The new luxury freeports: Offshore storage, tax avoidance, and ‘invisible’ art

Breaking Bad: What Does the First Major Tax Haven Leak Tell Us?

Summary

In 2013 the International Consortium of Investigative Journalists (ICIJ) published leaked financial information from offshore service providers mainly based in the British Virgin Islands, the Cook Islands, and Singapore. It contained information on more than 70,000 taxpayers and allowed the ICIJ to investigate how individuals use tax havens to evade taxes and conceal financial crimes such as money laundering. The author, who had worked for the ICIJ’s Canadian Media partner at the time, summarizes the main insights from the leaked data.

Most information is drawn from notes written by employees of the offshore service providers who help their clients manage and hide their funds. Analysis of these notes reveals that offshore service providers did not properly apply know-your-customer rules and therefore often ignored the origin of funds under their custody. The author illustrates different structures that typically help customers to hide their assets offshore. These include layers of shell corporations or the use of trusts and nominees which hold the legal titles of assets but actually follow – mostly oral – instructions of the true owners. The latter can receive undeclared payments via wiring, checks or offshore credit cards or launder money, for example by receiving paybacks of fictitious loans.

Key results

- Offshore service providers did not make sufficient effort to identify the origin of funds which impedes potential criminal investigations.

- Complex offshore structures make it difficult for investigators to identify the beneficial owners of assets.

- Oral instructions reduce papertrail, which can reveal illicit transactions.

Policy Implications

- Offshore service providers may be small businesses that can quickly close down, inhibiting any investigations. Enforcing compliance to hundreds of such small players is challenging.

Data

The author analyses leaked documents from the two offshore service providers Singapore-based Portcullis TrustNet and British and Virgin Islands-based Commonwealth Trust Ltd which were published by the International Consortium of Investigative Journalists. The author analyses only part of the documents and thus characterises his findings as anecdotal evidence.

Go to the original article

This article was published in Tax Notes International in August 2016. A free version of the article can be downloaded from the SSRN website. [pdf]

This might also interest you

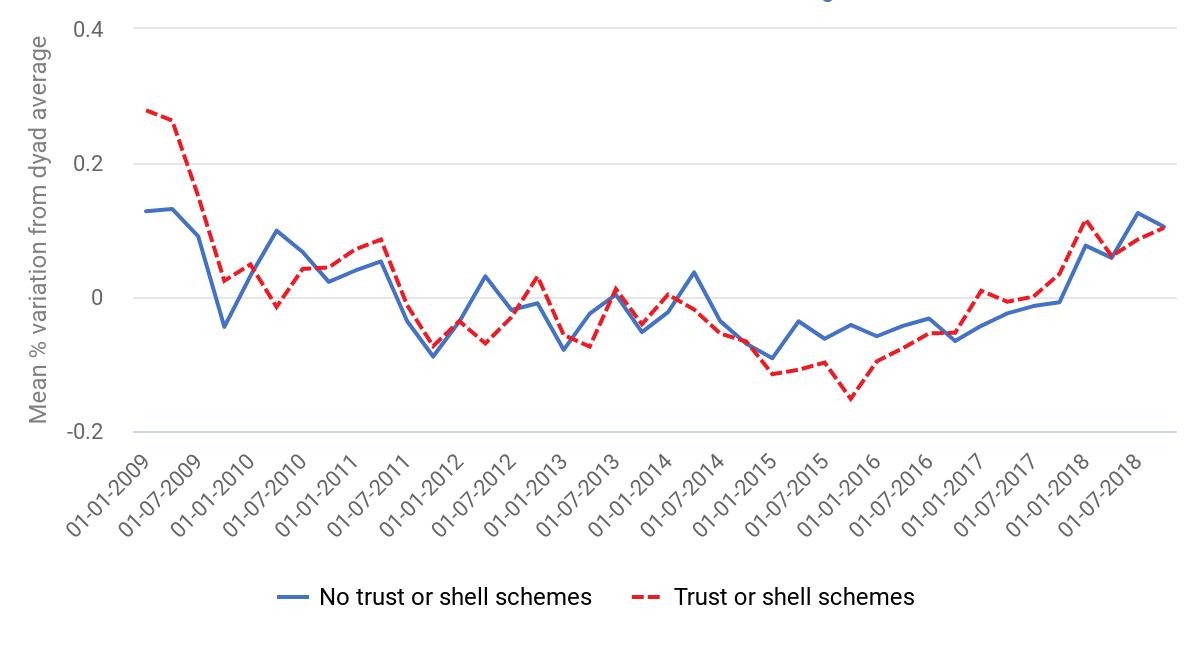

A victim of regulatory arbitrage? Automatic exchange of information and the use of golden visas and corporate shells

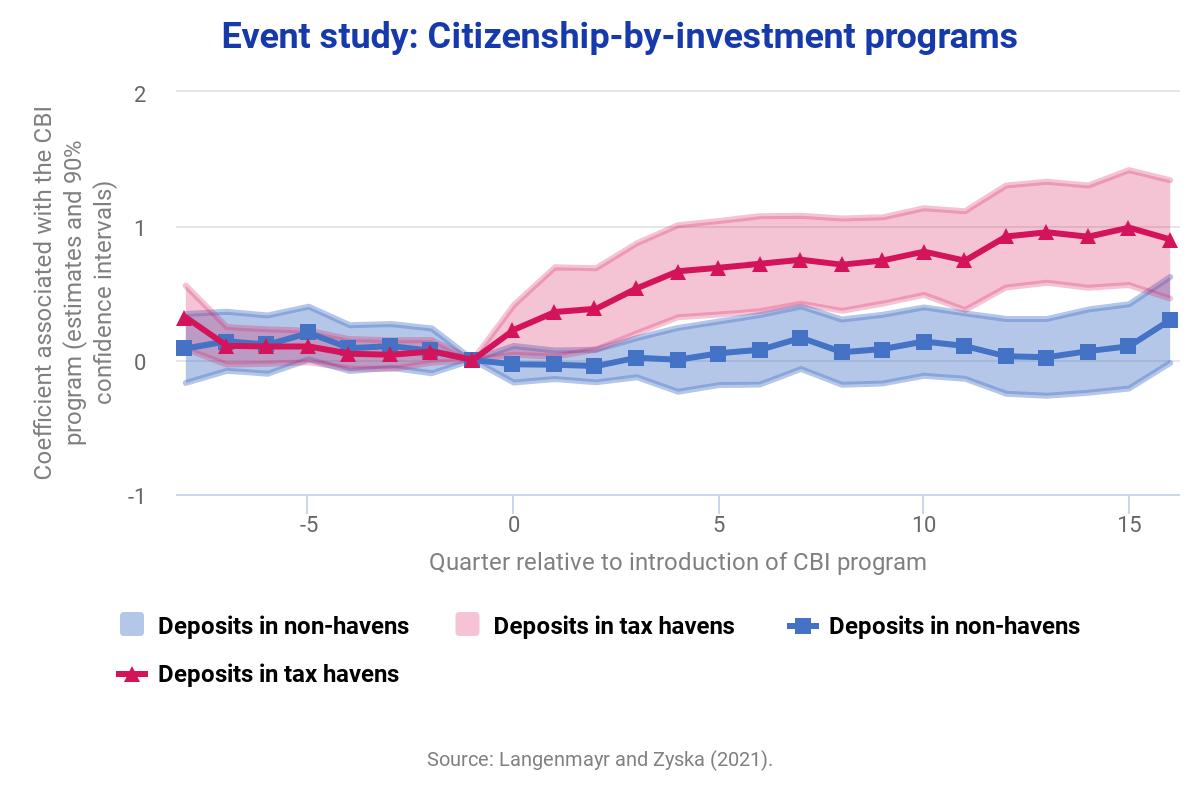

Escaping the Exchange of Information: Tax Evasion via Citizenship-by-Investment

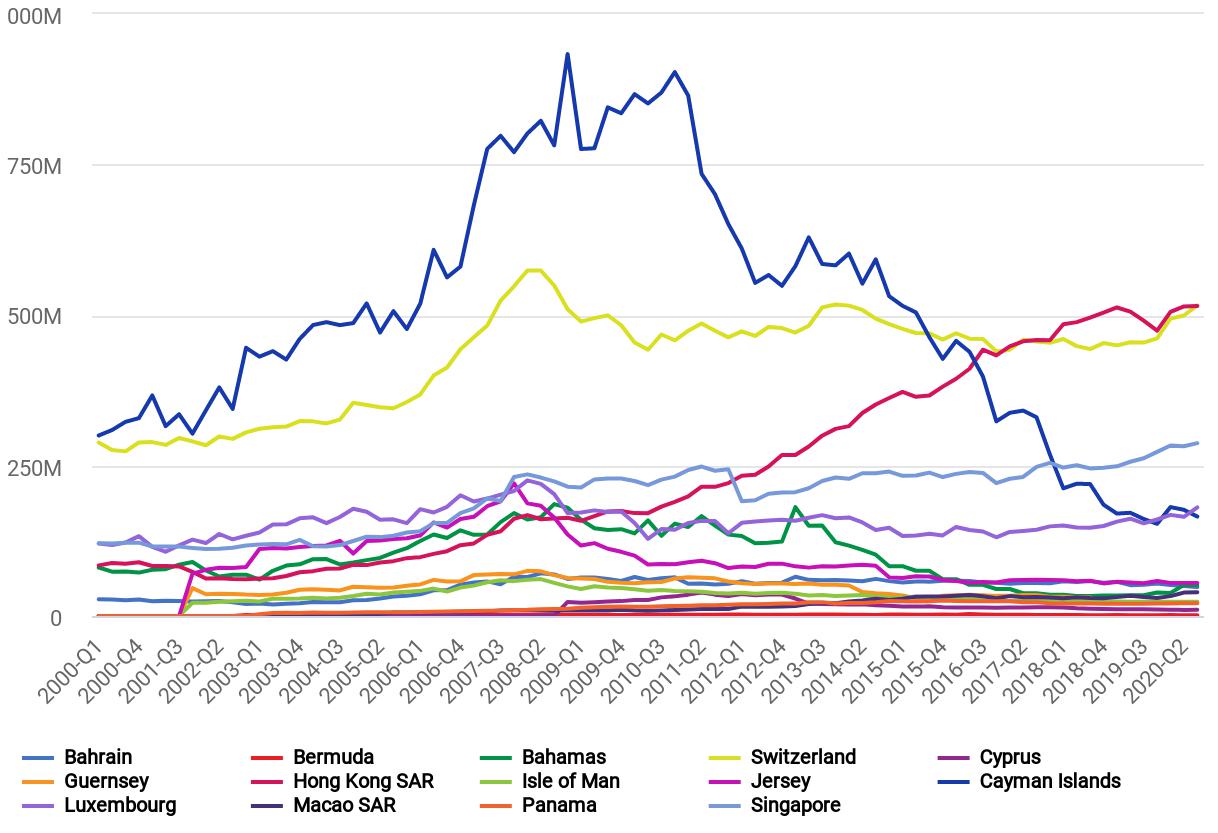

Cross-border wealth