Hidden in plain sight: Offshore ownership of Norwegian real estate

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis

In this project, the authors analyze the structure of anonymous real estate investments in Germany. Since the administrative data is not yet centralized, little is known about anonymous real estate ownership. However, the authors were able to gather data from five German states and cities. High fees for data use or the refusal of individual states to provide the data impeded a more comprehensive, country-wide analysis.

To identify ownership chains and ultimately beneficial ownership, Miethe et al. matched the administrative data gathered with corporate ownership data from the Orbis database. Thus, the authors analyze real estate owned by corporations and not by individuals. They were able to identify 10,737 companies in Orbis, resulting in a total of 29,453 ownership chains.

The corporate data examined shows that German real estate is predominantly owned by German companies (91% of all companies). In most cases (86% of all chains ending with a German company), the shareholders are natural persons from Germany and are typically recorded in the commercial register.

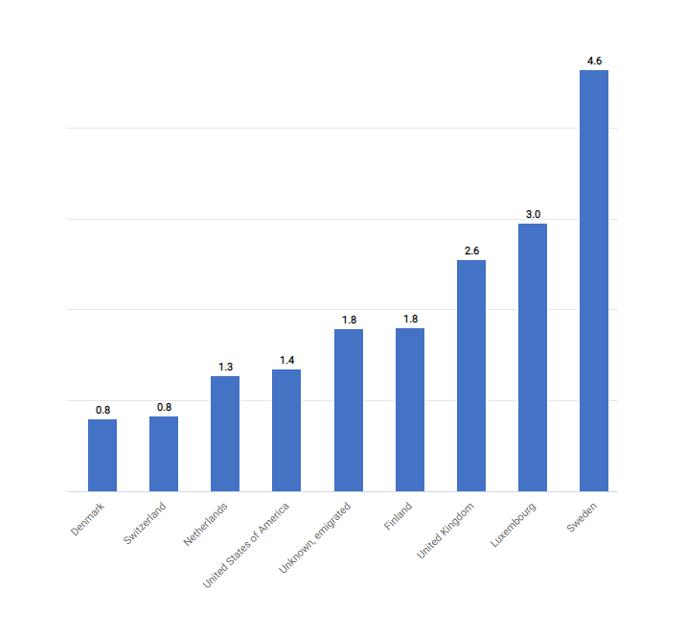

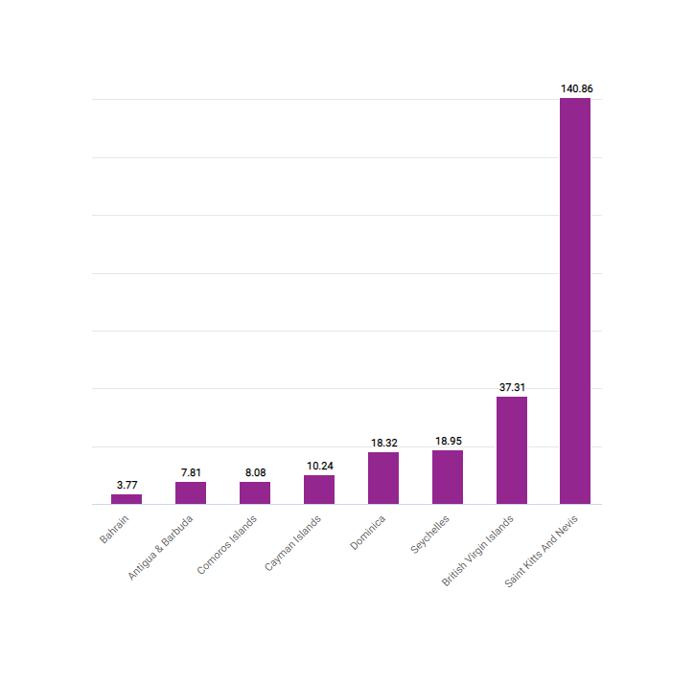

4.4% (1,297) of all ownership chains end up in secrecy jurisdictions, where they can rarely be traced back to a natural person. In fact, 55% of all ownership chains that end abroad cannot be traced back to a natural person and are therefore classified as “anonymous.” Of the ownership chains not traceable to a natural person, 22.3% ended in a secrecy jurisdiction. The most important secrecy jurisdictions were Switzerland (241), followed by Luxembourg (235) and the Netherlands (228). Secrecy jurisdictions such as Luxembourg, Cyprus, Liechtenstein, and the British Virgin Islands together account for 42.9% of foreign ownership. Furthermore, owners from secrecy jurisdictions were more likely to be anonymous (60.9% of owners there) than owners from other countries.

Key results

- The majority of real estate owned by companies is attributable to German companies (91%). In most cases , the shareholders are natural persons from Germany and are typically recorded in the commercial register.

- 4% (1,297) of the sample’s ownership chains end up in secrecy jurisdictions, where they can rarely be traced back to a natural person.

- Among the sample’s ownership chains ending abroad, 55% cannot be traced back to a natural person and are thus classified as “anonymous,” 22.3% of them ended in a secrecy jurisdiction.

- Luxembourg, Cyprus, Liechtenstein, and the British Virgin Islands together account for 42.9% of corporate foreign ownership in the sample.

Data

Miethe et. al. faced several challenges when collecting German real estate data. Nine out of 16 federal states would, in principle, be willing to provide administrative data on real estate ownership. However, this would be associated with very high costs (up to an estimated €45,375 in Hesse). Seven federal states, conversely, refused to provide data, citing data protection, lack of legitimate interest, and proportionality.

Nevertheless, the authors were able to gather data on five German states and cities, which were systematically matched with company ownership data. Data were available for Essen, Hanover, Dresden, Thuringia, and Saarland. Scientific evaluation of the data, including information on real estate ownership, was not permitted in all cases. Nevertheless, the authors were able to gather 24,577 data points of real estate owners.

Methodology

To determine ownership chains and ultimately beneficial ownership, the authors matched the administrative data with corporate ownership data. For the latter, the Orbis database (Bureau van Dijk) was used. The total of 10,737 matched companies resulted in 29,453 ownership chains. These ownership chains included information on the ultimate shareholder, as well as their share in the parent company. In addition, the ultimate owner identified by Orbis was retrieved at each chain step.

Go to the original article

The article was published in ifo Schnelldienst digital, 2022, 3, Nr. 6, 01-06. It can be downloaded from the ifo institute’s website (German). Download the technical report (German) [PDF].

This might also interest you

Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

The impact of beneficial ownership transparency on illicit purchases of U.S. property

“We’ll always have Paris”: Out-of-country buyers in the housing market