Tax evasion and Swiss bank deposits

The deterrence effect of whistleblowing: An event study of leaked customer information from banks in tax havens

Summary

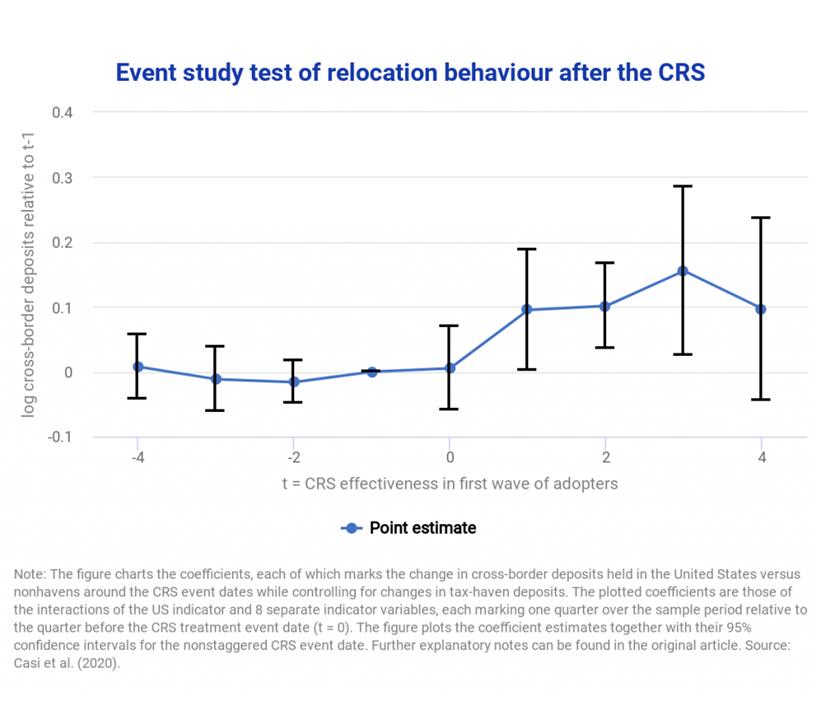

In this working paper, Johannesen and Stolper investigate the emergence of whistleblowers, who raise awareness about how tax-haven financial institutions facilitate tax evasion. They evaluate the impact of this trend on the scale of offshore tax evasion. Focusing on the release of customer files from Liechtenstein-based LGT Bank by Heinrich Kieber, which was made public in February 2008, they show that the leak caused a significant decrease (by 2.2% during the first 4 days of implementation) in the stock market valuation of Swiss banks that are known to be associated with tax evasion practices.

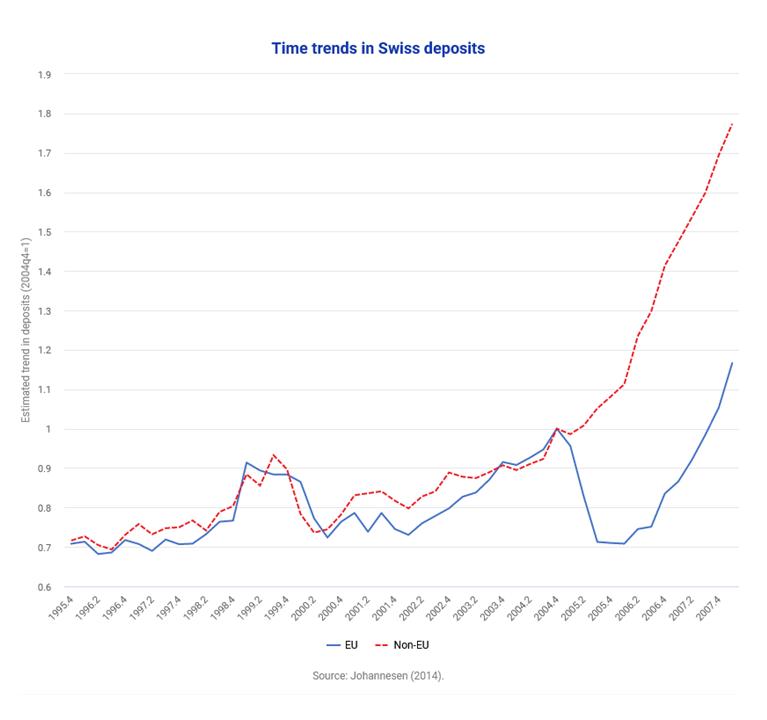

Using a variety of identification techniques, the authors demonstrate that the abnormal returns of the affected banks are very unlikely to be caused by a simultaneous shock unrelated with offshore tax evasion. Johannesen and Stolper further argue that the negative returns on the stock market cannot merely be explained by unwanted media attention drawn upon the topic of tax evasion because other media events did not induce similar stock market responses. Based on the data from the Bank for International Settlements, they also identify an “abnormal” decrease of foreign-owned deposits in tax havens as of the first quarter of 2008, following the leak, which speaks in favour of a real deterrence effect.

According to the authors, the most plausible interpretation of the observed stock market reaction is that the LGT leak induced a shock to the detection risk as perceived by tax evaders, which reduced the use of offshore bank deposits and eventually weighed down the expected future profits of Swiss banks.

Key Results

- On the first day of the LGT leak, banks known to be associated with tax evasion practices earned an abnormal return of -0.5% on the stock market.

- The shock was persistent, with statistically significant cumulative abnormal returns of -2% over four trading days.

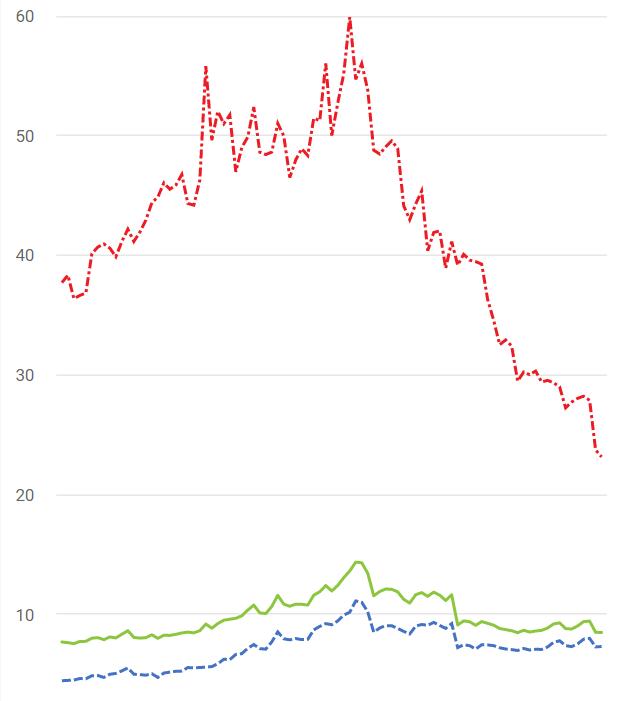

- While deposit stocks were evolving very similarly in tax havens and higher-tax jurisdictions until the last quarter of 2007, a sudden decrease by 10 to 15% in tax-haven bank deposits could be observed following the leak.

- The stock market reaction might indicate a correction of market expectations with regard to the future profits of banks providing access to tax evasion practices.

Policy Implications

- The authors find evidence that whistleblowing has a deterrence effect on tax evaders.

- Their findings suggest that only the first leak seemed to have an impact, which indicates that market participants and tax evaders fully updated their belief about the riskiness of tax evasion activities after the LGT leak.

Data

Stock market data are drawn from Bloomberg and information about the international location of bank deposits come from the Locational Banking Statistics of the Bank for International Settlements (BIS).

Methodology

The authors employ a standard event study framework comparing the development of portfolio returns before and after the leak for banks known to be involved in offshore tax evasion and those that were not.

Go to the Original Article

The original paper was published in 2017 by the Economic Policy Research Unit of the University of Copenhagen and can be accessed on the EconStor website.

This might also interest you

Cross-border tax evasion after the Common Reporting Standard: Game over?

Hidden treasures: The impact of Automatic Exchange of Information on cross-border tax evasion

Countermeasures to tax evasion