European tax evasion in the light of the Pandora Papers

Panama Papers, Paradise Papers, Bahamas Leaks and now Pandora Papers – these investigations keep reminding us of the importance of tax issues in our societies. To fully understand the significance of these revelations, it is useful to put them into perspective based on the most recent economic research, the international efforts in place to reduce offshore fraud, and future avenues to achieve greater fiscal transparency.

Offshore tax evasion: the scale of the phenomenon

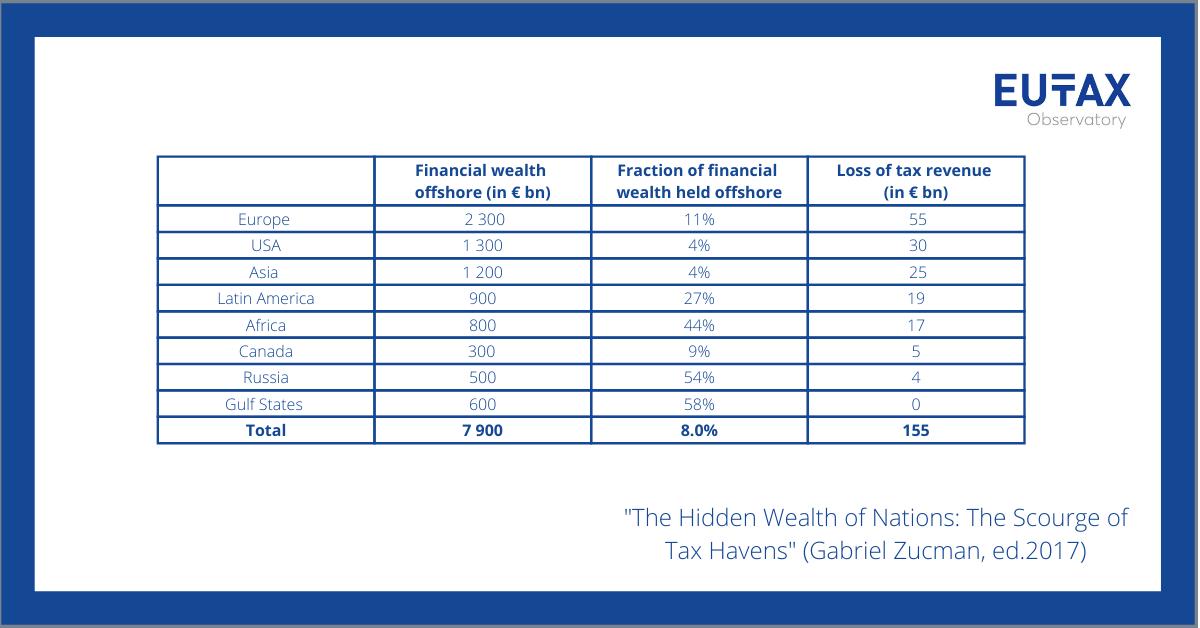

- Amount of financial wealth held in tax heavens: EUR 7,900 billion in 2017. According to estimates by French, Danish, and Norwegian researchers, this is the amount of the world’s financial wealth held in tax havens. This amount is equivalent to 8% of the world’s GDP. The result is a loss of tax revenue of around €155 billion per year worldwide.

- Europe is particularly affected by international tax planning. About 11% of its total net wealth, or EUR 2,300 billion, is held offshore. By way of comparison, this is equivalent to the GDP of France.

- The repercussions affect individuals and local firms alike: a tax base loss for many countries implies more taxes on taxpayers and local firms, a decrease in public expenditure, and more difficult efforts to deal with public deficits.

What progress has been made in recent years?

Since the recent financial crisis, there have been major efforts to address the activity of tax havens.

- The most ambitious initiative has been the introduction of automatic exchange of banking information system, the “Common Reporting Standard”, effective since 2017. This mechanism requires financial institutions to report the identity of their non-resident clients to the tax authorities where they are located, as well as the amount of assets held and income received by these clients.

- Although this has been a major step in the right direction, a number of gaps remain to be addressed. As the Pandora Papers illustrate, offshore wealth is often held through shell companies, the beneficial owners of which are sometimes non-identified. In this case, the relevant information is not reported to the relevant tax authorities.

- In addition, public statistics on these issues remain limited, making it difficult to assess the efforts undertaken. In 2020, the OECD estimated the amount of investments in offshore accounts at EUR 11,000 billions. But no information on the nature of these assets, their location, and their owners is published. As a result, it is impossible to know whether effective tax rates on high net worth individuals have increased in response to the implementation of the automatic exchange of banking information.

Avenues for greater financial transparency

In the spirit of continuing the progress of recent years, several additional steps can be envisaged.

- Firstly, more systematic registration of financial wealth, along the lines of what countries already do for real estate. This could take the form of a financial cadastre, which could be national, European, or global.

- Secondly, stronger sanctions for the providers of tax evasion services. This would include designers of fraudulent schemes, any financial institution that does not comply with international regulations, and other legal and financial intermediaries who facilitate tax evasion. One of the main lessons of recent research in this area is that the regulation of the supply of tax evasion and tax avoidance services is an essential tool to reduce these activities.