Tax rates and rankings

Multinational enterprises’ profits and activity

As European countries apply territorial tax regimes, corporate profits should ideally be taxed where they arise. However, the nature of multinational businesses makes it sometimes difficult to determine where value creation takes place. This can lead to conflicts over taxing rights in between countries and gives multinational enterprises (MNEs) more leeway for tax arbitrage than purely domestic companies. Not only can MNEs more easily relocate their activities to low-tax jurisdictions to avoid taxation, but they can also artificially arrange intra-group payments to shift profits from high-tax to low-tax countries without actually relocating much of their real economic activity. As a result, many MNEs report extremely high profits in many tax havens which seem disproportionate to the economic activity carried out there.

Representative data on MNEs’ profits and activity is still scarce as national statistics distinguish domestic and multinational companies only to a limited extent. Foreign affiliate statistics provide good macro data on the affiliates of multinational corporations in each country. The OECD AMNE database has recently published macro data on headquarter companies for the first time. The following overview presents different data sources that facilitate research on the location of multinational profits and activity. These include publicly available macro statistics, the recently developed country-by-country reports (CbCR), and public and private company-level data with restricted access.

What do you want to know?

- MNEs’ contribution to total output

- Profitability of MNE per employee

- Profitability of U.S. MNE per compensation of employees

- Tax contribution by the world largest MNEs

Publicly available data

The Analytical Activities of MNEs (AMNE) database allows for the analysis of MNE activities in value-added terms. It includes aggregate data on foreign affiliates (with at least 50% of foreign ownership), domestic MNE, and domestic non-MNEs. The data can be organised by the host country, by country of ownership, and by industry and thus allows to understand the relative importance of MNE in the economy.

Data access

Analytical AMNE tables can be downloaded from the OECD website.

Foreign Affiliates Statistics (FATS) are macroeconomic accounts that record the profit, compensation of employees, and other key variables of foreign-owned firms. These mainly include firms that are more than 50% owned by foreign shareholders, typically covering subsidiaries of foreign multinational corporations.

These data include two types of information:

- Inwards FATS reported by a given country about foreign firms active in its jurisdiction and tabulated by the origin of their parent companies;

- Outwards FATS reported by a given country about the foreign affiliates of its home multinationals and tabulated by jurisdictions where these affiliates are active.

Although the US has for instance compiled outwards FATS since the mid-1960s, these statistics have been released by more and more countries in recent years, including several low-tax jurisdictions (Ireland, Luxembourg, Switzerland, etc.).

Disadvantages: Some countries, including tax havens, do not publish FATS data yet. In theory, inwards FATS of host countries should be consistent with the outwards FATS of partner countries but a significant discrepancy exists between the profits of US affiliates computed from the inwards FATS of Ireland, Luxembourg, and the Netherlands and the same aggregates in US outwards FATS. See Tørsløv et al. and Devereux et al. (2019) for more details.

Data access

FATS are disseminated by the OECD, Eurostat, or national statistical agencies.

Recent studies based on FATS

Tørsløv et al. 2020 (read more), ; Devereux et al. 2020 (go to original article)

Country-by-country (CbC) reporting was introduced as part of the Action Plan 13 of the OECD’s Base Erosion and Profit-Shifting (BEPS) program. All multinational companies with a consolidated group revenue above 750 million EUR are required to report revenue, pre-tax profit, corporate income taxes paid, and other indicators aggregated for each tax jurisdiction in which they operate. The reporting standard was developed to support the national tax authorities’ audit activities. The data is thus especially suitable for tax analyses. However, at present, the CbC data is made available to the public only in an aggregated form. In July 2020, the first aggregated and anonymized version of the 2016 data was released by the OECD, covering approximately 4,000 multinational companies from 26 home countries and operating in more than 100 tax jurisdictions worldwide. It includes detailed reporting on small tax havens – which are sometimes absent from other datasets. With the recently published data for 2017, the country coverage has increased significantly.

As the reporting standard is relatively new the OECD highlights some potential shortcomings of the data including inconsistent reporting by MNEs and different approaches taken by national authorities when cleaning and aggregating the microdata. For confidentiality reasons, observations might be excluded or pooled together in country groups, if the number of multinationals operating in a given tax jurisdiction reported by a certain home country is too low.

Access to the data

CbC data published by the OECD for the 2016 and 2017 fiscal years can be accessed on the OECD website.

The EU Tax Observatory’s CbCR Explorer provides interactive visualisations of the data by home or host country.

Some members of the program may publish their own aggregated and anonymized CbC report before the OECD’s release. This is the case for the US, for which the 2018 and 2019 CbC data can already be downloaded from the IRS website.

A few MNEs voluntarily publish their CbC reports on their company websites.

Recent studies based on CbCR

García-Bernardo & Janský 2021 (read more); García-Bernardo et al. 2021 (go to original article); Clausing et al. 2021 (read more); OECD Economic Impact Assessment 2020 (go to original document); Fuest et al. 2021 (go to original article)

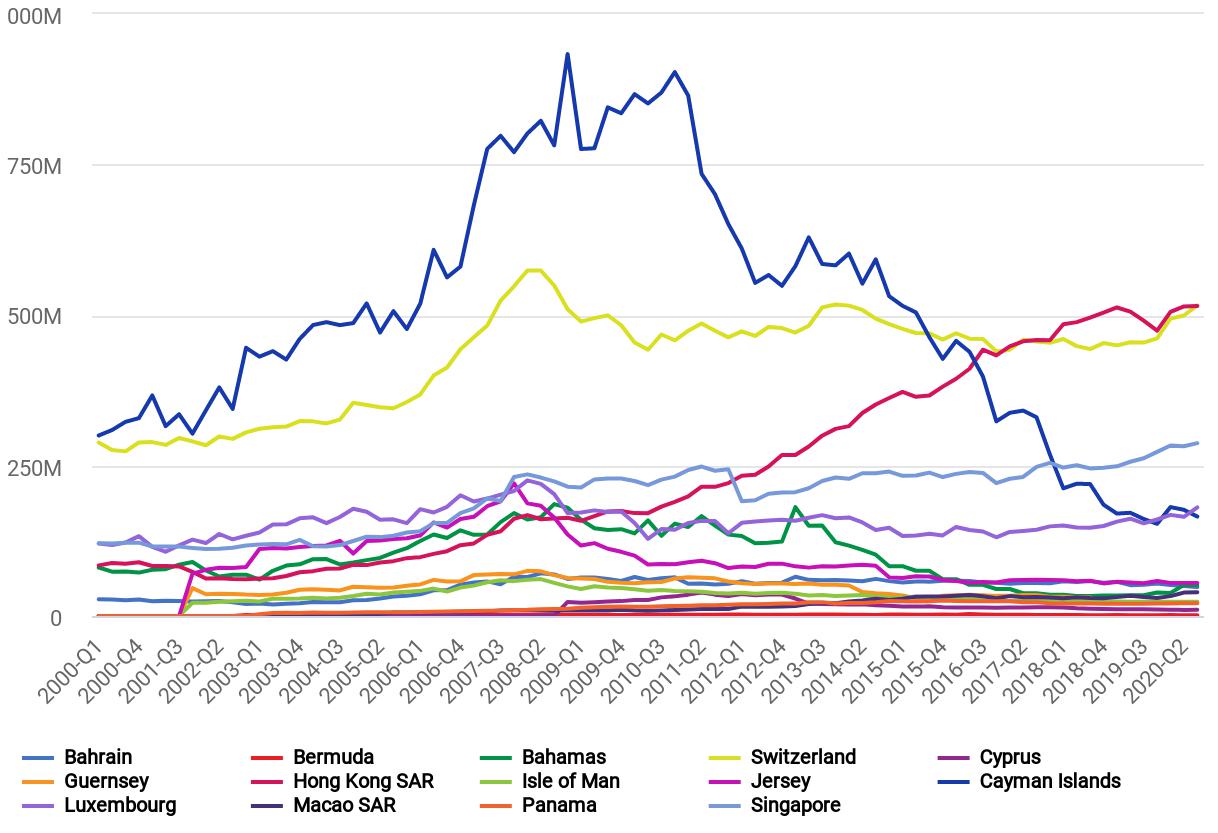

Foreign direct investment statistics provide macro-level information on the international presence and operations of MNEs. Not all FDI transactions might be considered MNE transactions as the participation threshold for FDI is 10% and definitions of MNE usually suggest a higher level of control exercised by the investor company. Still, investments by MNEs dominate FDI statistics which is why researchers have used them to explore global patterns of corporate profit shifting and to estimate the scale of the phenomenon. Advantages of FDI statistics include their extensive regional coverage and long time series availability. A potential disadvantage is that when MNE channel investment through several countries, the ultimate source and destination of FDI is hard to identify.

Bilateral FDI inward stock as provided by the IMF’s coordinated direct investment survey (CDIS) allows, for example, to track the share of international corporate investment stock routed through offshore financial centers. The Balance of payment statistics include the return on FDI and have been used by researchers to show that companies owned through offshore financial centers tend to generate fewer returns on FDI than others which might be an indication of profit shifting. The balance of payment statistics also include information on cross-border transactions to tax havens that are known to be conducive to profit shifting such as royalty payments and intra-group interest receipts.

Access to the data

FDI data is provided by the IMF (CDIS and BoP statistics) but also by the OECD and UNCTAD.

Studies based on aggregate FDI data

Bolwijn et al. 2018 (go to original article); Tørsløv et al. 2020 (read more); Janský & Palanský 2019 (read more)

These data were compiled and presented by Damgaard and Elkjaer (2017). In their working paper released by the IMF, they describe the methodology used to correct for three issues with the raw output of the IMF’s Coordinated Direct Investment Survey (CDIS):

- Asymmetries between inwards and outwards flows of investment

- Special Purpose Entities (SPEs) inflate FDI inflows especially of offshore financial centers

- Limited information about the Ultimate Investing Economy (UIE)

Using UIE-based information from the OECD, focusing on inwards data and excluding SPEs, Damgaard and Elkjaer construct a new global FDI network that gives less importance to financial centres and better reflects countries’ real economic integration.

Access to the Data

The 2017 working paper by Jannick Damgaard and Thomas Elkjaer, as well as the resulting FDI data, can be accessed on the website of the IMF.

Studies based on FDI data on an ultimate ownership basis

Devereux et al. 2020 (go to original article); Tørsløv et al. 2020 (read more)

The U.S. Bureau of Economic Analysis collects data on U.S. MNEs and their foreign affiliates and publishes them in an anonymized form and aggregated at the country or industry level. The BEA data was the first publicly available and comprehensive data explicitly covering multinational activity which is why it has frequently been used in research on profit shifting by MNE. Data on majority-owned foreign affiliates go back until 1983 while early data on domestic parent companies is provided only for individual years but on an annual basis since 2004. As potential shortcomings, researchers have pointed out that the aggregation process might involve some double-counting of income from equity investment and that the aggregated data does not allow researchers to retrace the consolidation of profits and losses.

Access to the data

The BEA provides aggregated data on Activities of U.S. multinational enterprises here. Access to firm-level data is currently only provided for approved researchers.

Recent research based on BEA data

Data with Restricted Access

The ORBIS database, provided commercially by Bureau Van Dijk Electronic Publishing (BvD), gathers micro-data on firms’ financial and productive activities, as well on their domestic and international ownership structure from public business registries. The information mainly consists of the consolidated and unconsolidated financial accounts (balance sheets and income statements) of public and private companies including tax payments, as reported by national and local Chambers of Commerce based on legal and administrative requirements.

To date, it reportedly covers more than 400 million entities worldwide. Certain subsets of the database are marketed separately and cover specific regions (AMADEUS for Europe or ORIANA for the Asia-Pacific area), countries (e.g. FAME for the UK), or company types (ISIS for insurance companies, BANKSCOPE for banks, etc.).

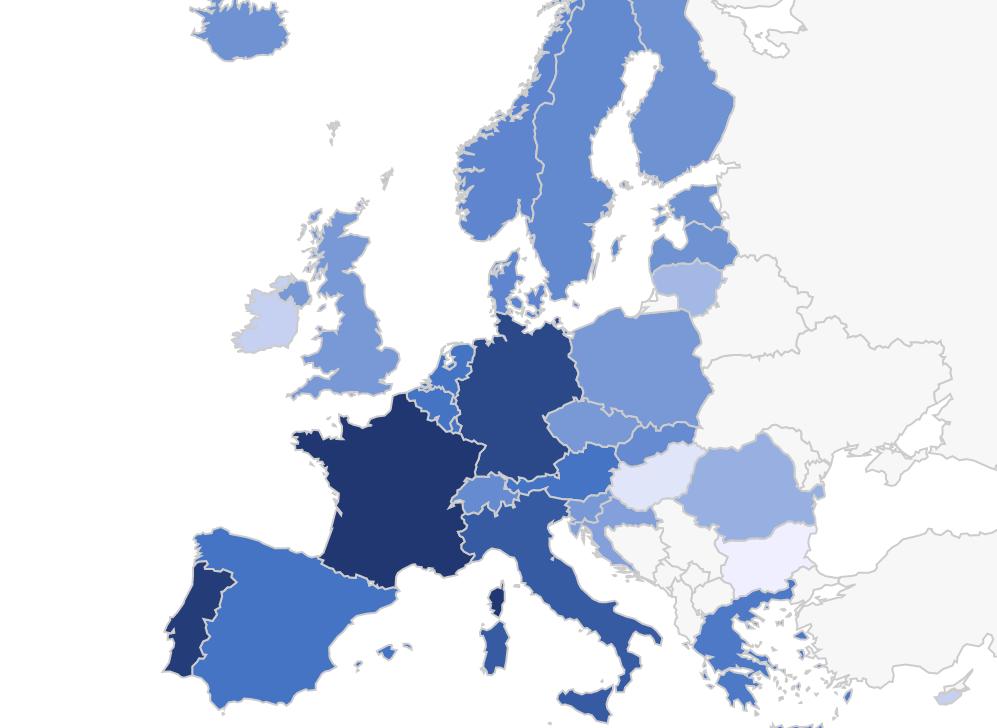

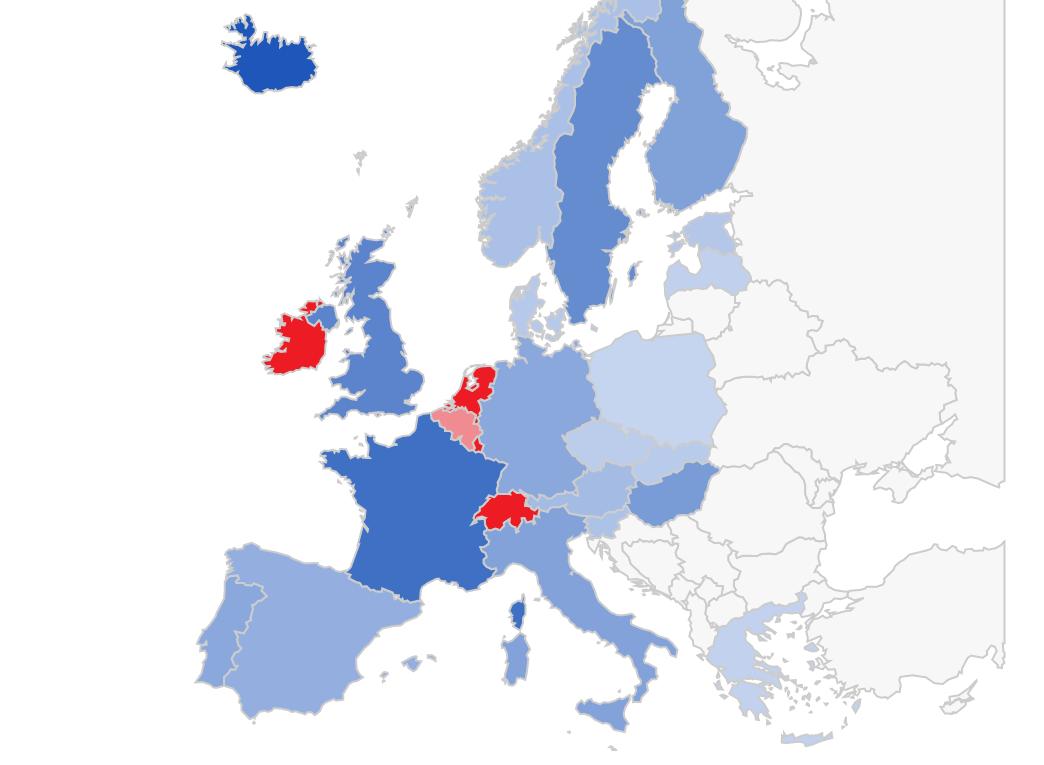

The Orbis database is the most comprehensive company-level database and has frequently been used in profit shifting research. The coverage of firms seems to be much better for European countries than for non-European countries. Especially companies in low-tax jurisdictions and poor countries seem to be underrepresented due to a lack of reliable public business registries (Johansson et al. 2017, Tørsløv et al. 2020). More details on the Orbis database and potential challenges when using it in research can be found in a paper by Kalemli-Ozcan et al. 2015 (go to original paper).

Data access

Orbis data needs to be purchased from the Bureau van Dijk. Some universities provide access for their researchers.

Recent research based on Orbis

Johansson et al. 2017 (read more), Tørsløv et al. 2020 (read more); Devereux et al. 2020 (go to original article); OECD Economic Impact Assessment 2020 (go to original document)

The Microdatabase Direct Investment (MiDi) provided by the Research Data and Service Centre of the Deutsche Bundesbank (Blank et al., 2020) covers inward and outward investment relations of Germany-based companies. It contains anonymised individual reports from 1999 onwards and is available as a panel data set. As reporting is obligatory, the database covers all firms with balance sheet totals of over EUR 3 million and above certain foreign participation thresholds which makes it attractive for micro econometric analyses. The data allows researchers to analyse a wide range of financial variables, some economic activity indicators, after-tax profits, and ownership structures of multinational corporations. Even if tax payments are not included in the MiDi data, it is frequently used by researchers to study the profit shifting behaviour of multinational corporations.

Data access

The Bundesbank provides free-of-charge access to the MiDi data. However, due to the strict confidentiality requirements, research is only possible on-site and to a very limited extent by controlled remote data processing.

Recent Studies based on MiDi Data

Braun & Weichenrieder 2015 (go to original article); Gumpert et al. 2016 (go to original article)

This might also interest you

The scale of corporate tax avoidance

Cross-border wealth

Channels of corporate tax avoidance