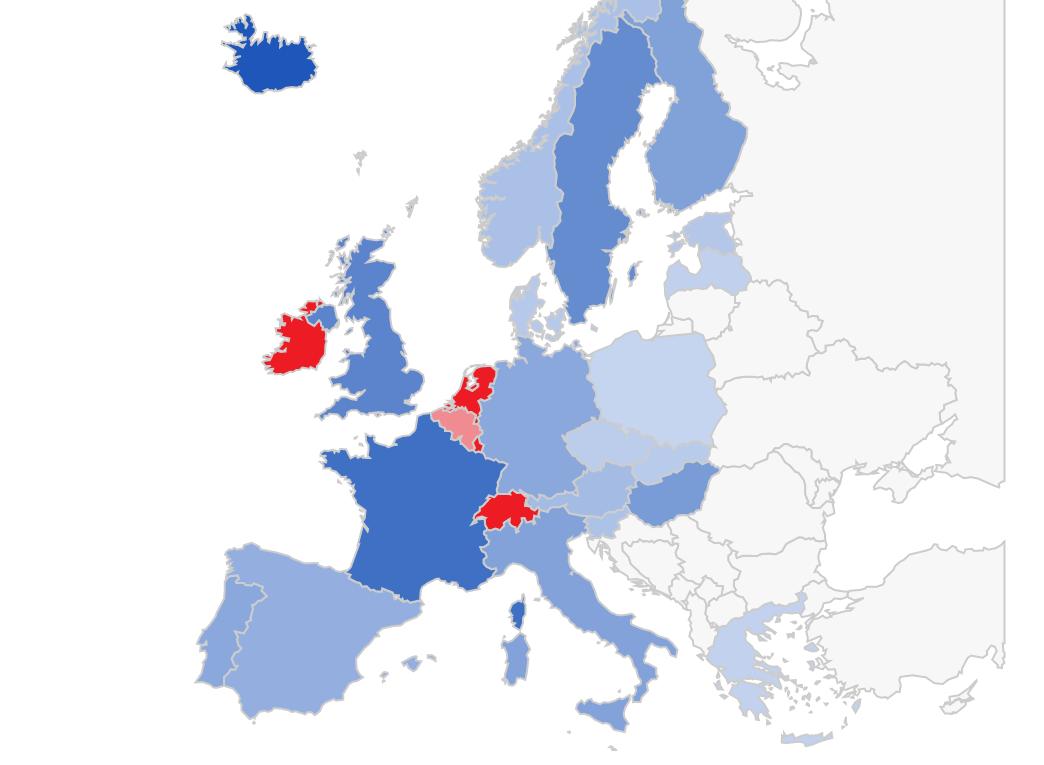

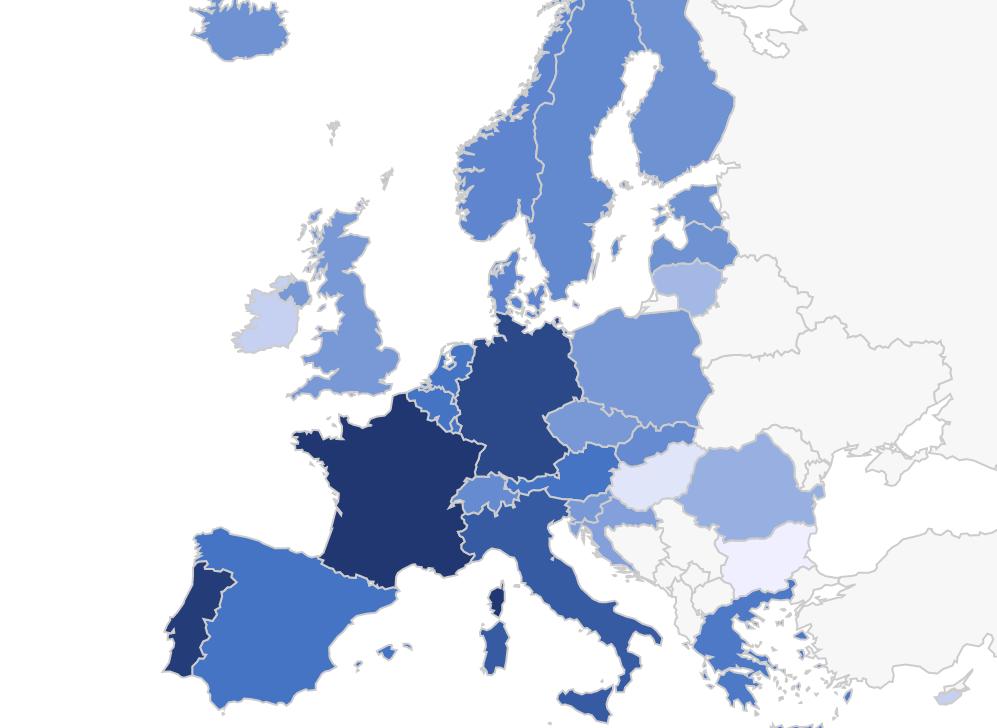

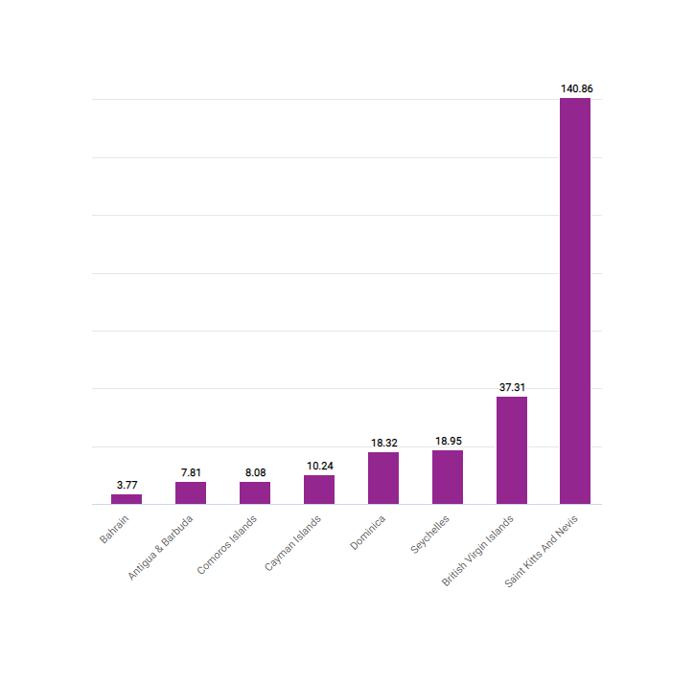

Offshore ownership of real estate

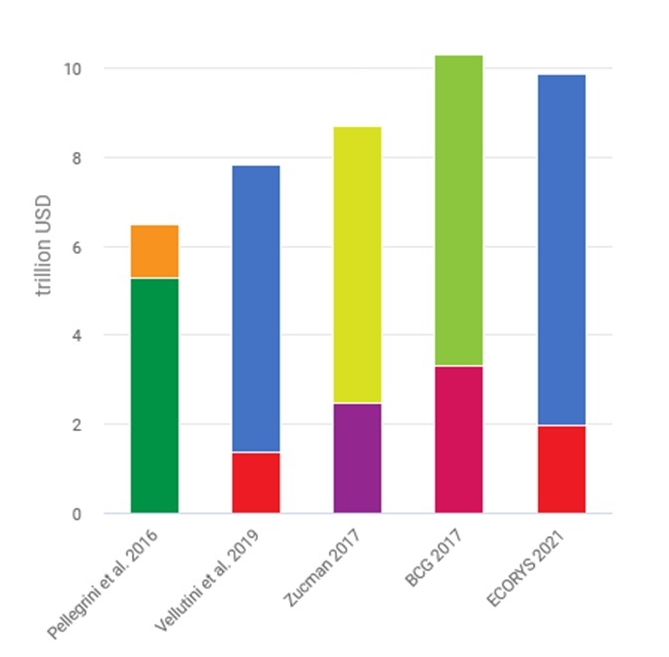

Recent estimates of tax avoidance and offshore wealth

Explore recent estimates of the scale of tax avoidance, tax evasion and offshore wealth. Compare estimates across countries, download figures and underlying data or learn more about the methodological approaches used by different researchers.

Data sources

In the data sources section you find a collection of original data on multinational enterprises‘ tax payments, profits and activity, cross border wealth, and tax rates and rankings which researchers have used in their work.

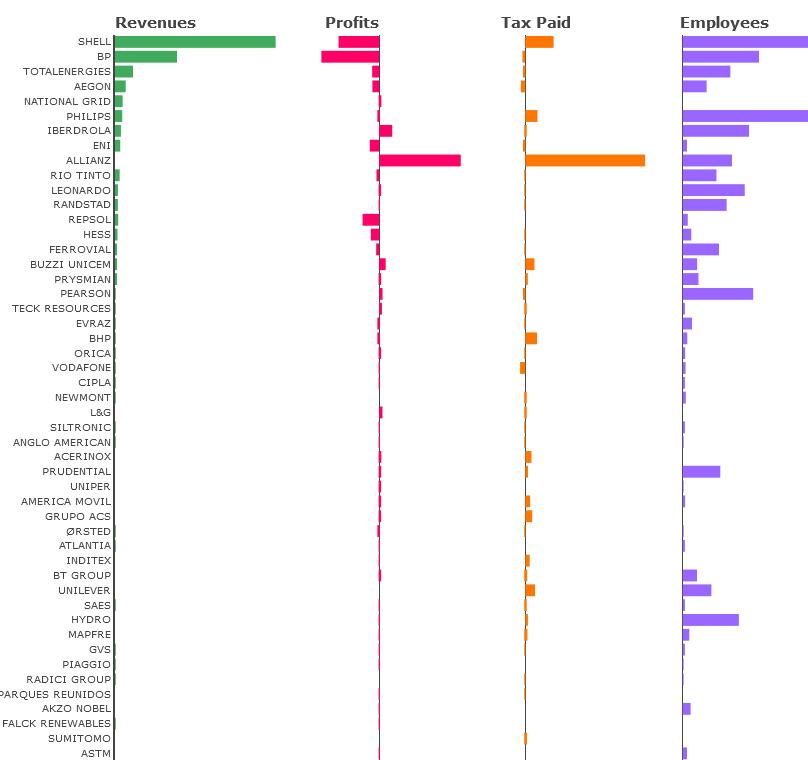

The Public Country-by-Country Reports Explorer

Banks' country-by-country reporting

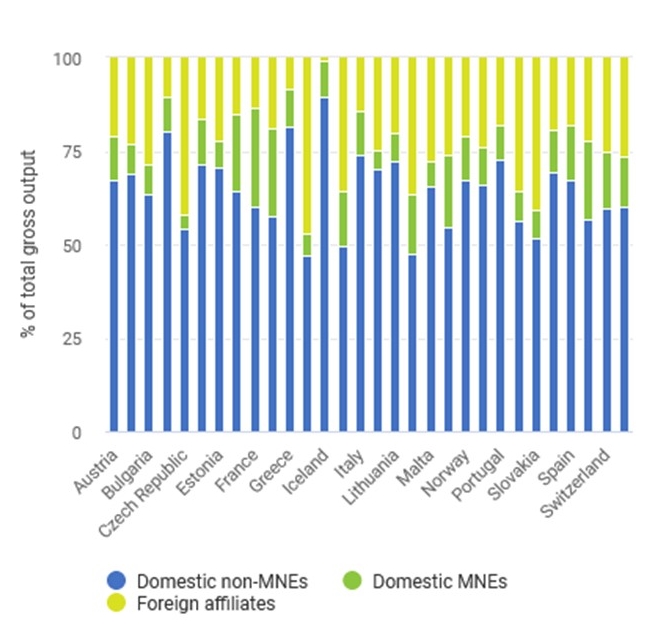

Multinational enterprises' profits and activity

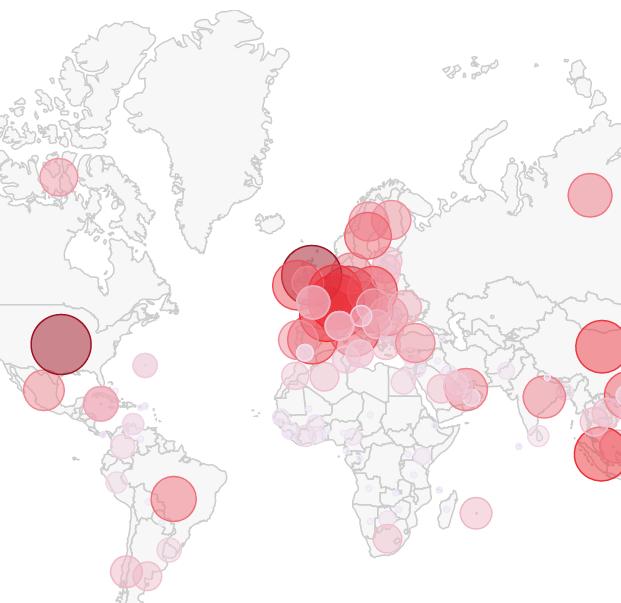

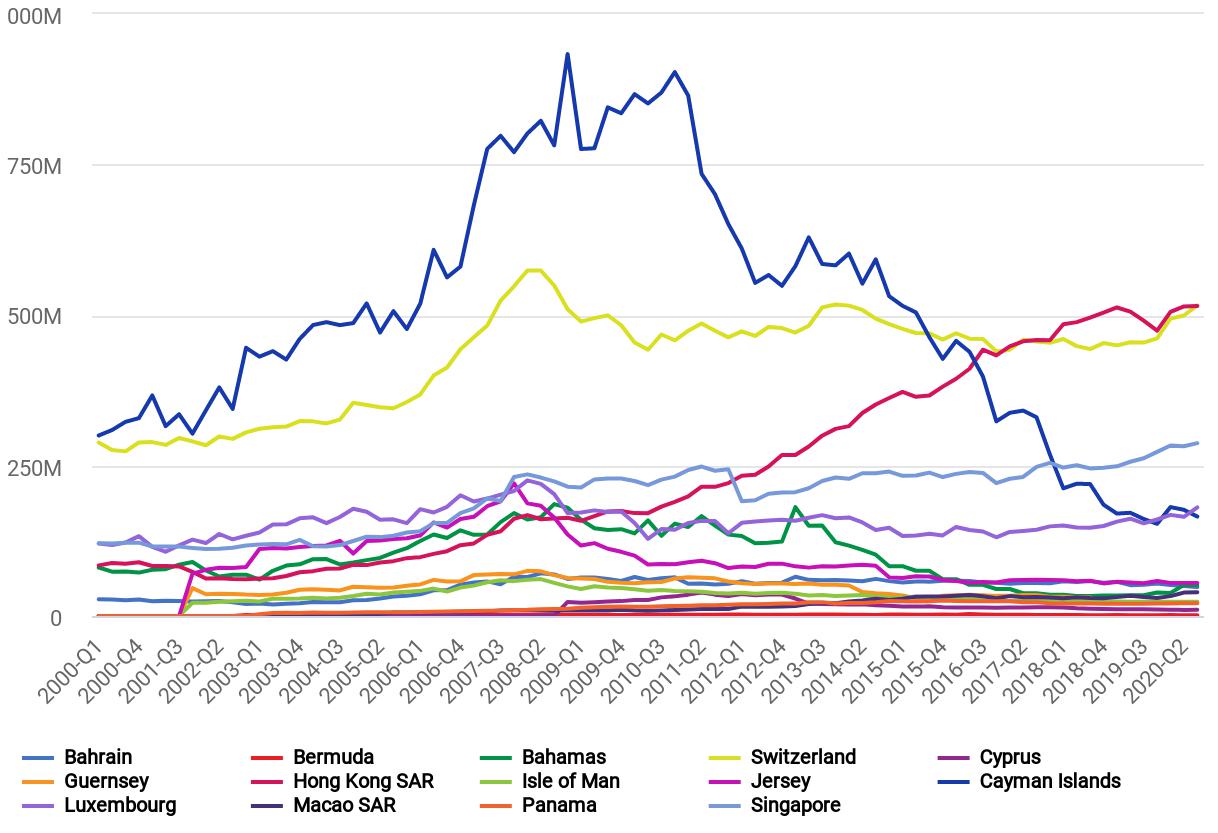

Cross-border wealth

Tax rates and rankings

The Tax Observatory's literature summaries

In this section, you find summaries of recent empirical research on corporate tax avoidance and tax evasion by individuals. Our selection covers reports, working papers and peer-reviewed articles which analyse the scale and channels of tax avoidance and evasion, evaluate the effectiveness of countermeasures or assess new policy proposals.

Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

Hidden in plain sight: Offshore ownership of Norwegian real estate

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis

Homes incorporated: Offshore ownership of real estate in the U.K.

Straw purchase or safe haven? The hidden perils of illicit wealth in property markets

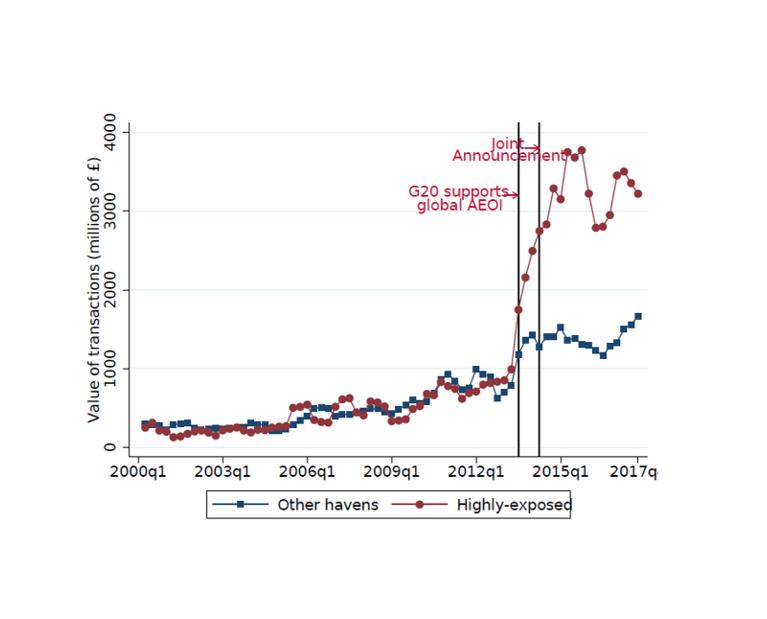

Will we ever be able to track offshore wealth? Evidence from the offshore real estate market in the UK

Join Us

Please contact us for further information.

Newsletter

Subscribe