Escaping the Exchange of Information: Tax Evasion via Citizenship-by-Investment

A victim of regulatory arbitrage? Automatic exchange of information and the use of golden visas and corporate shells

Summary

Ahrens et al. find limited evidence that sophisticated tax evaders circumvent the automatic exchange of information (AEI) on financial accounts with the help golden passport schemes or the use of shell corporations and anonymous trusts. Since the implementation of AEI, most countries exchange information on bank accounts held by non-residents in order to detect cross-border tax evasion. However, if the holders of tax haven bank accounts pretend to be tax haven residents or conceal their ownership with tax-haven-based shell companies or trusts, the ownership information might not be forwarded to their true country of residence. The authors gather a list of jurisdictions offering citizenship-by-investment (CBI) or residency-by-investment (RBI) schemes and that display a high “tax risk” according to the 2018 Financial Secrecy Index compiled by the Tax Justice Network. Countries that facilitate the use of corporate vehicles for tax evasion, for example by lax beneficial ownership regulation, are identified based on two other components of this index.

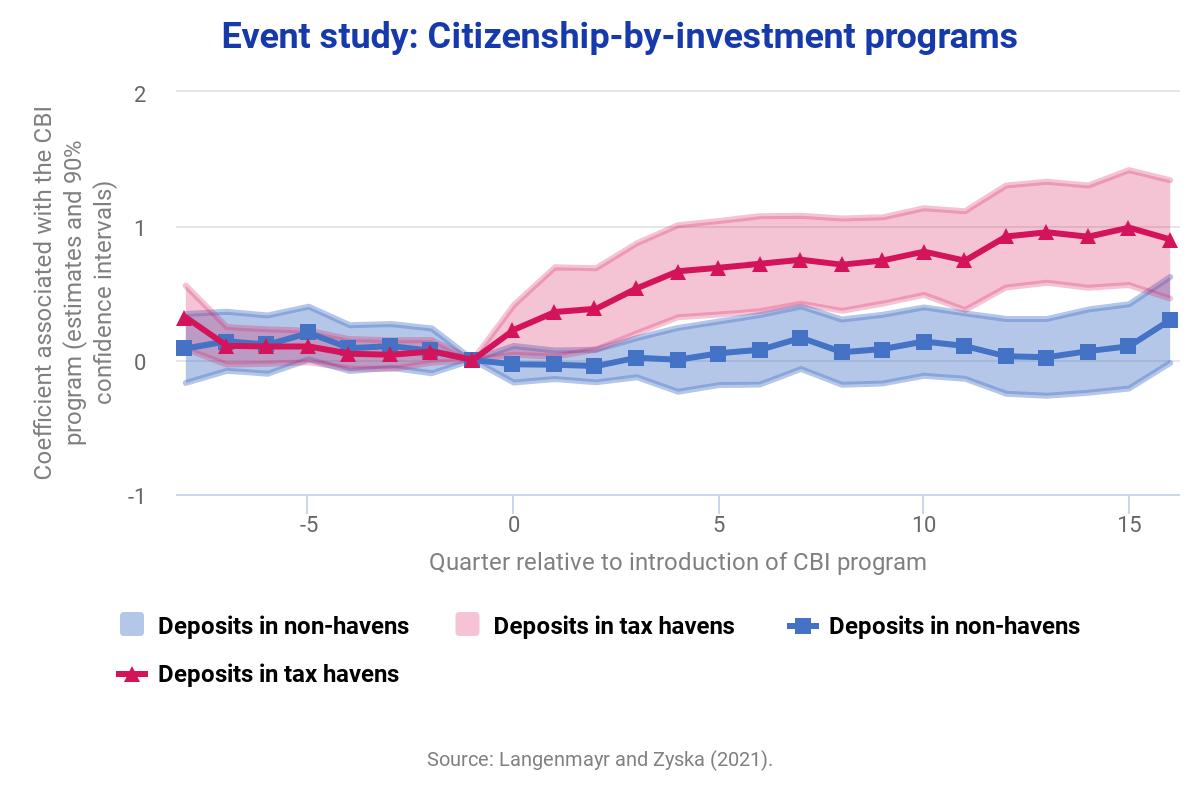

To identify the effect of such schemes, Ahrens et al. compare the evolution of cross-border deposits and portfolio investments from jurisdictions that offer lax beneficial ownership regulations or golden passport schemes with countries that do not. A relative increase of cross-border deposits held by residents or entities from countries offering CBI schemes or lax beneficial ownership regulation would indicate that these loopholes are used by tax evaders to circumvent the AEI.

The authors find evidence that the two types of schemes are used to hide portfolio investments in the euro area, but not in other key areas (Dollar and Pound markets). They do not find a significant effect for cross-border deposits in any of the three markets. The results, therefore, provide only limited evidence for tax evaders’ regulatory arbitrage through RBI/CBI schemes or shell corporations. The authors thus conclude that these avoidance practices have been used but to a limited extent so far.

Key results

- The authors find evidence that citizen-by-investment (CBI), residence-by-investment (RBI) schemes and lax beneficial ownership regulations have been used to conceal the ownership of portfolio assets in the euro area.

- Portfolio investments in the euro area from countries offering shell corporations and trust schemes have increased by 22%.

- Portfolio investments from countries offering CBI or RBI schemes in the euro area have increased by 16% but with limited statistical significance.

- The authors do not find evidence of increased use of these loopholes for the Dollar and Pound markets or cross-border deposits in any of the three markets.

- The authors conclude that some tax evaders have used golden passport schemes and shell corporations to circumvent transparency regulations, but that these practices have remained limited so far.

Policy implications

- The authors stress that even if the use of the examined loopholes seems limited according to their results, circumventions of the CRS undoubtedly exist and call for further normative work to close the remaining loopholes, especially through multilateral processes like the OECD’s.

Data

Ahrens et al. rely on two main sources: portfolio investment data from the Coordinated Portfolio Investment Survey (CPIS) of the IMF and cross-border deposit data from the Locational Banking Statistics of the BIS (read more).

Countries with high-tax-risk CBI/RBI schemes and lax beneficial ownership regulations are identified based on various components of the 2008 version of Tax Justice Network’s Financial Secrecy Index.

Methodology

The authors use a difference-in-difference estimation with the countries offering RBIs, CBIs or trusts and shell corporations as the treatment groups and countries which do not offer them as control groups. They assess the robustness of results with an event study approach.

Go to the original article

The article was published by the Regulation and Governance review and can be downloaded from the website of the Wiley Online Library.

This might also interest you

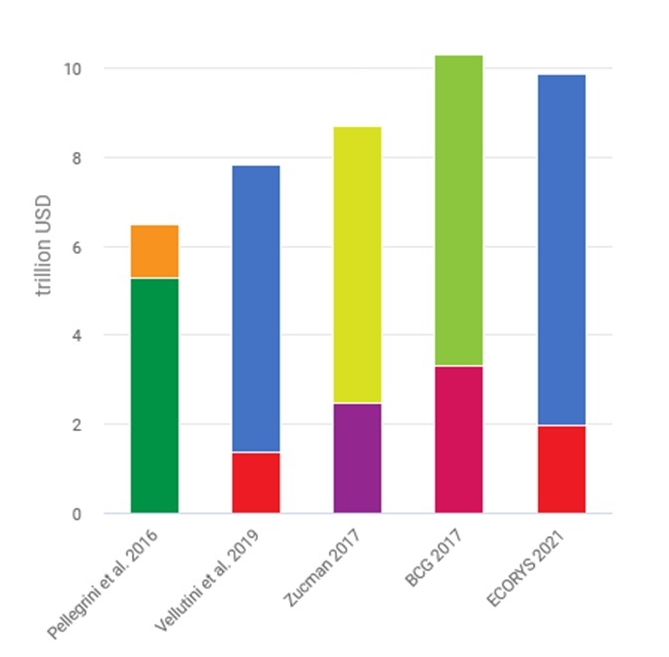

The scale of tax evasion by individuals

Channels of tax evasion

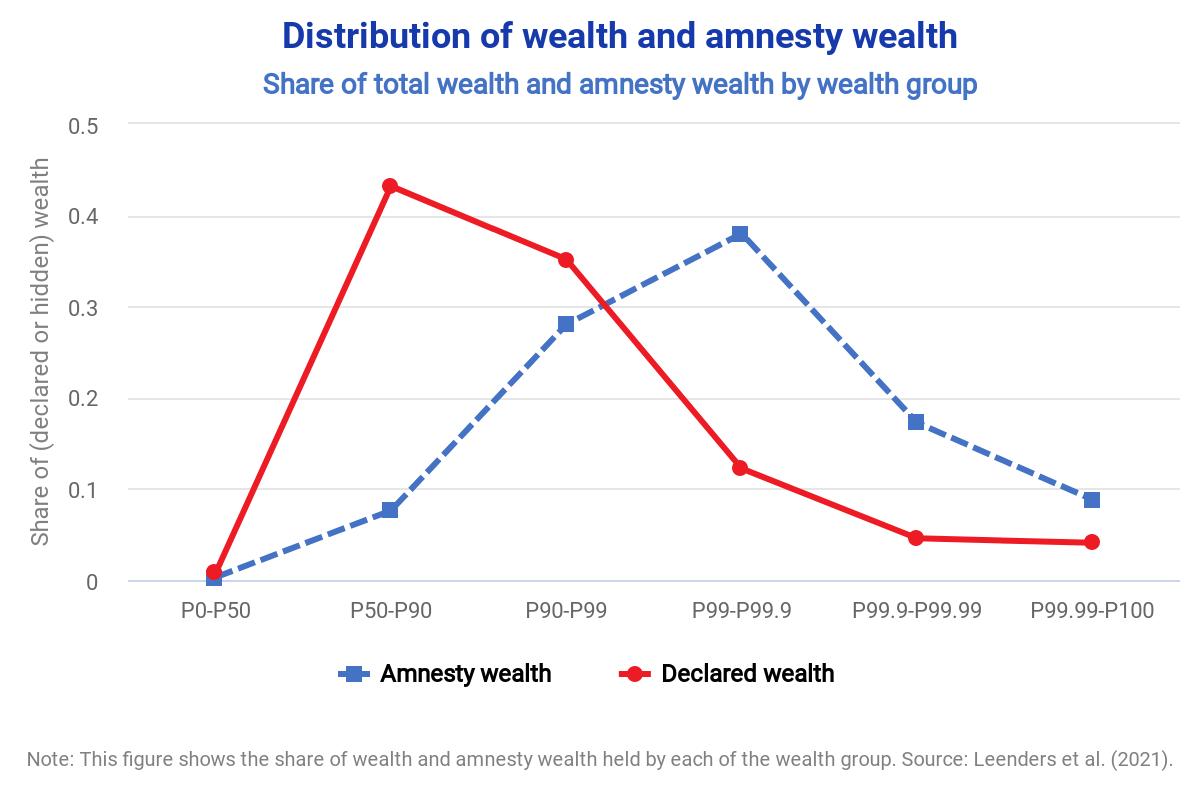

Offshore tax evasion and wealth inequality: Evidence from a tax amnesty in the Netherlands