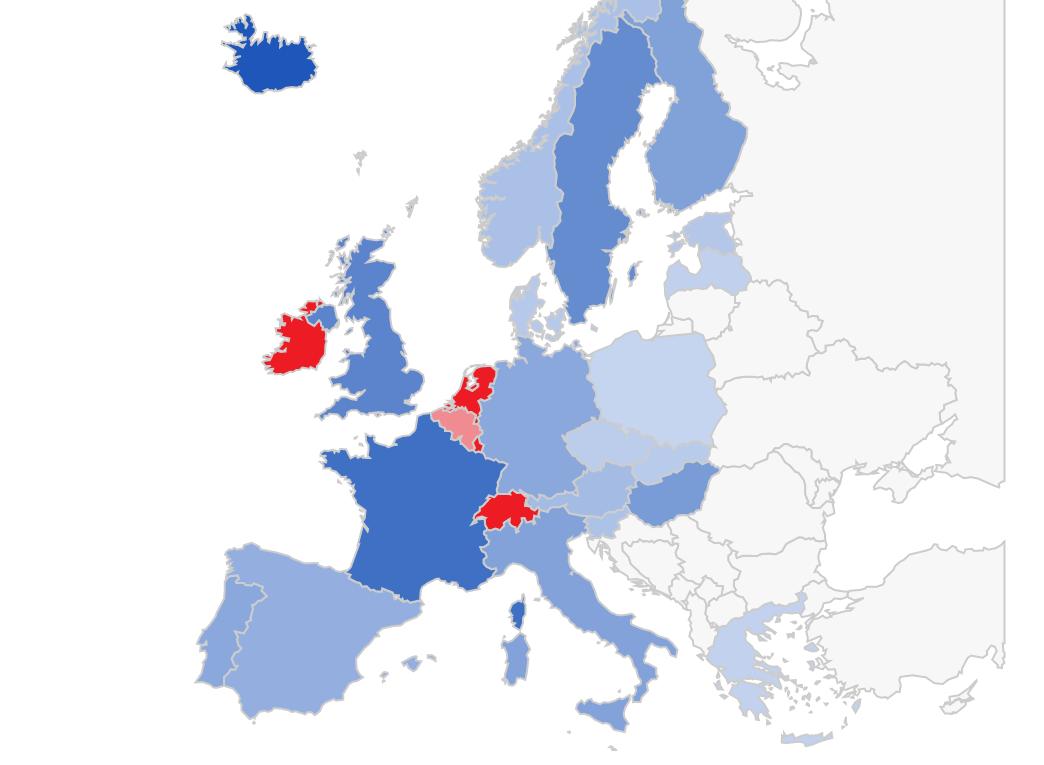

How much profit shifting do European banks do?

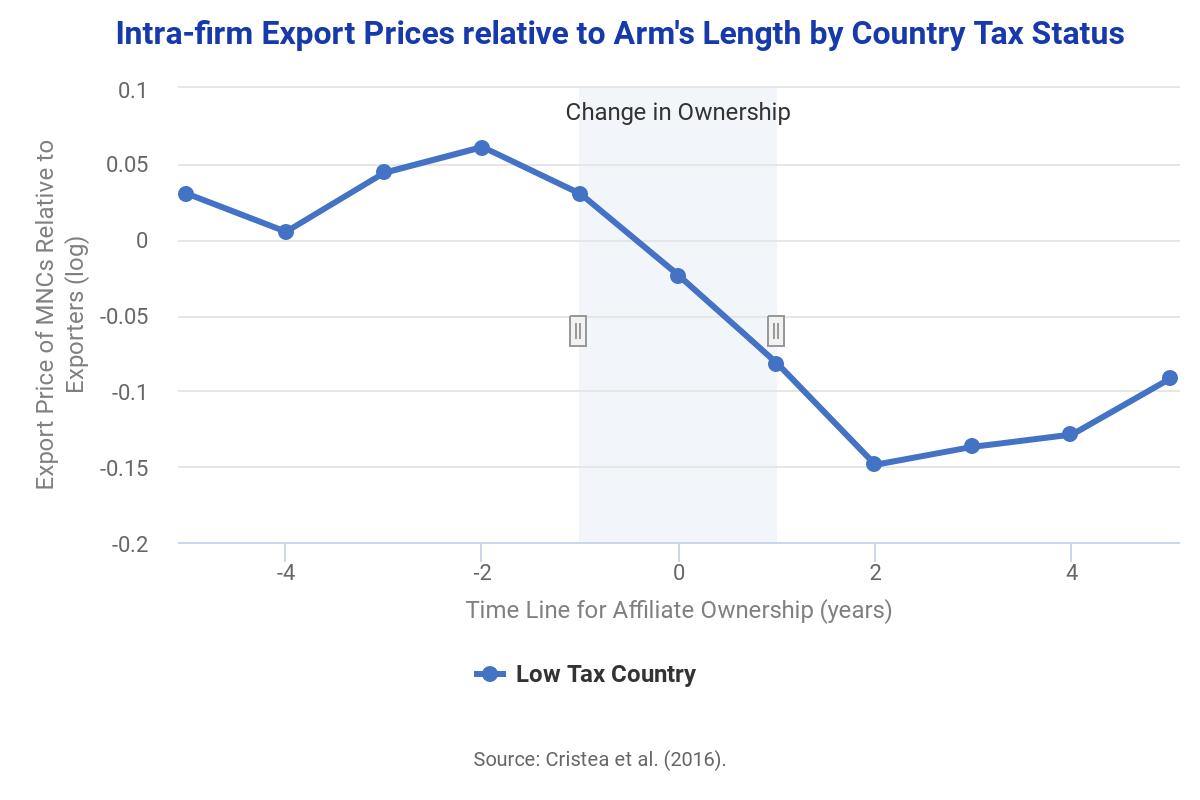

Transfer Pricing by Multinational Firms: New Evidence from Foreign Firm Ownerships

The scale of corporate tax avoidance