Hidden in plain sight: Offshore ownership of Norwegian real estate

Offshore ownership of real estate

Real estate markets are highly vulnerable to inflows of illicit financial flows, as real estate ownership in or through tax havens creates opportunities for tax evasion and money laundering. Investment through shell companies which conceal the beneficial owner of real estate properties may have undesirable effects in housing markets or can be used to evade international sanctions.

Real estate has been a blind spot in statistics on international investments for years. Information on tangible assets owned by households outside their country of residency is limited and data is often neither centralized nor accessible for research. As a result, little is known about who owns real estate in tax havens, who owns real estate through shell companies located in tax havens and how much of this wealth has been duly reported to domestic authorities.

Furthermore, since the automatic multilateral exchange of information between tax authorities enforced in 2017 does not cover tangible assets, there is an incentive to convert financial assets into real estate to preserve anonymity. Recognizing the importance of this issue, this page provides an overview of the current state of research on cross-border ownership of real estate and the role of tax havens.

Explore research by location

Alstadtsæter, Økland, Planterose & Zucman (2022): Who owns offshore real estate? Evidence from Dubai.

The authors analyse a micro-dataset capturing the private and corporate ownership of about 800,000 properties in Dubai. They find that:

- 27% of total Dubai real estate is foreign-owned, 5% through other tax havens or citizenship-by-investment territories.

- At least 70% of Dubai properties owned by Norwegian taxpayers were not reported for tax purposes in 2019.

Morel & Uri (2021): The increase in real estate investments made by non-residents is driven by expatriates.

The authors analyse the development of direct investment in French residential properties by non-residents. They find that:

- At the end of 2009, non-residents owned 1.5% of residential real estate in France, up from 1% in 2001.

- Switzerland and Luxembourg are among the top ten countries of origin of foreign investment in French residential real estate, contributing 16.1% and 3.5% respectively to total foreign investment.

> read more about this research

Cvijanovic & Spaenjers (2020): “We’ll always have Paris”: Out-of-country buyers in the housing market.

The authors analyze real estate transaction data to explore the influence of non-resident foreigners in the Paris housing market. They find that:

- The top 20 foreign-buyers’ nationalities include several tax havens like Belgium, Ireland, Lebanon, Switzerland, and the Netherlands.

- The out-of-country buyers’ purchase price is about one-third higher than the average price paid by French buyers and more than 40% above the average purchase price of resident foreigners.

> read more about this research

Miethe, Peichl & Trautvetter (2022): Die Rolle von anonymen Immobilieneigentümern am deutschen Immobilienmarkt: Erste Ergebnisse einer systematischen Datenauswertung.

The authors gather data on real estate owned by corporate entities from five German states and cities and investigate the country of ultimate beneficial owners. They find that:

- 4% of the analysed corporate ownership chains end up in secrecy jurisdictions, where they can rarely be traced back to a natural person.

- The most important secrecy jurisdictions for investing in real estate via corporate entities are Switzerland and Luxembourg.

Alstadtsæter & Økland (2022): Hidden in plain sight: Offshore ownership of Norwegian real estate.

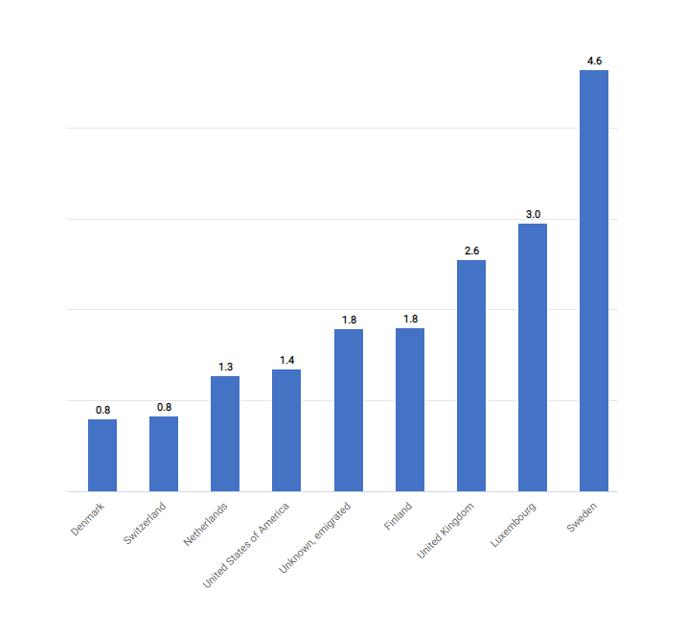

The authors analyze Norwegian administrative data to map foreign owned commercial and residential real estate and its links to tax havens. They find that:

- Overall, 2% of Norwegian real estate assets were owned by foreigners in 2017, while this share amounts to 10% for properties held by non-listed corporations.

- About 30% of corporate-owned, foreign-owned real estate was owned through tax havens in 2017. Half of the top 18 jurisdictions are well-known tax havens with Luxembourg accounting for more than half of tax haven ownership.

Agarwal, Chia & Sing (2020): Straw purchase or safe haven? The hidden perils of illicit wealth in property markets.

The authors explore real estate transaction data and offshore leak data from the Panama Papers to analyze how individuals associated to the Panama Papers behave in housing transactions occurring in Singapore. They find that:

- Illicit wealth transactions in Singapore’s housing market amount to SGD 3.72 billion per year on average (or 5.24% of the total transaction volume by individuals from 1995 to 2018).

- Real estate buyers linked to offshore secrecy pay a premium of 3.8% in their property purchases.

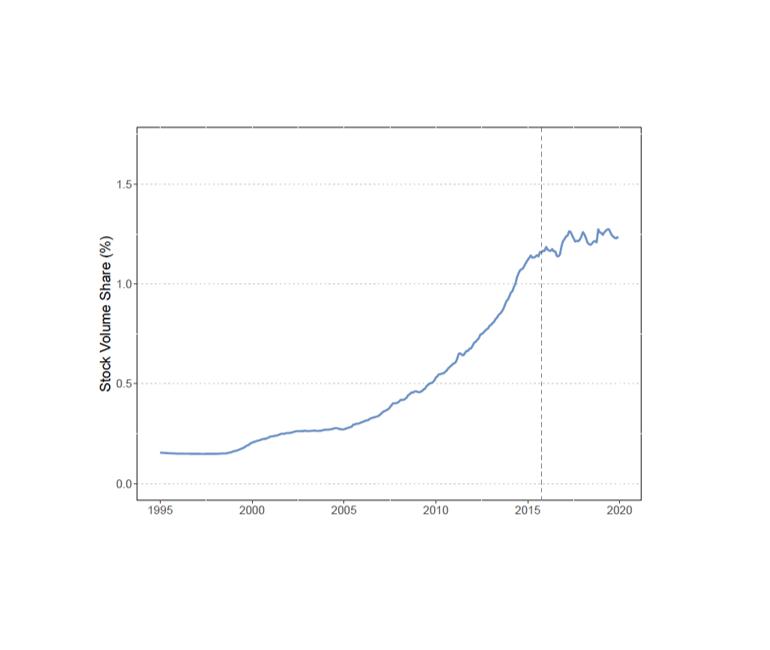

Johannesen, Miethe & Weishaar (2022): Homes incorporated: Offshore ownership of real estate in the UK.

The authors analyze several micro-data sources, from administrative data to offshore data leaks, to reveal the ultimate beneficial owners of real estate in the UK. They find that:

- The market share of offshore corporations increased rapidly between 2005 and 2015.

- Corporations in offshore tax havens were most commonly registered in the British Virgin Islands, Jersey and Guernsey.

> read more about this research

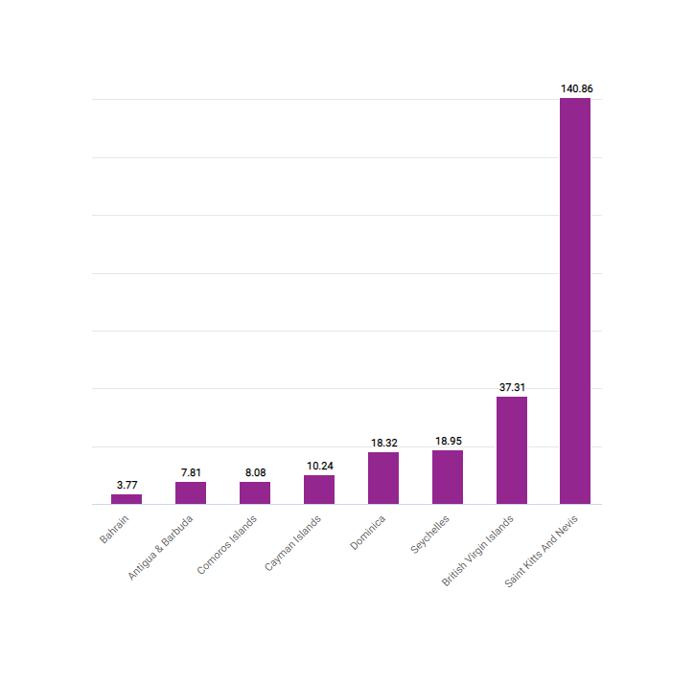

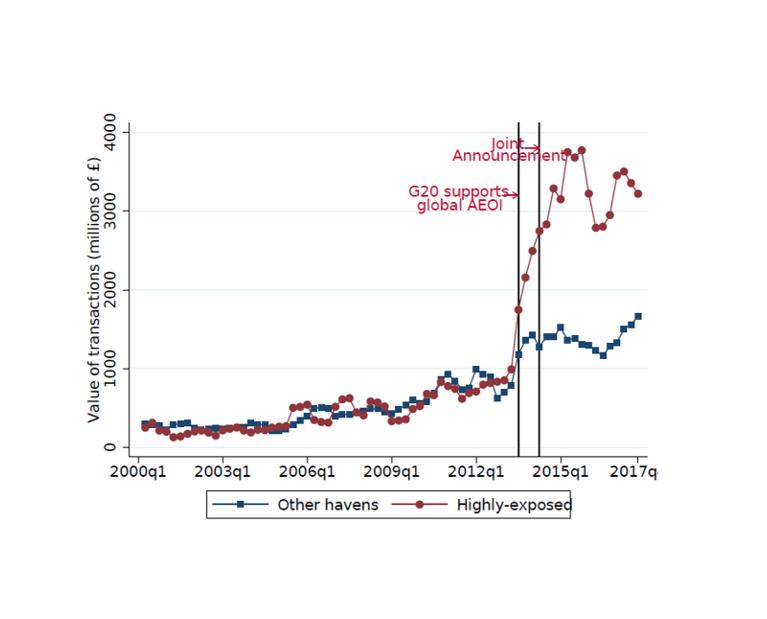

Bomare & Le Guern Herry (2022): Will we ever be able to track offshore wealth? Evidence from the offshore real estate market in the UK.

The authors analyze administrative data on real estate purchases made by foreign companies in the UK and leaked data to trace ultimate ownership for a subsample of transactions. They find that:

- The introduction of the Common Reporting Standard is associated with a significant increase of UK real estate investments from companies incorporated in highly exposed tax havens.

- Global scale estimates suggest that 24% to 27% of the offshore financial wealth fleeing tax havens might have been shifted to real estate.

> read more about this research

Badarinza & Ramadorai (2018): Home away from home? Foreign demand and London house prices.

The authors analyze several data sets of housing transactions and country-level economic and political risk measures to explore the influence of foreign risk on London house prices. They find that:

- Foreign capital accounts for 7.9% of the total variation in London house prices.

- At least 85% of residential property purchases by foreign companies in London occur through an offshore corporation such as Jersey (26.6%), Isle of Man (14.5%) and Guernsey (13.4%)

> read more about this research

Sá (2016): The effect of foreign investors on local housing markets: Evidence from the UK.

The author analyses administrative data to explore the effect of foreign investment by overseas companies on the housing market in England and Wales. She finds that:

- An increase of one percentage point in the volume share of residential transactions registered to overseas companies is associated with an increase of about 2.1% in house prices.

- Among the residential property transactions involving a foreign company, most of them were incorporated in tax havens such as British Virgin Islands (33.5%), Guernsey (19.4%), and Jersey (11.5%).

Collin, Hollenbach & Szakonyi (2022): The impact of beneficial ownership transparency on illicit purchases of U.S. property.

The authors analyze data on 39 million real estate transactions in the US over the period 2014–2019 to estimate the effect of beneficial ownership transparency on property purchases. They find that:

- From 2010 to 2015 real estate purchases by corporations have become more common in the luxury property market.

- There is little evidence that the recently introduced policy aimed at providing beneficial ownership transparency, reduced the amount of money being invested into the U.S. real estate market through the corporate all-cash route.

This might also interest you

Homes incorporated: Offshore ownership of real estate in the U.K.

Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

Will we ever be able to track offshore wealth? Evidence from the offshore real estate market in the UK