The state of tax justice 2021

Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality

Summary

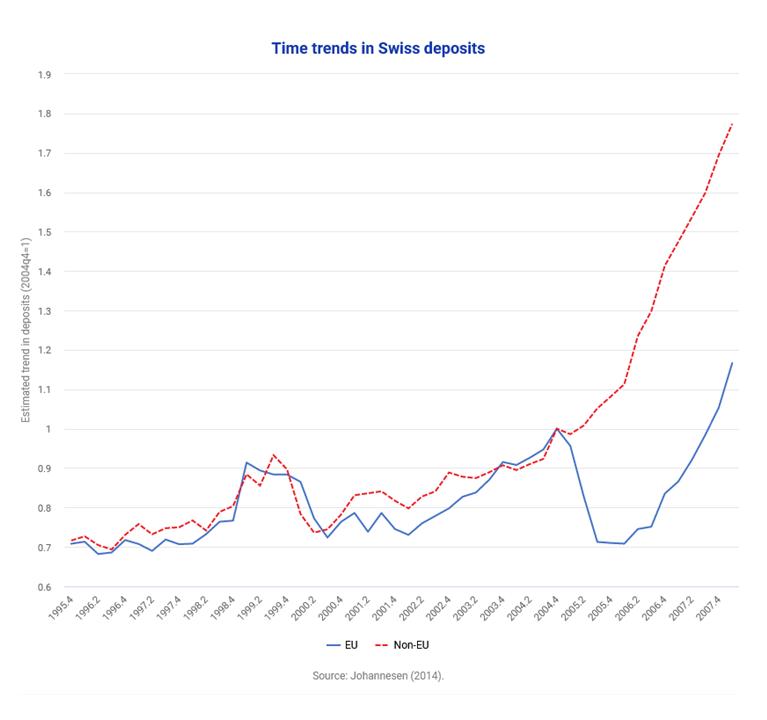

Alstadsæter et al. provide a by-country breakdown of the ownership of offshore wealth. They further show that wealth inequality measures increase if the unequal distribution of hidden offshore wealth is taken into account. First, the authors update the global offshore wealth estimates proposed by Zucman (2013), which rely on three sources of information: the detailed Swiss National Bank’s (SNB) statistics about the funds managed by Swiss banks on behalf of foreigners, the disclosures of major tax havens regarding foreign ownership of bank deposits held in their banks and the anomalies that can be observed in IMF’s series on cross-border portfolio investment. The authors find that 8% of the world’s household financial wealth, i.e. 10% of global GDP, is held in tax havens, with no particular time trend observed through the 2000s.

Second, the authors propose a country-by-country attribution of their 5.6 trillion USD offshore wealth estimate focusing on the year 2007. They allocate the wealth held in Switzerland using the SNB’s statistics on foreign-held fiduciary deposits and cross-check the resulting distribution with the customer base of HSBC Switzerland, revealed in 2007 during the so-called “Swiss leaks”. Then, they extend this distribution to other tax havens which started to release bilateral banking statistics via the Bank for International Settlements in 2016. As an example, if 5% of deposits held in Jersey are reported to originate from Germany, the latter is allocated 5% of the total financial wealth estimated to be held in Jersey. The by-country results reveal major differences between countries. Measured as a percentage of their country’s GDP, Scandinavian taxpayers own relatively little offshore wealth (a few percentage points), taxpayers in Continental Europe own around 15% and in Russia, in countries of the Gulf and in some Latin American countries the percentage rises to 60%.

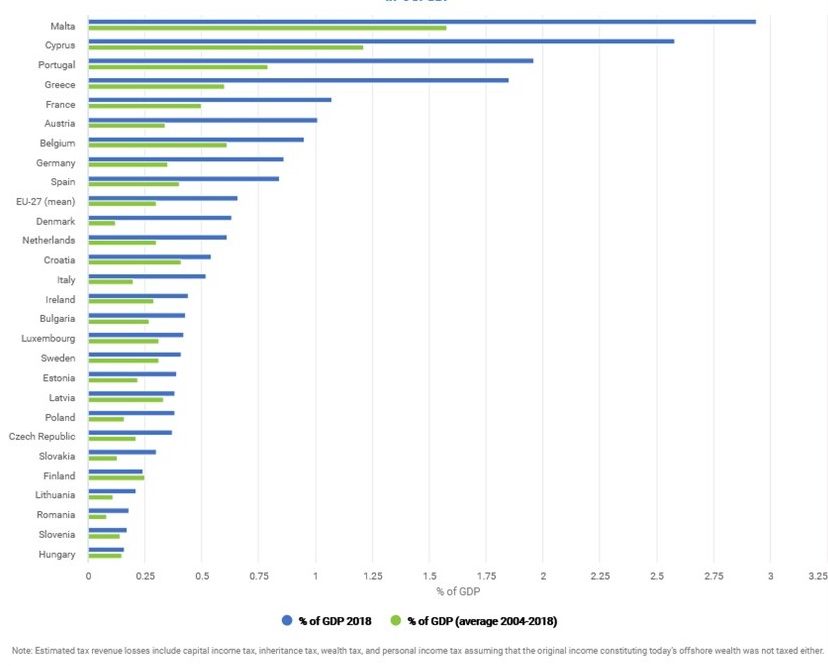

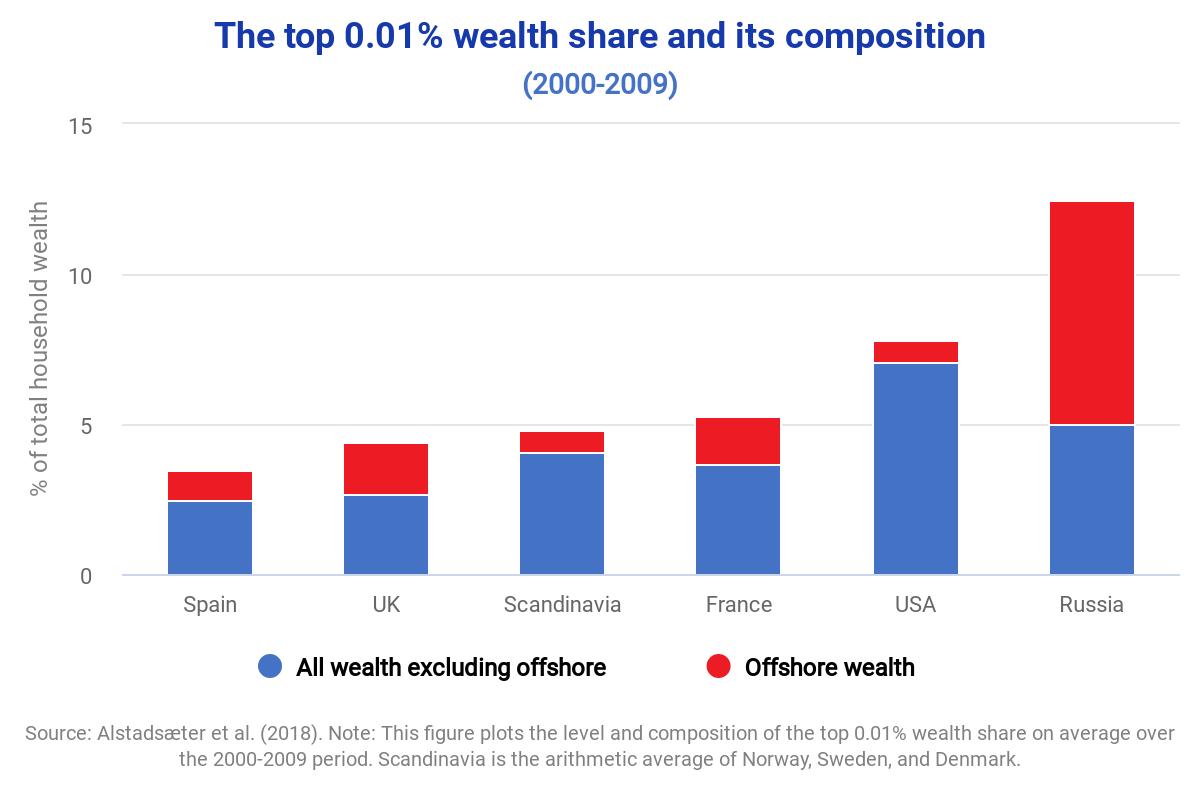

Third, Alstadsæter et al. argue that hidden offshore wealth is not reflected in the tax returns traditionally used to assess wealth inequalities. Their results indicate that ownership of offshore wealth is very concentrated at the top of the wealth distribution, with 80% belonging to the top 0.1% richest households. Thus, they revise existing estimates of the top 0.01% wealth share. This leads to upward corrections of wealth inequality, albeit with significant heterogeneity across countries.

Key results

- Results suggest that 8% of the world’s household financial wealth, i.e. 10% of global GDP, is held in tax havens. In 2007, this represented 5.6 trillion USD.

- The amount of wealth held in tax havens (as a percentage of global GDP) was relatively stable from 2000 to 2015.

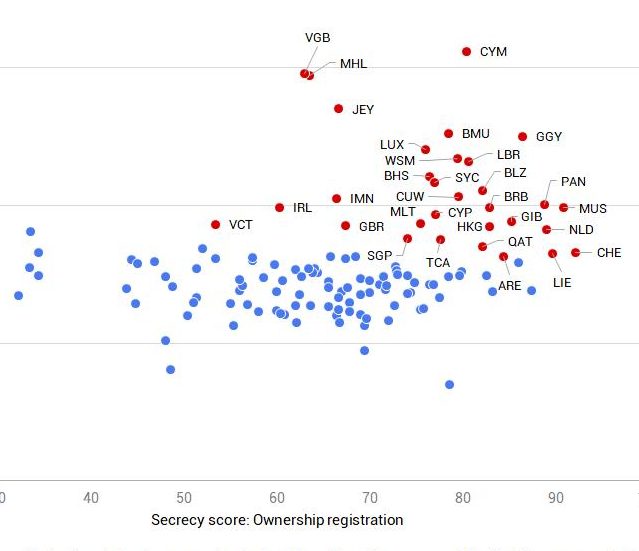

- Countries that hold a larger amount of wealth in Switzerland than what their share of global GDP would suggest form a heterogeneous group. It includes major oil exporters, a number of Continental European and Latin American countries, as well as various autocracies.

- For Asian economies and the United States other tax havens are relatively more important.

- While offshore wealth in relation to GDP amounts to only a few percentage points in Scandinavian countries, this ratio increases to 15% in Continental Europe and to 60% in Russia, countries of the Gulf and some Latin American countries.

- Incorporating of offshore wealth into inequality wealth leads to significant upward corrections. The top 0.01% wealth share of Scandinavian countries rises from circa 4% to 5%. In the UK, Spain and France, 30% to 40% of the wealth of the 0.01% richest households is found to be held abroad. In Russia, the vast majority of wealth at the top is held outside of the country.

Policy implications

- The authors’ findings have major implications for the estimation of wealth inequalities and the evolution of top wealth shares since the 1950s. For example, they show that the top 0.01% wealth share is now significantly higher in France than it was in the early 1950s.

- Alstadsæter et al. also call for the publication of more detailed banking statistics by low-tax jurisdictions and tax havens, following for instance the model of the Swiss National Bank.

Data

For their estimates of the amount of wealth being held in tax havens globally, the authors combine statistics from the Swiss National Bank (SNB), information released by various tax havens about bank deposits held by foreigners on their soil and cross-border portfolio investment series of the IMF.

Offshore wealth is allocated across countries based on SNB data and on the 2016-enriched Locational Banking Statistics of the Bank for International Settlements (BIS). These distributions are compared with leaked data gathered by the International Consortium of Investigate Journalists (ICIJ). [read more about these data sources]

Methodology

In this study, the authors develop descriptive macro-data analyses. They check the robustness of their estimates based on individual-level leaked data.

Go to the original article

This working paper was published in the Journal of Public Economics. It can be found on the journal’s website or downloaded from Gabriel Zucman’s website. [pdf]

This might also interest you

Monitoring the amount of wealth hidden by individuals in international financial centres

Tax evasion and Swiss bank deposits

Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality