How much profit shifting do European banks do?

Banks’ country-by-country reporting

According to the Capital Requirements Directive IV of the European Union, all EU banking groups are required to publicly disclose tax payments, profits, and economic activity consolidated for each country in which they operate. The resulting public Country-by-Country Reports (CbCRs) of banks provide an unprecedented data source to study banks’ use of tax havens and their effective tax rates worldwide.

The dataset comprises a collection of these CbCRs for 36 multinational banks headquartered in 11 EU countries and operating in up to 90 jurisdictions worldwide. It covers the period 2014 – 2020 and includes, for each bank: the turnover, the number of employees, the profit or loss before tax, tax on profit or loss, and public subsidies received.

About the dataset

- Number of observations by country

- Reporting banks and their total global earnings

- Banks' global effective tax rates

Access to the data

Download the full banks’ CbCR dataset [xlsx].

Explanatory notes to the dataset can be found in the following working paper:

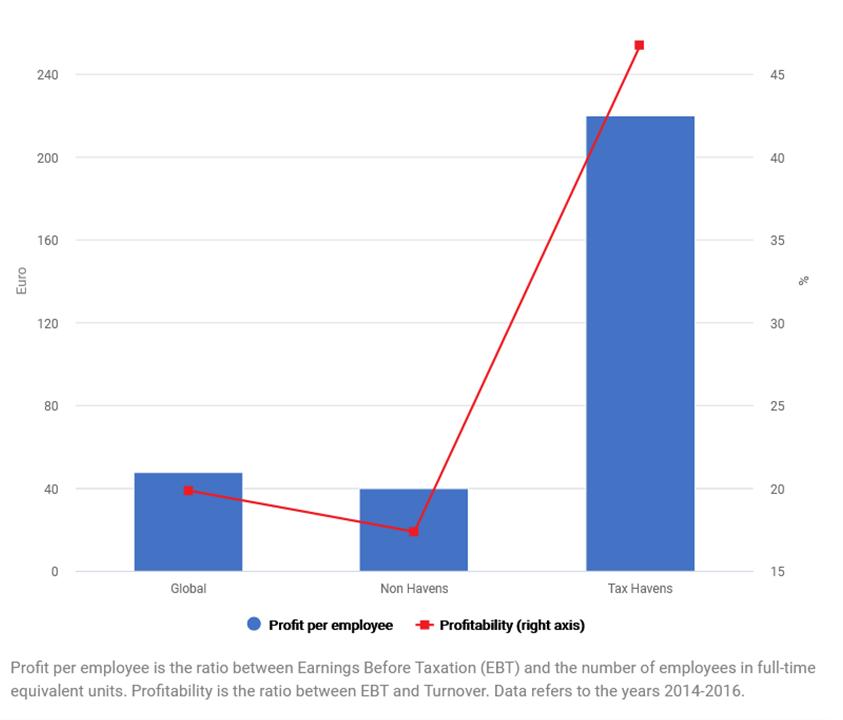

Barake, M. (2022). Tax Planning by European Banks. EU Tax Observatory Working Paper No. 9. [PDF].

Please refer to this working paper when using the dataset in your research.

Recent studies based on Banks’ CbCR

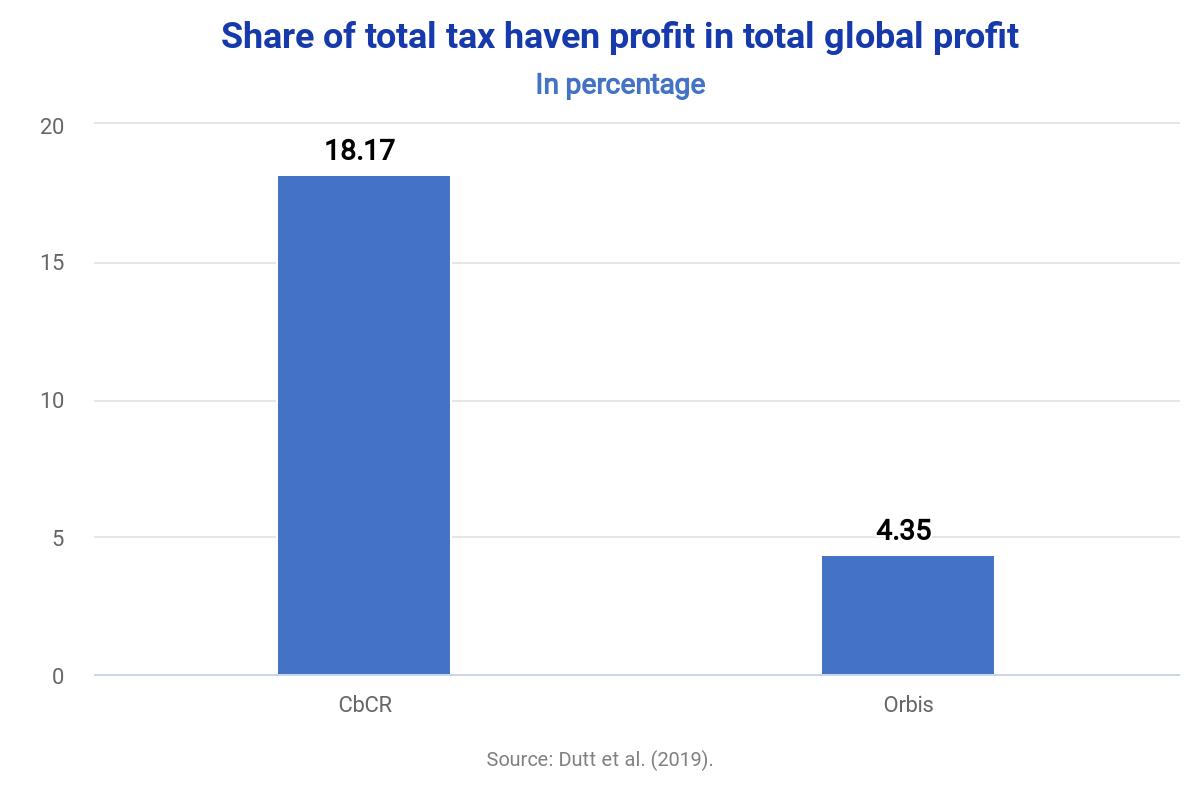

Aliprandi et al. 2021 (read more); Fatica & Gregori 2021 (read more); Bouvatier, Capelle-Blancard and Delatte 2020 (go to original article); Janský 2020 (go to original article), Dutt et al. 2019 (read more)

Explore more data visualisations at Transparency International’s Corporate Tax Tracker.

This might also interest you

Can European Banks’ Country-by-Country Reports Reveal Profit Shifting? An Analysis of the Information Content of EU Banks’ Disclosures

The deterrence effect of whistleblowing: An event study of leaked customer information from banks in tax havens

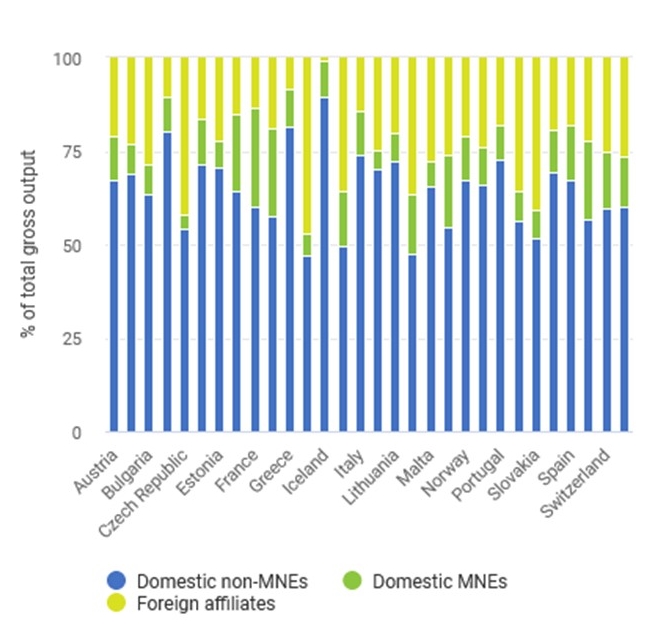

Multinational enterprises' profits and activity