Base Erosion, Profit Shifting and Developing Countries

Global distribution of revenue loss from tax avoidance: re-estimation and country results

Summary

In this research article, Cobham and Janský review the study conducted by Crivelli et al. (2016) to estimate the scale of global base erosion and profit shifting and the associated corporate income tax (CIT) revenue losses. They introduce new CIT revenue data from the ICTD-WIDER Government Revenue Database and question the list of tax havens retained in previous research.

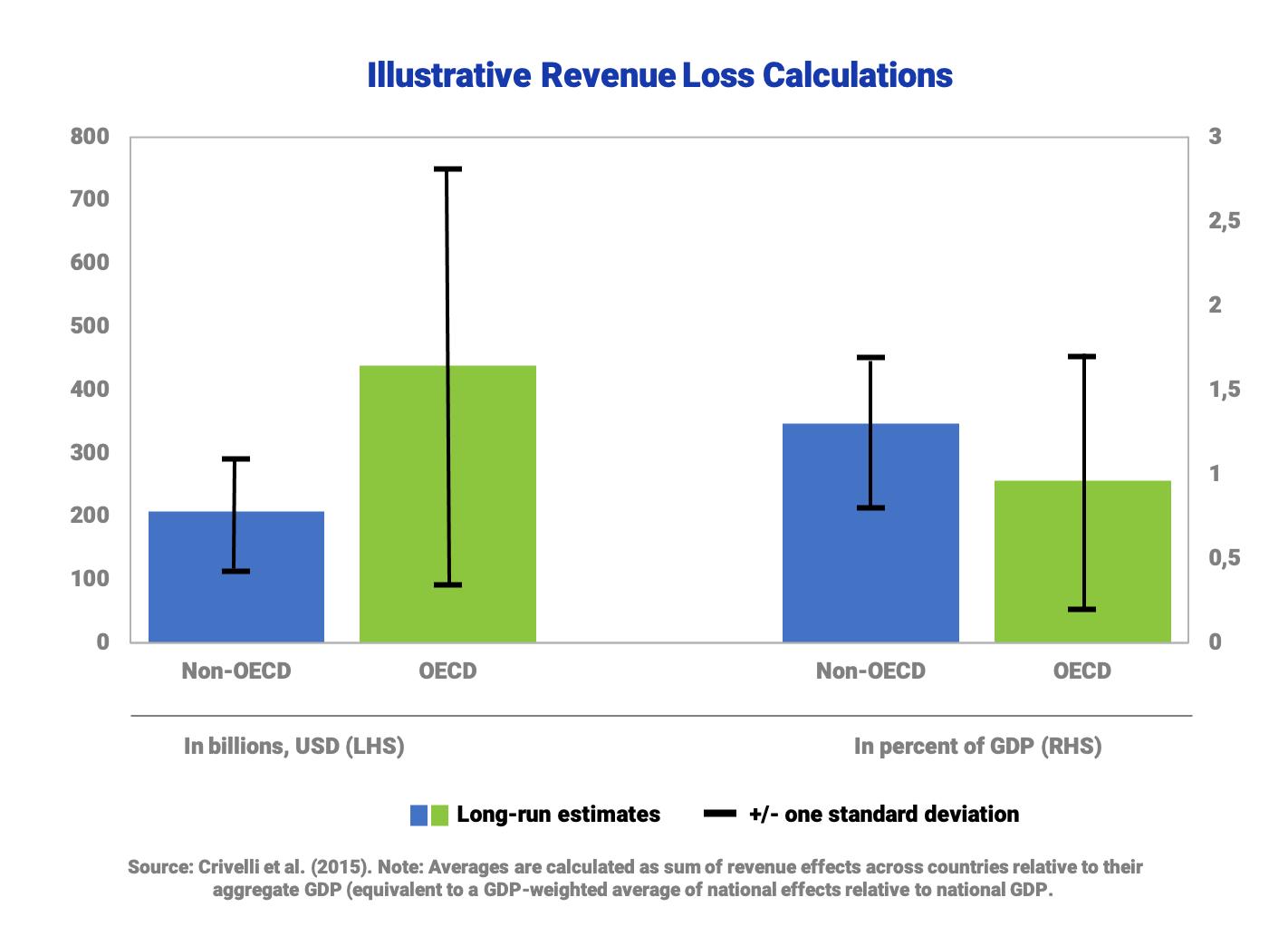

Their re-estimation broadly confirms previous results. They obtain global revenue losses of circa 500 billion USD, which is lower than the 650 billion USD identified by Crivelli et al. (2016). The majority of the reduction in the total estimate relates to OECD countries. While Crivelli et al. already identified non-OECD countries as the biggest losers from base erosion and profit shifting, these newer results provide evidence of an even wider gap between advanced economies and developing countries. This is because tax revenue losses amount to a higher percentage of GDP for the latter group of countries.

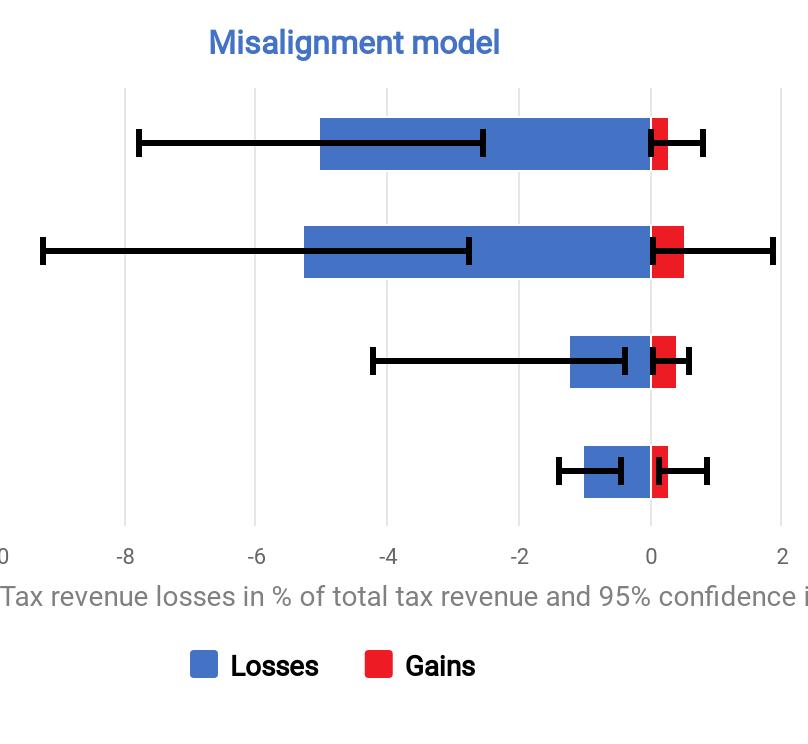

Besides, Cobham and Janský propose regional and per-country disaggregation of CIT revenue loss estimates. Middle-income and low-income countries appear as the most severely harmed by base erosion and profit shifting. In these two income groups, 14 countries face losses of between 3 and 7% of their GDP. In contrast, 22 countries exhibit revenue gains of more than of 1% of GDP.

Key results

- For OECD members, estimated tax revenue losses due to corporate profit shifting amount to 0.66% of GDP versus 0.96% according to Crivelli et al.

- In contrast, non-OECD countries are estimated to lose about 1.32% of GDP which is more consistent with the previous estimate of 1.26% by Crivelli et al.

- Although OECD countries are consistently the biggest losers in absolute terms, low- and middle-income countries saw a sharp rise in revenue losses during the commodity boom of the 2000s.

- Sub-Saharan Africa, Latin America and the Caribbean, and South Asia are the most severely harmed areas when considering tax revenue losses as a percentage of GDP.

Policy implications

In terms of policy-relevant conclusions, like Crivelli et al. (2015), Cobham and Janský mainly insist on the necessity for middle- and low-income countries to weigh in international debates about corporate taxation, as they are the most severely harmed by base erosion and profit shifting in relation to their GDP.Data The authors use the dataset provided by Crivelli et al. and rely on the corporate income tax revenues from the Government Revenue Database (GRD) of the ICTD-WIDER as an alternative data sourceEstimates of average effective tax rates drawn from ORBIS data by Cobham and Loretz (2014) and from Bureau of Economic Analysis data by Cobham and Janský (2015).

Methodology

The authors review the regression analysis initially proposed by Crivelli et al. (2015). Their econometric model relates the corporate tax base to the domestic tax rate, foreign tax haven tax rates, and several control variables. A significant effect of the tax havens’ tax rates on domestic profits is interpreted as evidence of profit shifting to these tax havens. The authors replicate the estimates with new CIT revenue data and an alternative list of tax havens. They mostly focus on the tax revenue loss estimates that can be drawn from these models on a regional or per-country basis.

Go to the original article

The article was published in the Journal of International Development 30(2), pp. 206-232. It can be downloaded from the journal’s website. [pdf]

This might also interest you

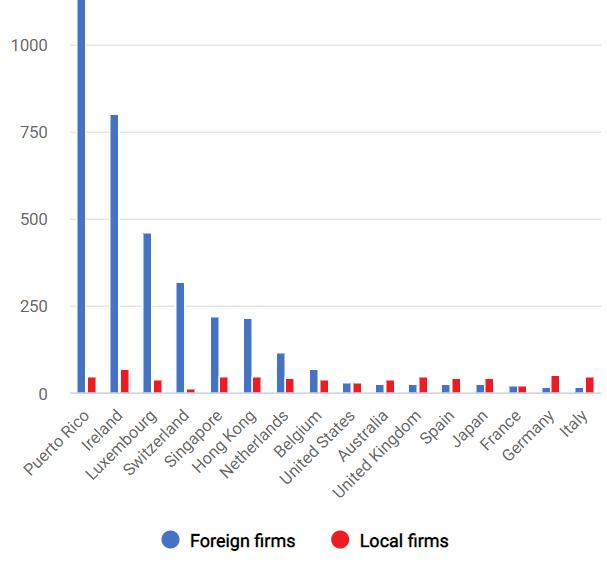

Big and ‘unprofitable’: How 10% of multinational firms do 98% of profit shifting

Profit shifting of multinational corporations worldwide

The Missing Profits of Nations