Escaping the Exchange of Information: Tax Evasion via Citizenship-by-Investment

Tax Evasion and Inequality

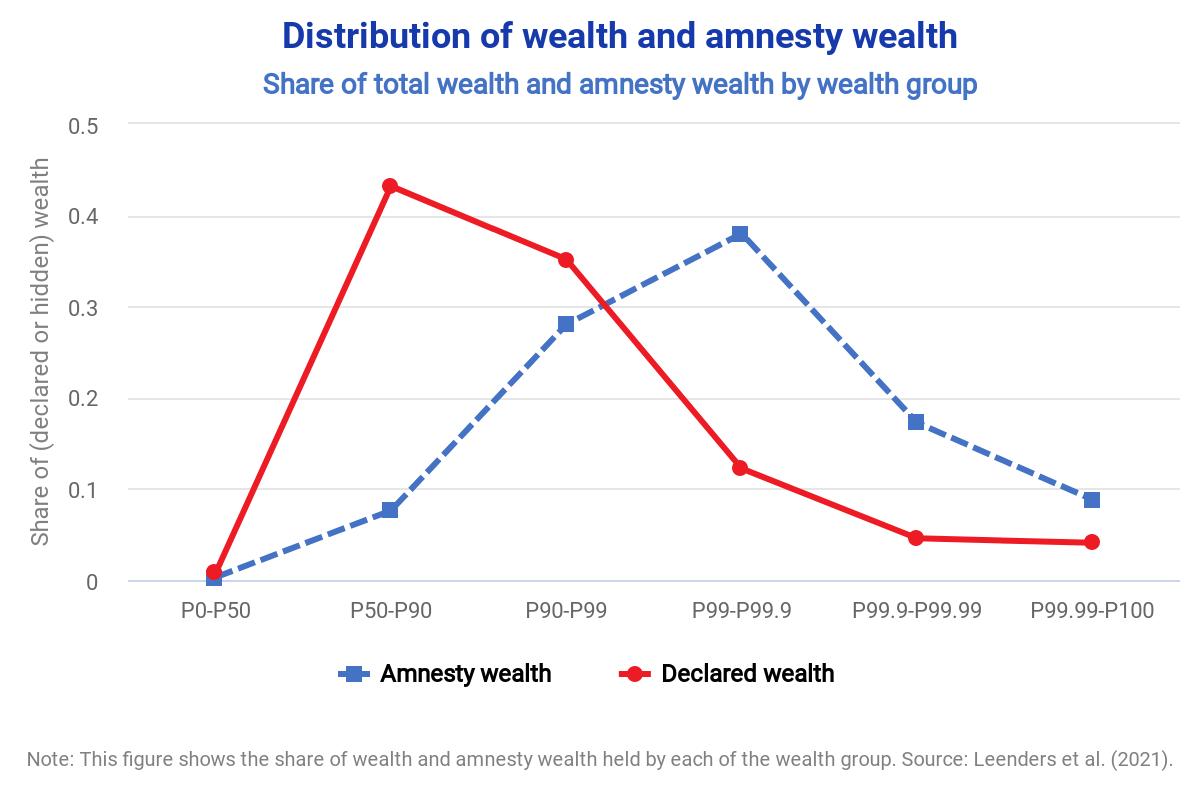

Alstadsæter et al. estimate the size and distribution of tax evasion by individuals in Scandinavian countries. The authors combine leaked customer lists from offshore financial institutions — HSBC Switzerland (“Swiss leaks”) and Mossack Fonseca (“Panama Papers”) — and administrative data from tax amnesties and match them to administrative wealth records in Norway, Sweden, and Denmark. They find that offshore tax evasion is highly concentrated among the rich since about 50% of the wealth uncovered in the Swiss leaks and the amnesty data belongs to the 0.01% richest households. Applying the same distribution to the macro amount of offshore wealth owned by Scandinavians, the authors estimate that the 0.01% richest households evade about 25% of their taxes on asset income. This is much more than the tax evasion detected by random tax audits which is less than 5% throughout the distribution. Furthermore, the authors find that top wealth shares increase substantially when accounting for non-reported assets. This implies that taking tax evasion into account would be important to properly measure inequality.

Key results

- Offshore tax evasion is highly concentrated among the rich.

- The top 0.01% richest households evade approximately 25% of taxes on asset income through tax havens.

- Inequality increases when assets hidden offshore are taken into account.

- Non-compliance at the top is higher than what random audits would suggest.

Data

Tax amnesty data by the Norwegian and Swedish administrations; population-wide income and wealth records made available by all Scandinavian administrations; leaked customer data of HSBC Switzerland (“Swiss leaks”) and Mossack Fonseca (“Panama Papers”); random audit data by the Danish Tax Authority; National Accounts Data on household wealth.

Method

Descriptive statistics based on combinations of micro and macro datasets, imputation and extrapolation.

Go to the original article

This article was published in the American Economic Review 109(6), pp. pp. 2073-2103. It can be found on the journal’s website.

A working paper version can be downloaded from the NBER website. [pdf]

This might also interest you

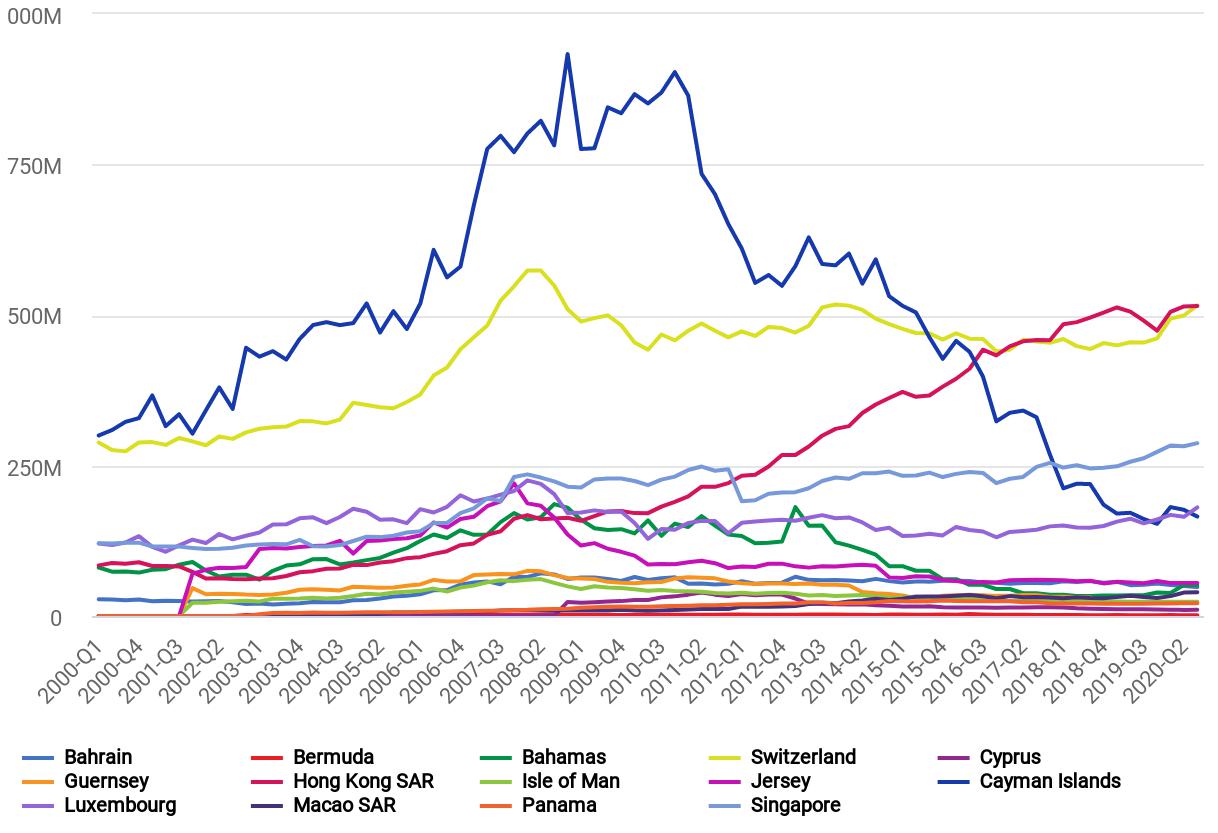

Cross-border wealth

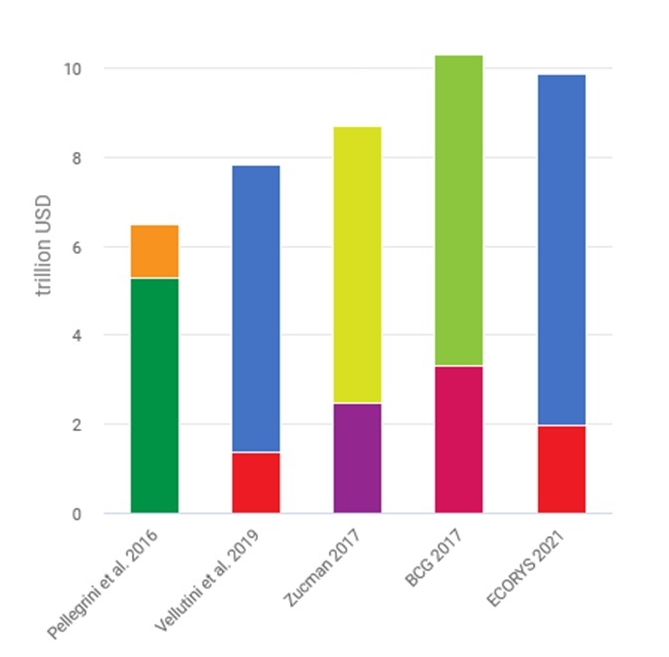

The scale of tax evasion by individuals

Offshore tax evasion and wealth inequality: Evidence from a tax amnesty in the Netherlands