Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data

Estimating the Scale of Profit Shifting and Tax Revenue Losses Related to Foreign Direct Investment

In this article, Janský and Palanský re-estimate and extend an earlier study by UNCTAD (2015) with the aim of providing estimates of corporate profit shifting for as many countries as possible. The extensive country coverage of data on foreign direct investment (FDI) allows them to present by-country results including many low-income countries. In addition, the authors examine which country groups’ tax revenues are most affected based on a more granular definition of developing countries and present heterogeneous effects across income groups and regions.

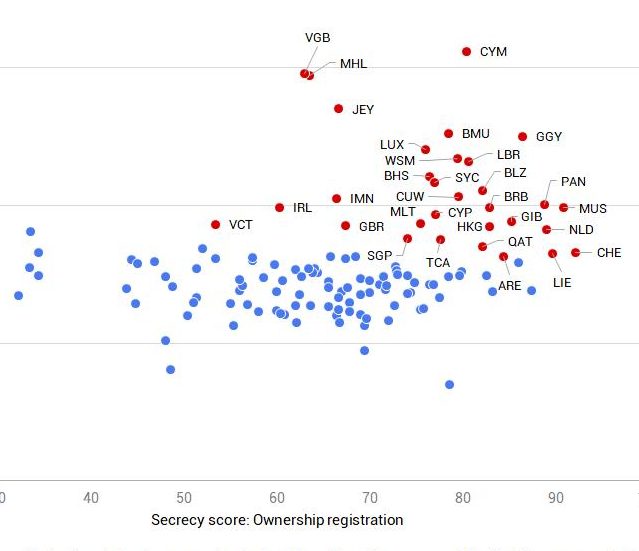

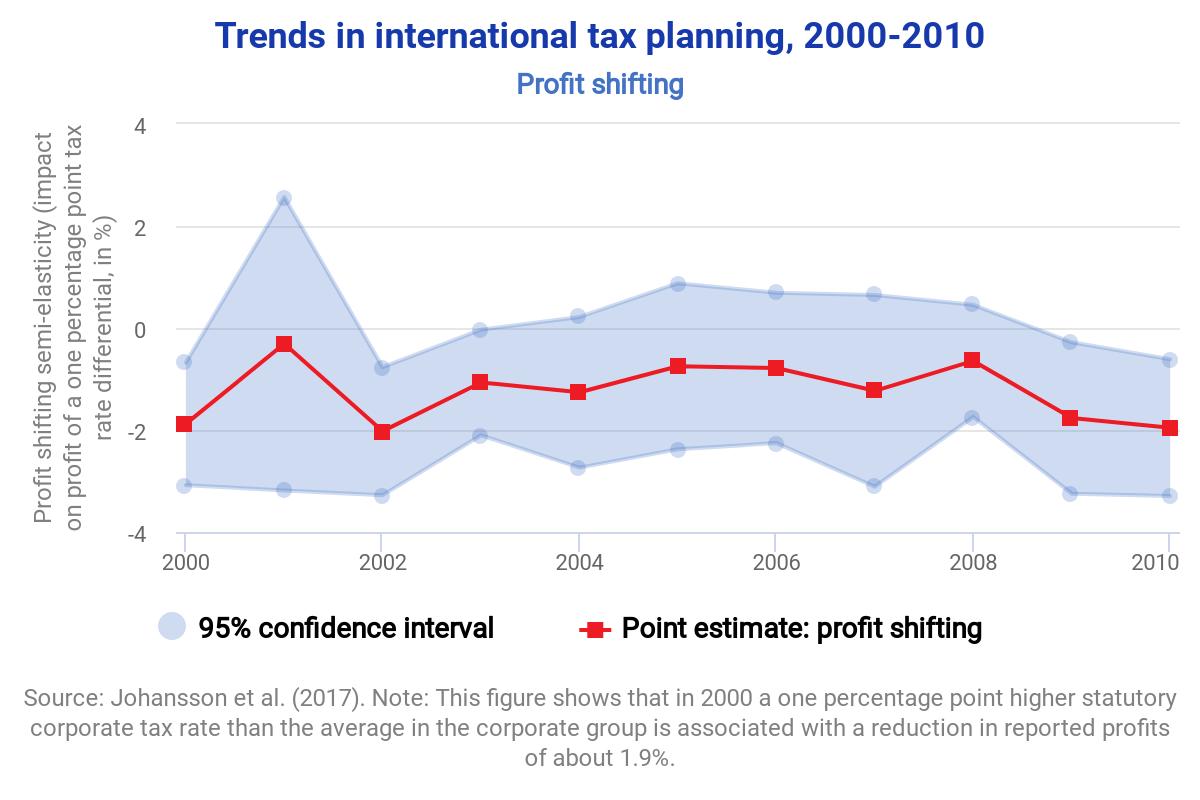

Using data on FDI from the IMF, the study shows that a higher share of investment from tax havens is associated with a lower reported rate of return on inward FDI. This would be consistent with MNEs shifting profits to tax havens through debt-shifting, trade mis-pricing, and strategical location of intangible assets as all those channels have the potential to artificially deflate the return on investment in high-tax countries. The authors thus base their profit shifting estimates on this observed discrepancy in the rates of return on FDI controlling for time-invariant regional characteristics.

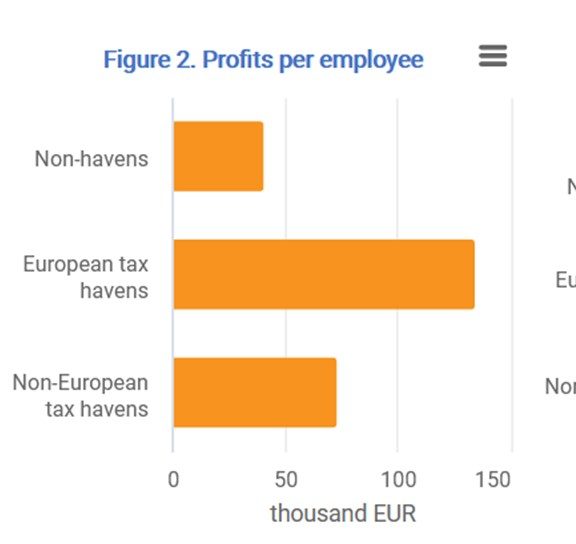

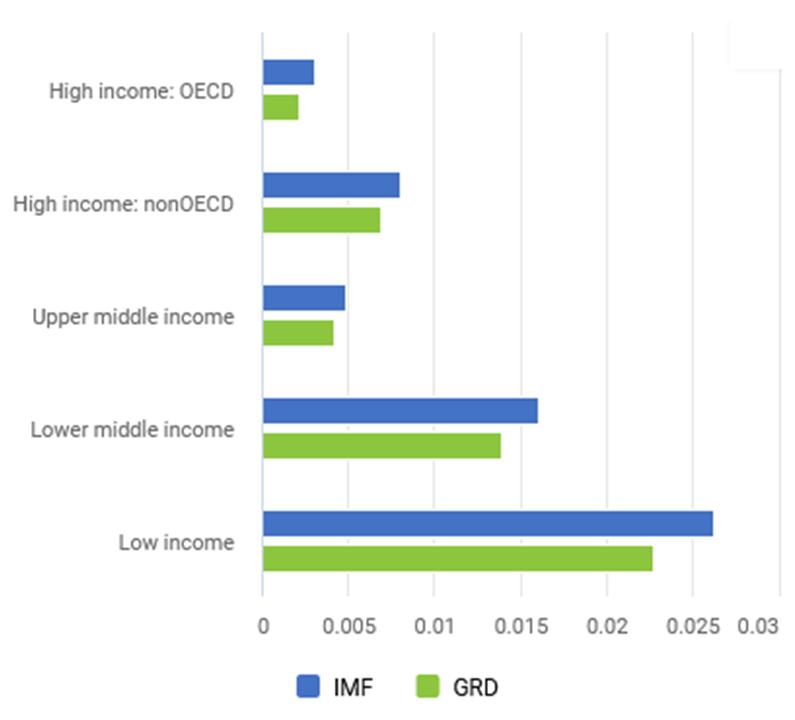

The results suggest the 79 countries included in the sample lose a total of $125 billion due to profit shifting. Comparing revenue losses across country groups, the authors conclude that low- and lower middle-income countries lose the most corporate tax revenue both relative to their GDP and relative to their corporate and total tax revenue.

Key results

- Results suggest that in 2016, MNEs’ profit shifting amounted to $420 billion for a total of 79 countries resulting in tax revenue losses of $125 billion.

- In relative terms, 6% of all corporate profits or 37% of the MNEs’ total profits are shifted resulting.

- Estimated tax revenue losses due to profit shifting amount to 8% if corporate tax revenue or 1% of total tax revenues.

- In relation to GDP, low- and lower middle-income counties seem to lose more tax revenue than high-income OECD countries.

Policy implications

- The authors argue that current initiatives for international corporate tax reform should aim at a wider inclusiveness due to the relatively higher vulnerability of developing countries to profit-shifting.

Data

The study relies on the CDIS data and Balance of Payment Data from the IMF (read more). Additional data sources include corporate tax rates from KPMG and the World Bank and tax revenue data from the ICTD/UNU-WIDER’s Government Revenue Dataset.

Methodology

Janský and Palanský estimate the relationship of the rate of return on FDI in each country and the share of FDI from tax havens in that country with regressions controlling for year fixed and regional and income-group fixed effects. In addition, they include interaction effects to allow for heterogeneous effects across regions and income groups.

Go to the original article

The article was published in published in International Tax and Public Finance in 2019. It can be downloaded from the journal’s website. [pdf]

This might also interest you

The state of tax justice 2021

Global distribution of revenue loss from tax avoidance: re-estimation and country results

Tax Planning by Multinational Firms: Firm-Level Evidence from a Cross-Country Database