What do external statistics tell us about undeclared assets held abroad and tax evasion?

Estimating International Tax Evasion by Individuals

Summary

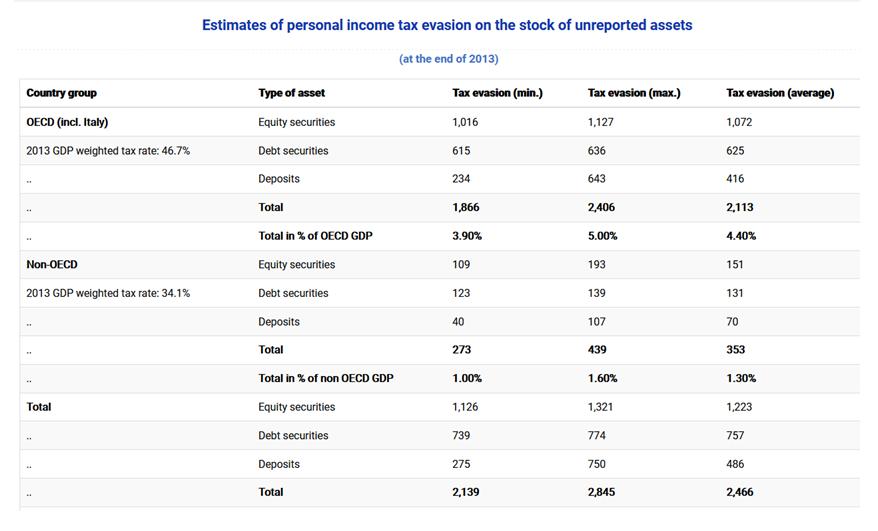

The study provides global and by-country estimates of offshore wealth held by individuals and its development over time. Related tax revenue losses are estimated for three different types of taxes: capital income tax, wealth and wealth-transfer taxes, and personal income tax on the income originally transferred offshore.

The authors derive their estimates of the global amount of wealth hidden offshore from the observed discrepancy between global portfolio assets and liabilities in international macro statistics. This discrepancy likely arises from the fact that corporations report their liabilities to foreign investors correctly while some of those investors conceal their ownership of assets from their domestic authorities by using shell companies in tax havens. The tax haven authorities do not report the ownership of assets because the shell companies belong to non-residents.

In a second step, the authors allocate the estimated global offshore wealth to each country of ownership. They do so by assuming that the ownership of offshore portfolio assets is distributed in the same way as offshore bank deposits held by non-banks for which bilateral country data is available. In order to refine the allocation method used in previous studies, Vellutini et al. assume that countries with a large outgoing FDI stock have a higher share of offshore deposits owned by corporations and adjust the share of offshore deposits owned by private households accordingly. In addition, they undertake some adjustments to account for offshore deposits held through shell corporations in other tax havens as these likely belong to residents of non-havens as well.

Based on non-compliance rates from the literature, the authors estimate how much tax is evaded in terms of capital income tax, wealth tax and wealth transaction taxes. In addition, they assume that part of the income transferred offshore to form the hidden wealth was also concealed to evade personal income tax.

Key results

- The estimated global offshore wealth is EUR 7.5 trillion in 2016 or 10.4% of global GDP.

- Offshore wealth held by EU residents in 2016 is estimated at EUR 1.5 trillion.

- The average yearly revenue lost to international tax evasion for the EU-28 over the period 2004-2016 is estimated at EUR 46 billion, or approximately 0.46% of GDP.

- Germany, the UK, France, and Italy account for the largest part of the absolute wealth hidden offshore. Cyprus, Malta, Portugal and Greece have the highest share of wealth hidden offshore in % of their GDP.

- International initiatives to fight cross-border tax evasion coincide with temporary decreases in offshore wealth.

Data

Data on international portfolio securities stem from the IMF’s Coordinated Portfolio Investment Survey (CPIS); the IMF’s International Investment Position (IIP), and the External Wealth of Nations Mark II database. Data on cross-border deposits are taken from the BIS Locational Banking Statistics. Additional data sources are used for refining the estimates and for calculation potential tax revenue losses. [read more about the data]

Method

Descriptive data analysis combining various data sources and extrapolation methods.

Go to the original article

The original report was published in the European Commission Taxation Papers. It can be downloaded from the EU website.

This might also interest you

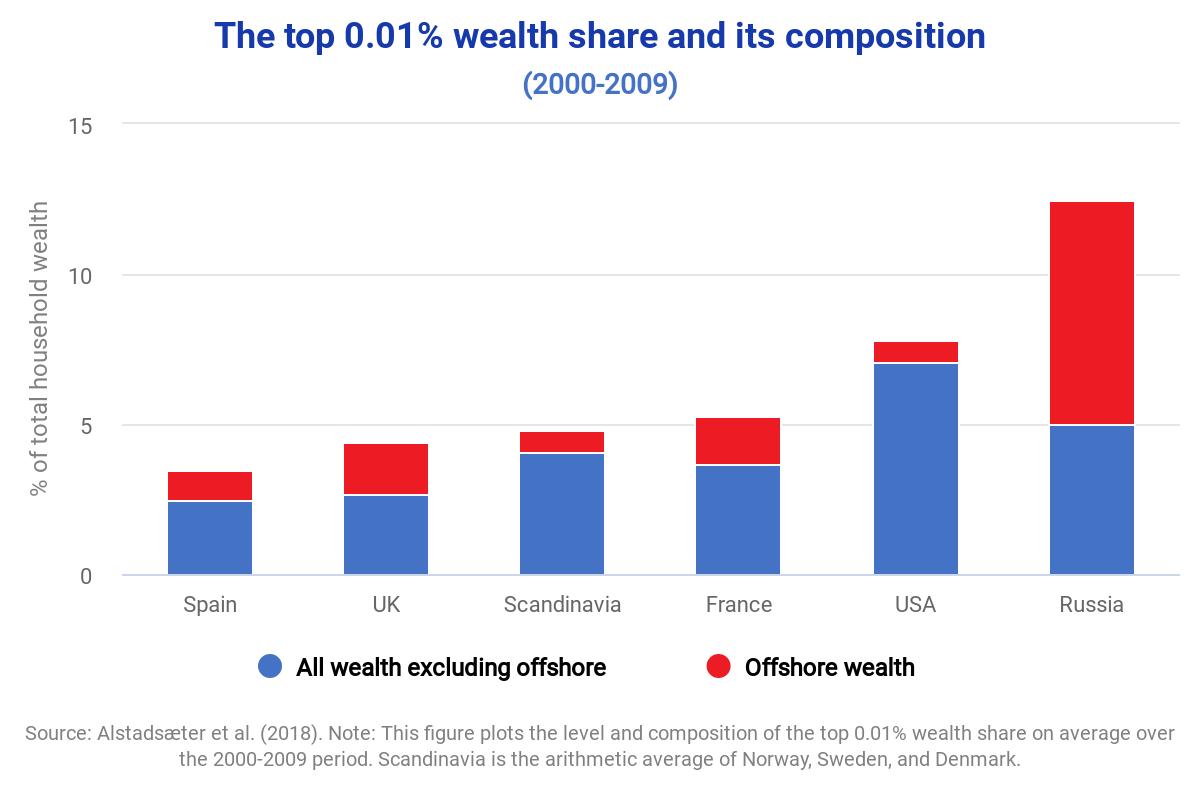

Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality

Tax Evasion at the Top of the Income Distribution: Theory and Evidence

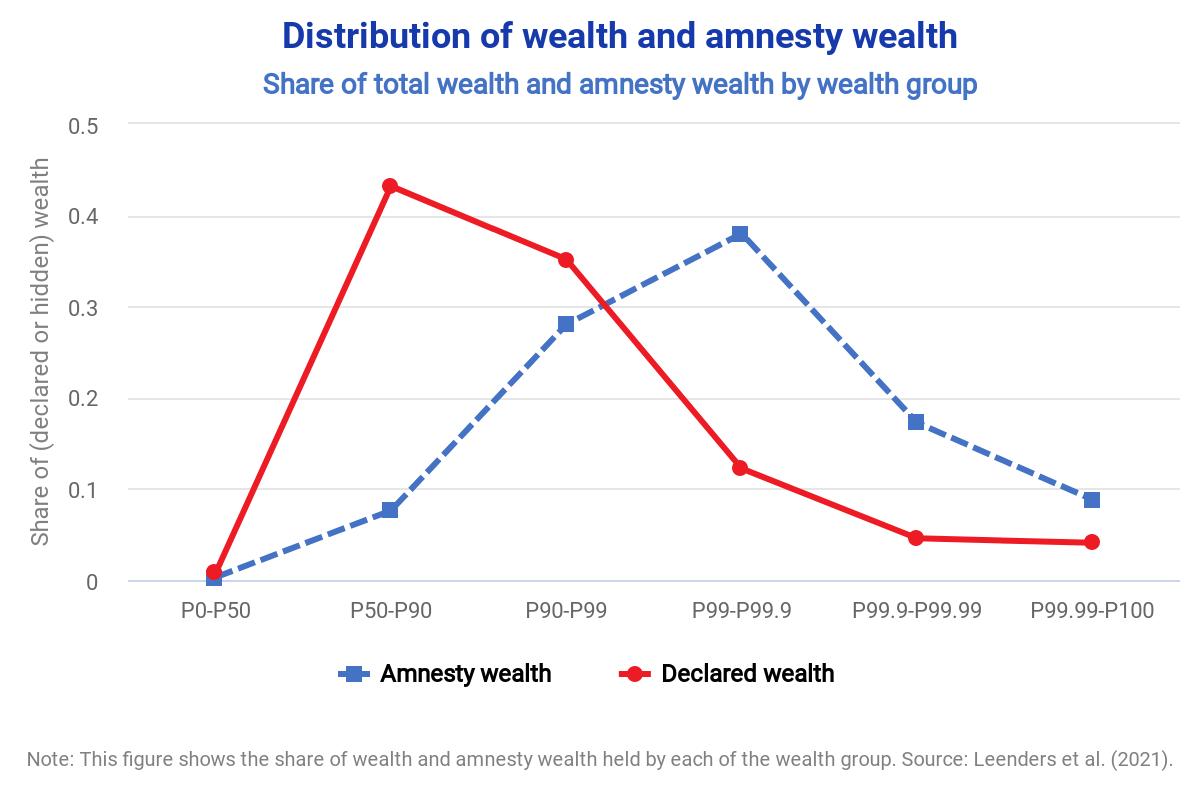

Offshore tax evasion and wealth inequality: Evidence from a tax amnesty in the Netherlands