Hidden in plain sight: Offshore ownership of Norwegian real estate

The increase in non-residents’ real estate investments is driven by expatriates

Morel and Uri (2021) analyze foreign-owned real estate in France. They observe that real estate investment accounted for about 16% of the total stock of foreign direct investment in France. At the end of 2019, non-residents owned 1.5% of residential real estate in France, which amounted to 125 billion euros, four times more than in the early 2000s. According to Morel and Uri, only half of the rising value can be explained by rising prices.

Furthermore, the authors suggest that one of the main drivers of foreign ownership is the expatriates since 42% of non-residents who held residential real estate assets were born in France. The predominant share of real estate assets was owned by residents of border countries (led by the United Kingdom, 29 billion euros at the end of 2019), but this trend declined from 86% in 2009 to 80% in 2019.

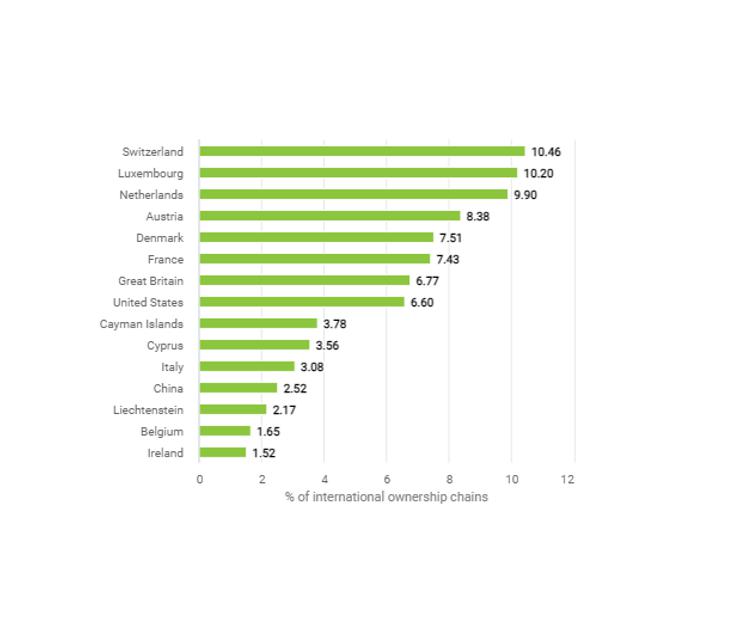

Even though the study focuses on foreign-owned real estate, it does not examine anonymous ownership and/or owners located in tax havens. However, their results show that Switzerland (16.1%) and Luxembourg (3.5%) are among the top ten origin countries for real estate assets owned by foreigners in 2019.

The highest proportion of non-resident homeowners in France was observed in Paris. However, the authors did not find indication that non-resident buyers had an inflationary effect on Parisian real estate prices over the 2010–2019 period. While the purchase price per square meter of housing purchased by non-residents was 2.5% higher than that of housing purchased by residents, the transaction price per square meter of housing sold by non-residents on average was 2.5% lower.

Key results

- At the end of 2009, non-residents owned 1.5% of residential real estate in France, up from 1% in 2001. The value of their real estate assets amounted to 125 billion euros, four times more than in the early 2000s.

- Switzerland and Luxembourg are among the top ten countries of origin of foreign investment in French residential real estate, contributing 16.1% and 3.5% respectively to total foreign investment.

- For similar housing characteristics, non-residents conduct real estate transactions at prices that are not very different from those of residents.

Data

The authors use data from the Statistical Data and Studies Division (SDES) and Banque de France – to be more precise, their research is based on the Fidéli, Filocom, and property databases. All databases can be found here: https://www.casd.eu/en/data-used-at-casd/

The Filocom and Fidéli databases are compiled to improve the knowledge of the French housing stock and resident demographics. This data allows to measure the stocks of residential real estate direct investments by non-residents, which until now had been proxied by aggregating flows. This is possible since the databases provide information on the tax address of the owner of each dwelling in France.

Methodology

Determination of stocks of real estate direct investments by non-residents in France: The surface areas provided are restated to address certain geographic or time limitations and are valued in euros, using Insee-Notaires hedonic price indices.

Hedonic regression of real estate transactions in Paris: to measure the price differential between residential and non-residential owners, property characteristics are matched with two indicators specifying whether the buyer or seller lives outside France.

Go to the original article

This article was published in Bulletin de la Banque de France 237/6 September-October 2021. It can be downloaded from the website of Banque de France. [PDF]

This might also interest you

Homes incorporated: Offshore ownership of real estate in the U.K.

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis

Who owns offshore real estate? Evidence from Dubai cross-border real estate investments