Base Erosion, Profit Shifting and Developing Countries

The scale of corporate tax avoidance

How big is profit shifting? How much tax revenue is lost globally and in your country? The biggest challenge when estimating the scale of profit shifting is to establish a credible counter-factual of how profits would be distributed across countries in the absence of profit shifting. Generally, researchers assume that the location of MNEs’ real economic activity should be a good proxy for where profits are generated. The search for appropriate measures of real economic activity and methods to account for existing productivity differentials across countries or industries has frequently been hindered by the lack of reliable data. Still, researchers have produced a variety of profit shifting estimates. This page presents a selection of the most recent studies.

Chose an estimate

- García-Bernardo & Janský 2021

- Tax Justice Network 2021

- Tørsløv et al. 2020

- Janský & Palanský 2019

Choose an estimate

- Álvarez-Martínez et al. 2021

- García-Bernardo & Janský 2021

- Tørsløv et al. 2020

- Janský & Palanský 2019

- Cobham & Janský 2017

Download data and explanatory notes

- Estimates of profit shifting and tax revenue losses. [data table]

Read more about the estimates

- Álvarez-Martínez et al. (2021). How large is corporate tax base erosion and profit shifting? A general equilibrium approach. [research summary]

- García-Bernardo & Janský (2021). Profit Shifting of Multinational Corporations Worldwide. [research summary]

- Tax Justice Network (2021). The state of tax justice 2021. [research summary]

- Tørsløv et al. (2020). The Missing Profits of Nations. [research summary]

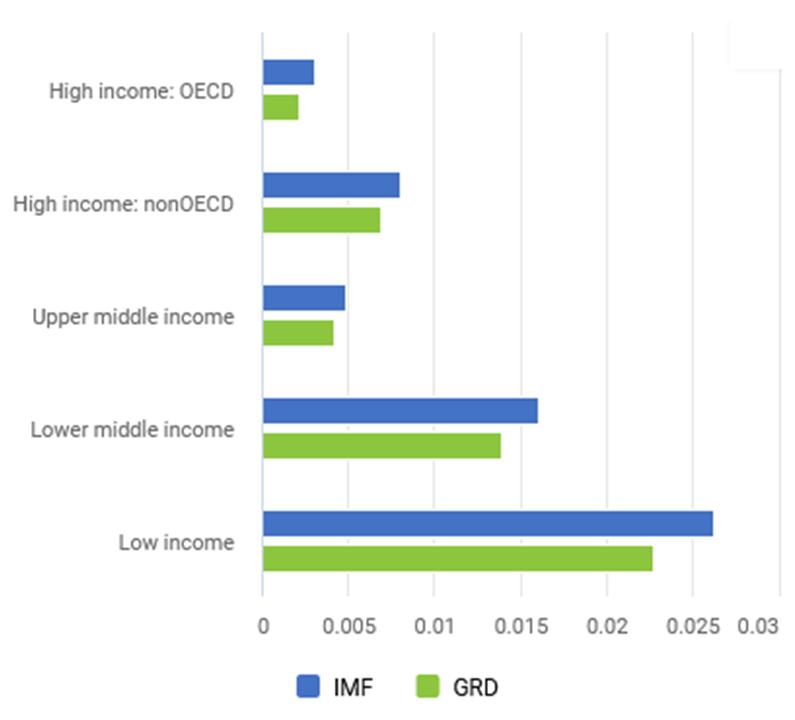

- Janský & Palanský (2019). Estimating the scale of profit shifting and tax revenue losses related to foreign direct investment. [research summary]

- Cobham & Janský (2017). Global distribution of revenue loss from tax avoidance: re-estimation and country results. [research summary]

More research on the scale of corporate tax avoidance

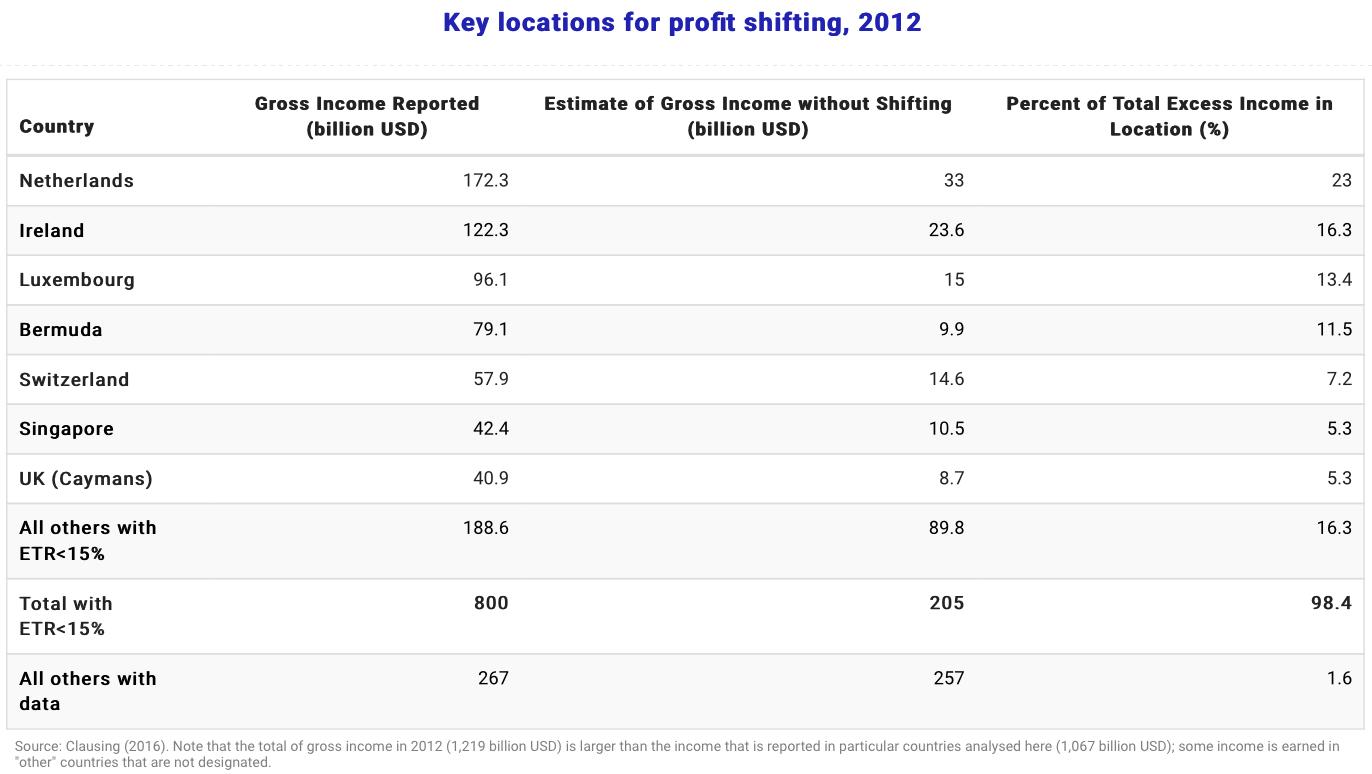

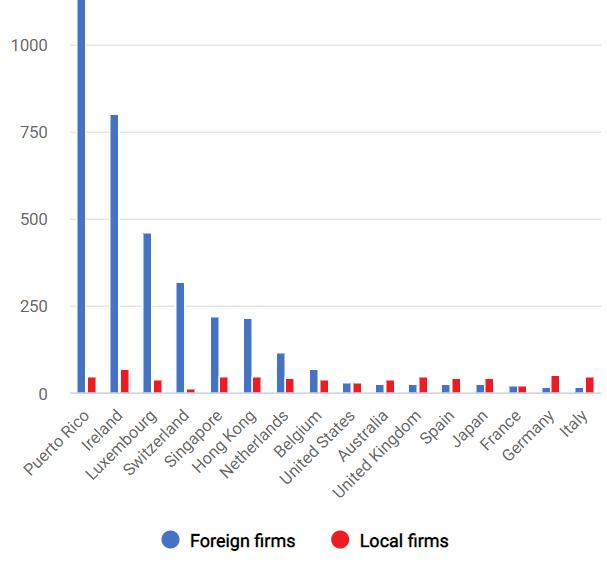

Big and ‘unprofitable’: How 10% of multinational firms do 98% of profit shifting

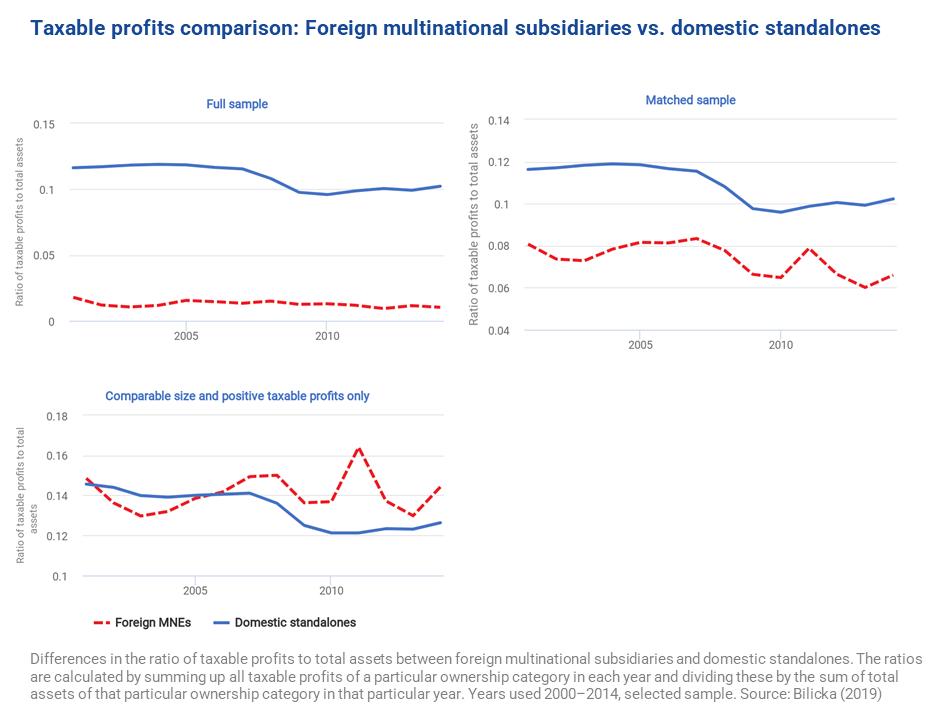

Comparing UK tax returns of foreign multinationals to matched domestic firms

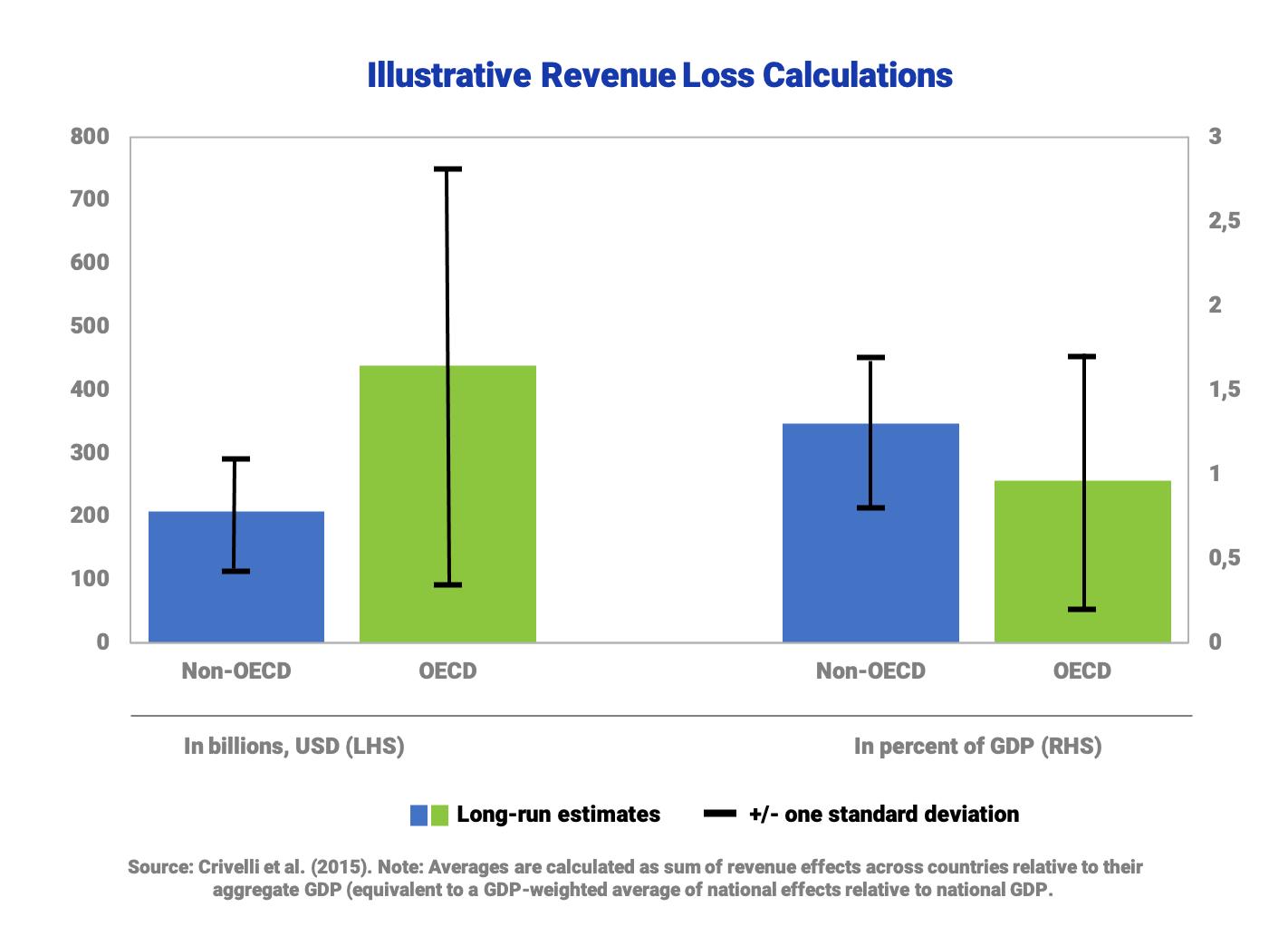

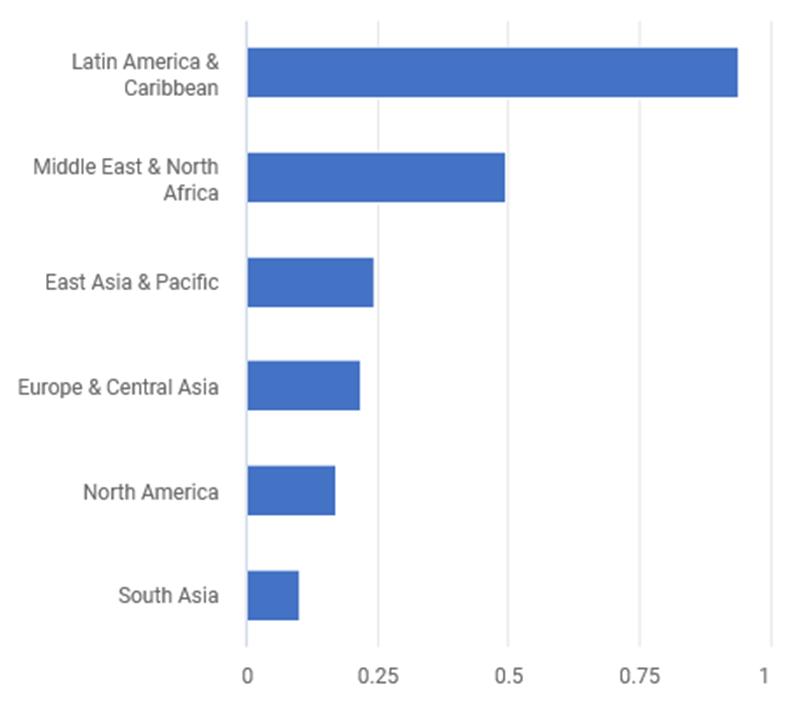

The Effect of Profit Shifting on the Corporate Tax Base

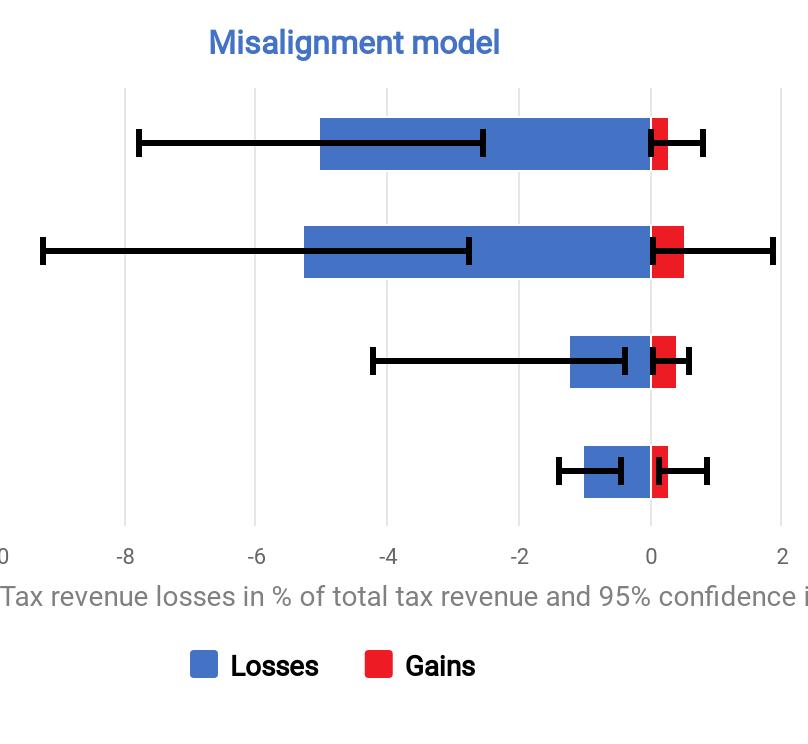

Profit shifting of multinational corporations worldwide

The Missing Profits of Nations

Global distribution of revenue loss from tax avoidance: re-estimation and country results

Estimating the Scale of Profit Shifting and Tax Revenue Losses Related to Foreign Direct Investment