Can European Banks’ Country-by-Country Reports Reveal Profit Shifting? An Analysis of the Information Content of EU Banks’ Disclosures

How much profit shifting do European banks do?

Fatica and Gregori estimate the extent of profit shifting by European banks based on their country-by-country reports from 2014 to 2016. To increase financial transparency in the aftermath of the financial crisis, European banks are required to publicly report turnover, profits before tax, taxes paid and number of employees for each country where they have affiliates since 2014. The authors collected this data from the largest and systemically relevant multinational banks to analyse their profit shifting behaviour.

Their econometric approach builds on the idea that in the absence of tax-motivated profit shifting, economic activity and other control variables such as GDP per capita or the quality of governance should explain the profitability of the banks’ foreign affiliates in each country. However, they find that profits are also sensitive to the differentials in tax rates between the affiliates’ host country and the rest of the corporate group, which is commonly interpreted as evidence of profit shifting: The higher the tax burden faced by banks in the host country compared to the other foreign jurisdictions in which the group operates, the lower is the level of reported earnings. This constatation holds both for differences in statutory and effective tax rates.

Their estimation results further suggest that the effect of tax rates on the level of pre-tax earnings is much stronger for affiliates based in tax havens than for affiliates in non-havens. Reported profits in tax havens are higher when the level of regulatory quality is lower, which, according to the authors, might indicate that an opaque regulatory framework favours profit shifting by banks.

Key results

- The higher the tax burden faced by banks in the host country compared to the other foreign jurisdictions in which the group operates, the lower is the level of reported earnings.

- The effect of the tax rate differential on reported earnings is stronger for affiliates based in tax havens. The average semi-elasticity of profits with regard to the effective tax rate is 2.23 for non-havens and 4.99 for tax havens.

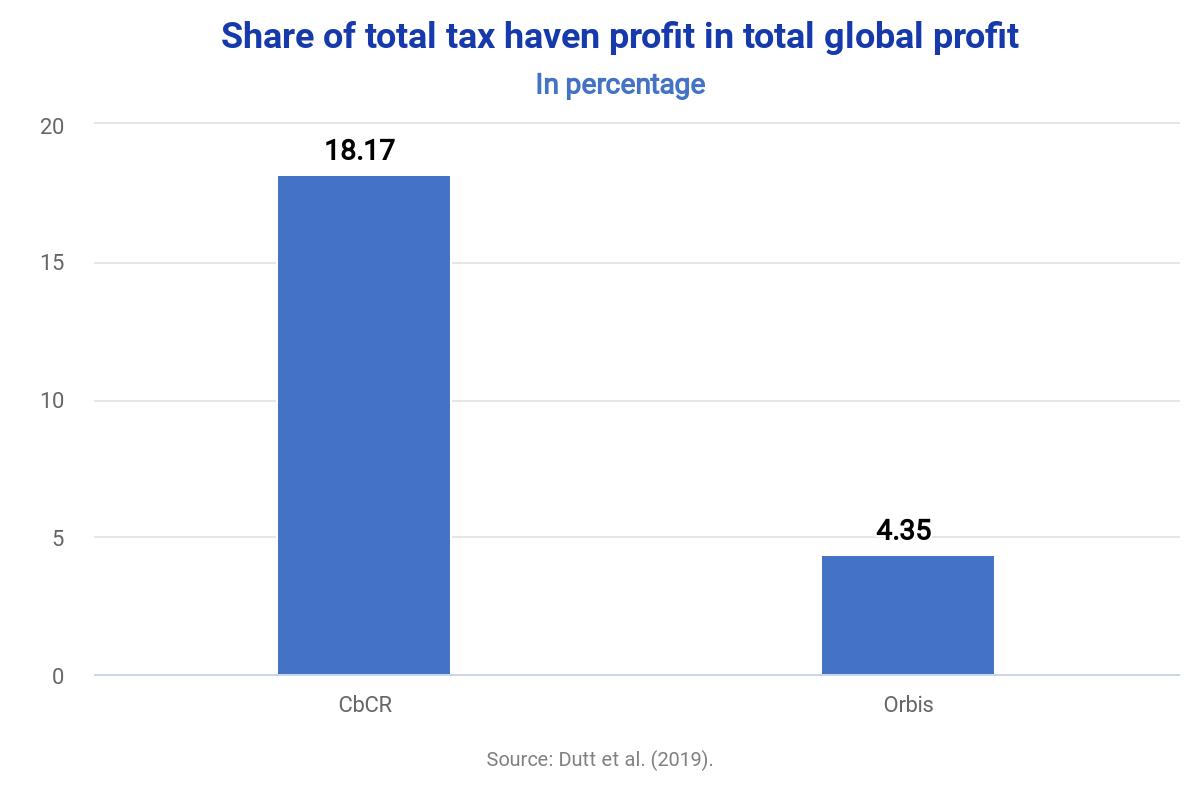

- Overall, the authors estimate that 21% of banks’ profits are shifted to avoid taxation and that profits in tax havens are 51% higher than they would be without profit shifting.

Data

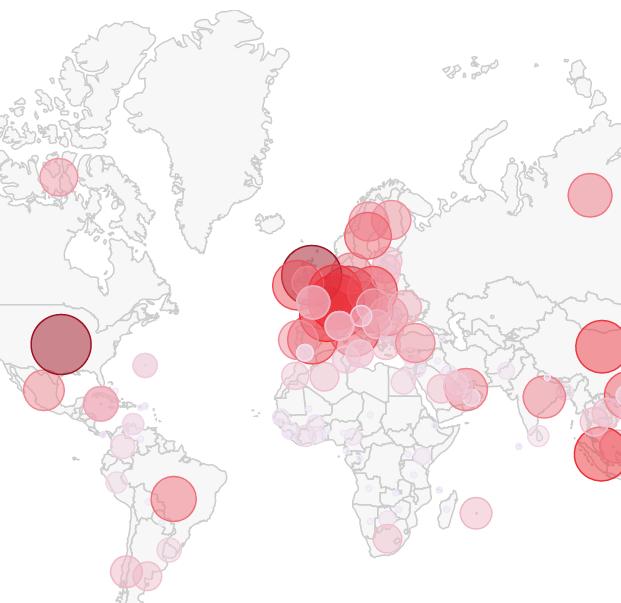

The study relies on country-by-country reports from 2014 to 2016, collected from 27 multinational banks headquartered in 8 European countries and operating in up to 90 jurisdictions worldwide. Statutory tax rates are collected from various sources, among which is the International Bureau of Fiscal Documentation (IBFD). The effective tax rates are calculated based on the tax payments from the country-by-country reports. The authors use the tax haven list by Gravelle and complement their dataset with control variables from Orbis and the Worldwide Governance Indicators of the World Bank.

Methodology

The authors estimate a fixed effects panel regression with the logarithm of earnings before tax as the dependent variable and the weighted bilateral tax differentials between each country and all other group locations as the independent variable. Additional variables are the number of employees, GDP per capita, and two indicators of governance quality. For robustness, a measure of capital based on fixed and financial assets is included. The regressions further include group, country and year fixed effects.

Go to the article

This article was published in Economic Modelling 90 (2020), pp. 536–551. It can be downloaded from the journal’s website. [PDF]

This might also interest you

The Missing Profits of Nations

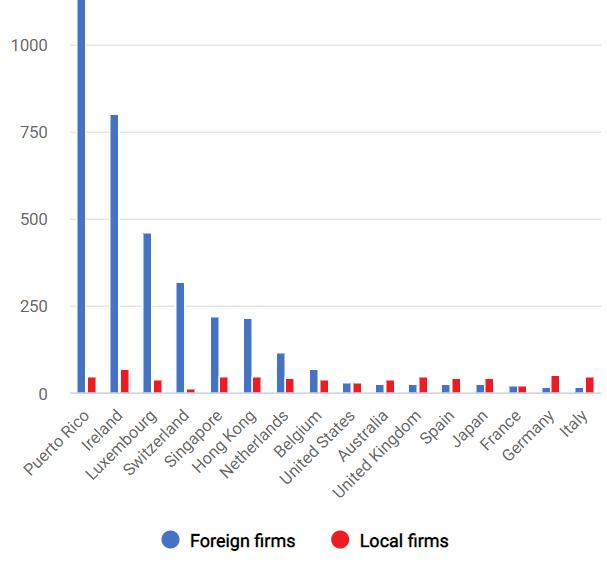

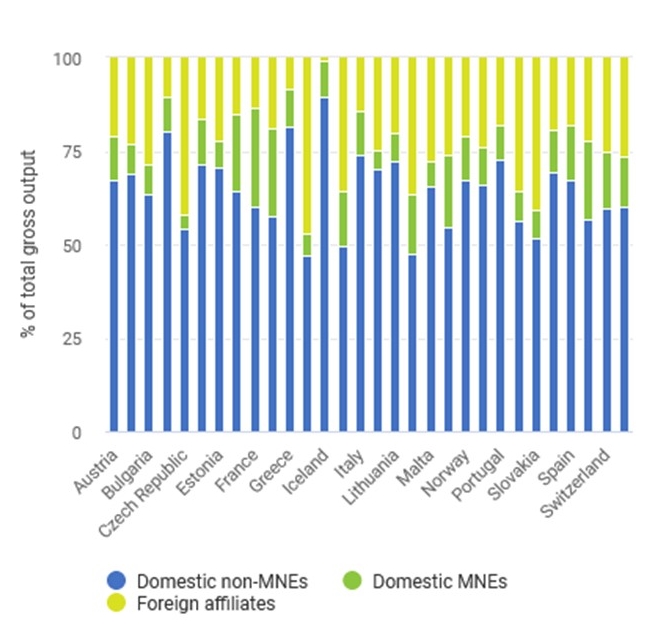

Multinational enterprises' profits and activity

Banks' country-by-country reporting