The deterrence effect of whistleblowing: An event study of leaked customer information from banks in tax havens

Tax Avoidance through Advance Tax Rulings: Evidence from the LuxLeaks Firms

Summary

In 2014, the International Consortium of Investigative Journalists released the tax documents of over 340 multinational enterprises (MNEs). The so-called “LuxLeaks” mostly included advance tax rulings (ATRs) issued and signed by the Luxembourg tax authorities between 2002 and 2010. ATRs may be requested by a taxpayer to clarify specific taxation arrangements. The interpretation of tax laws then provided by the authority is binding and generally serves the purpose of providing the taxpayer with tax certainty. However, the ATRs revealed by the LuxLeaks were associated with complex tax structures that in many cases led to almost zero tax payments in Luxembourg. In this study, Huesecken and Overesch assess the extent to which Luxembourg ATRs facilitated corporate tax avoidance for involved MNEs.

Based on consolidated financial account data, they investigate the evolution of the effective tax rate (ETR) faced by 136 MNEs that benefitted from an ATR issued by the Luxembourg tax authorities. Results suggest that the ETR of the MNEs involved in the LuxLeaks decreased by 4 percentage points after the entry into force of the ATR compared to a control group of MNEs that were not involved in the ICIJ revelations. As the most aggressive MNEs might have self-selected into entering an ATR with the Luxembourg tax authorities, which might confound the identification of the ATR effect, the authors match firms involved in the LuxLeaks with comparable unaffected MNEs based on several criteria. These include the size of the company, the return on assets (ROA), capital intensity, the leverage, R&D expenses and the mobile nature of income. The results based on the matched sample of 70 ruling firms and 303 control counterparts confirm a negative effect of signing an ATR on the ETR of approximately 3.4 percentage points. The authors conclude that ATRs were used as tax shelters to facilitate aggressive tax planning.

Key results

- Huesecken and Overesch document the use of advance tax rulings (ATRs) as a method of aggressive corporate tax planning by MNEs.

- Between 2009 and 2011, the period in which most of the Luxembourg ATRs entered into force, the mean effective tax rates of involved MNEs decreased significantly.

- MNEs benefitting from an ATR reduced their groupwide effective tax rates by 3-4 percentage points relatively to unaffected MNEs.

The authors find that ATRs are most effective in reducing MNEs’ effective tax rates in the year after the documents are issued and signed. For companies that requested more than one ATR however, each year a ruling was signed, it displays a negative and highly significant effect.

Data

In this study, Huesecken and Overesch rely on the “LuxLeaks” documents released by the International Consortium of Investigative Journalists (ICIJ). These mention 345 firms benefitting from ATR and whose ultimate parents were identified manually.

The consolidated financial accounts of MNEs involved in the LuxLeaks were drawn from the Compustat and Compustat Global databases. Spanning a sample period of 16 years around the signing of ATRs by the Luxembourg tax authorities, the resulting dataset covers 136 ruling firms and 5,683 non-ruling MNEs, which serve as a control group.

Ruling MNEs identified by the authors come mostly from the US (34.6%), Great Britain (16.2%), and Germany (6.6%). The financial sector is the most represented, accounting for 33.8% of involved MNEs.

Methodology

The authors conduct a descriptive analysis and a difference-in-difference estimation with MNEs involved in the LuxLeaks as the treatment and non-involved MNEs as control group. To correct for a potential self-selection bias, they use a propensity score matching to pair treated MNEs with unaffected comparable MNEs.

Go to the original article

The original article was published by FinanzArchiv: Public Finance Analysis, and it can be downloaded from the website of the Social Science Research Network (SSRN).

This might also interest you

The new luxury freeports: Offshore storage, tax avoidance, and ‘invisible’ art

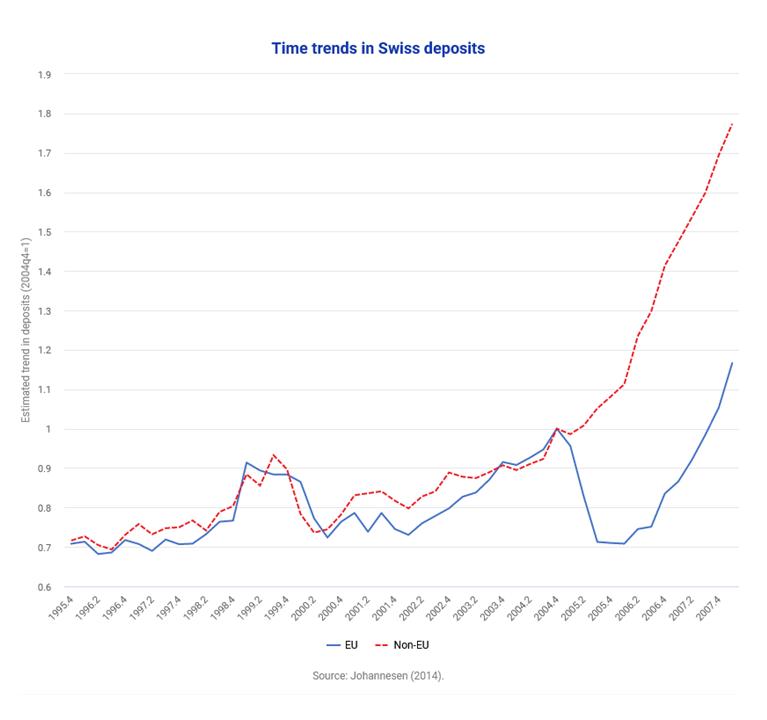

Tax evasion and Swiss bank deposits

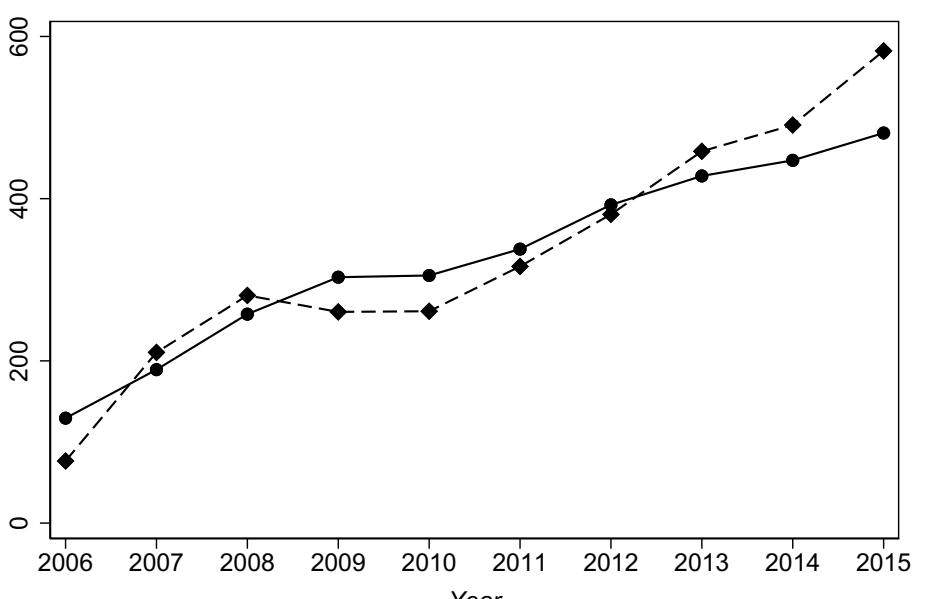

Transparency and Tax Evasion: Evidence from the Foreign Account Tax Compliance Act (FATCA)