Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

Corporate taxes, patent shifting, and anti-avoidance rules

Summary

Baumann et al. investigate the relationship between the patent location decisions of firms and corporate tax avoidance incentives. In their study, they elucidate the frequent separation of patent ownership and inventor location: in an average tax haven, 78.5% of locally-owned patents were invented elsewhere, compared with only 6.5% in non-haven countries. This constatation arises even in large tax haven economies like Switzerland, where foreign-invented patents make up 78.7% of patents owned locally. In absolute numbers, the phenomenon seems to be of modest scale since only 2% of the patents invented in non-haven EU or OECD countries are owned in a tax haven. However, substantial variations exist between multinational and purely local firms or depending on the value of the patent.

To show that these disconnections between the origin of R&D inputs and the location of resulting patents are related to corporate tax incentives, the authors further examine the determinants of these locational choices. They first observe that the propensity to separate the patent ownership from its inventor’s location and relocate it to a tax haven substantially increases with the value of the patent: the higher the potential tax revenue gain, the higher the incentive to shift patent ownership. Second, the inventor country’s patent income tax rate appears as a significant determinant of this decision.

Eventually, Baumann et al. assess the effect of various regulatory frameworks on the propensity to transfer patent ownership to low-tax countries. While results suggest that CFC rules can effectively curb the phenomenon, strict transfer pricing rules are not associated with any significant impact on the patent shifting decision.

Key results

- In the average tax haven, 78.52% of locally-owned patents were invented in a foreign country, while only 6.45% of patents owned in non-haven countries.

- Among patents from inventors in non-haven EU or OECD countries, only 2% are owned in a tax haven economy. Considering only the patents filed by multinational enterprises (MNEs) raises this fraction to 4.8%, underlining the difference in the income shifting opportunities that MNEs and purely local companies face.

- For high-earnings patents, an increase in the inventor country’s patent income tax rate by ten percentage points is estimated to raise the relocation propensity by 24.5%.

- The propensity to hold patents in low-tax countries increases if CFC laws are abolished. On the contrary, transfer pricing rules do not seem to exert any statistically significant effect on the propensity to transfer patent ownership to a tax haven.

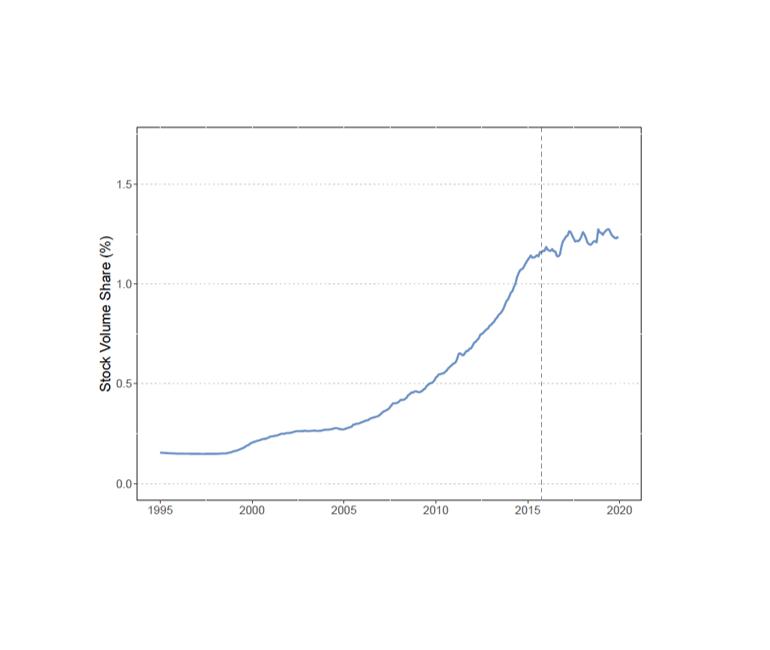

- The tax responsiveness of patent ownership location decisions tends to increase over time.

Policy implications

- Baumann et al. stress the apparent effectiveness of Controlled Foreign Company (CFC) rules in reducing the propensity of firms to shift patent ownership to low-tax jurisdictions. Contrarily, transfer pricing rules are not associated with any significant impact on these decisions.

- The article shows how countries that currently apply high patent income tax rates would benefit from an international harmonisation of the taxation of R&D outputs. Conversely, low-tax countries (especially Ireland, Luxembourg, and Switzerland) would observe significant declines in their patent location propensities.

Data

Baumann et al. rely on the Worldwide Patent Statistical Database (PATSTAT) of the European Patent Office (EPO). The database gathers information on all patent applications submitted to the regulator, including the patent applicant and the inventor of the patented technology, the application date, and the technology classes of the patent and patent citations. They focus on the 1990-2006 period, with up to 100 000 patent applications per year registered in PATSTAT.

Patent data are linked to the AMADEUS database of Bureau Van Dijk, which provides unconsolidated financial account data and information on ownership structures for European firms.

Patent income tax rates are drawn from the Corporate Tax Guides of Ernst and Young, while information on CFC rules was collected from Sandler (1998), Lang et al. (2004), and the International Bureau of Fiscal Documentation. Information on transfer pricing rules derives from the corporate “transfer pricing risk” index defined by Mescall and Klassen (2018), Deloitte’s transfer pricing matrix, and Ernst and Young’s transfer pricing guides.

Methodology

For their study, the authors first develop descriptive analyses of the data and estimate various regression models to identify the determinants of firms’ patent shifting decisions. Furthermore, they build and estimate a full location choice model which allows them to corroborate previous findings and simulate diverse policy experiments.

Go to the original article

The original article was published by the Public Finance Review. However, access is restricted.

A working paper version released in March 2018 can be downloaded from the website of the Ruhr-University Bochum.

This might also interest you

Hidden in plain sight: Offshore ownership of Norwegian real estate

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis

Homes incorporated: Offshore ownership of real estate in the U.K.