Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data

The Cadbury Schweppes judgment and its implications on profit shifting activities within Europe

Summary

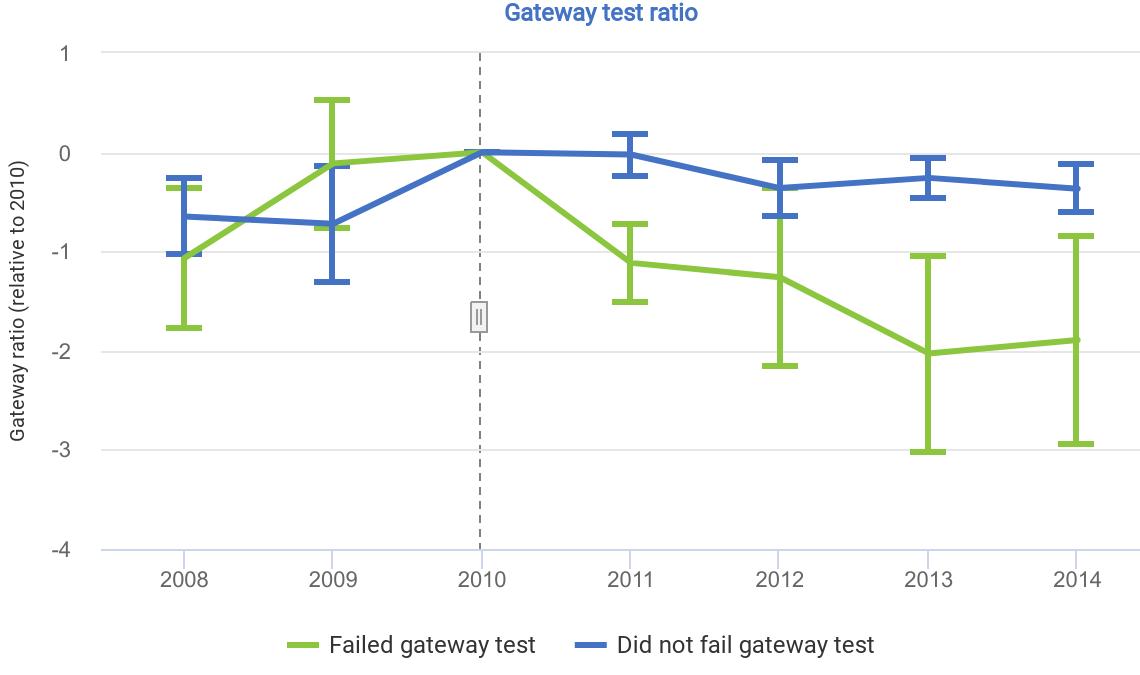

To prevent their home multinational enterprises (MNEs) from shifting their profits to low-tax jurisdictions, many headquarter countries introduced Controlled-Foreign-Company (CFC) rules. Based on variable conditions, these rules generally impose that the low-taxed earnings of affected MNEs’ foreign affiliates be taxed at the tax rate of the parent company’s country. While prior research has underlined the effectiveness of these rules in curbing income shifting, in 2006, the European Court of Justice (ECJ) decided with the Cadbury-Schweppes judgment that CFC rules infringe the European principle of freedom of establishment. Their applicability was restricted to wholly artificial arrangements, i.e. pure letter boxes. In this article, Schenkelberg questions whether this weakening of CFC rules facilitated profit shifting for European MNEs.

Schenkelberg evaluates the impact of the judgement on MNE subsidiaries in low-tax countries by comparing the evolution of reported profits for affiliates owned by European MNEs and those by American MNEs. The latter are chosen as a control group because they are not subject to European CFC rules and the judgement should therefore not affect them. She finds that in the wake of the Cadbury-Schweppes judgement, European-owned subsidiaries in low-tax jurisdictions increased their pre-tax earnings by around 10%, in comparison to the control group. Pre-tax earnings of affected subsidiaries rise even more sharply when the subsidiary is located in a very low-tax country, when the subsidiary is owned by a country with a tax rate above 25%, or when the MNE receives mobile income such as interests, licenses, and royalties. Her results further suggest that 85% of the increased profit shifting activities are related to transfer pricing and less than 15% are related to debt shifting.

Key results

- The Cadbury-Schweppes judgement has weakened the effectiveness of European CFC regulations.

- In the wake of the Cadbury-Schweppes judgement, the pre-tax earnings of the affiliates of MNEs affected by CFC rules in low-tax jurisdictions have increased by 10% relative to that of US-owned subsidiaries.

- The effect was stronger, the lower the statutory corporate income tax rate of the affiliate’s country and the higher the tax rate of the MNE’s headquarter country.

- MNEs with mobile income, such as interests, licenses, or royalties reacted more strongly to the judgement.

- On average, more than 85% of the increased profit shifting activities are related to transfer pricing and less than 15% are related to debt shifting.

Policy implications

According to the author, the observed rise in profit shifting after the Cadbury-Schweppes judgement points to the previous effectiveness of CFC in curbing corporate income tax avoidance.

Data

Schenkelberg relies on panel data on European MNE affiliates drawn from the Amadeus database of the Bureau Van Dijk, which provides unconsolidated financial account data and information about the ownership structures of the firms considered. The resulting sample gathers 15250 European-owned subsidiaries and 3616 US-owned ones.

These data are complemented with the worldwide corporate tax summaries of PwC, KPMG, and EY and with macroeconomic control variables taken from various World Bank databases.

Methodology

The study includes a descriptive analysis and a difference-in-difference analysis to estimate the impact of the Cadbury-Schweppes judgement on pre-tax earnings or EBT. This analysis is accompanied by several robustness checks, including a matched sample model relying on propensity score or kernel matching.

To analyse the channels of profit shifting used by MNEs, Schenkelberg contrasts the effect of the judgement on the earnings before interest and tax (EBIT) and on the earnings before tax (EBT, which includes interest payments) of affected MNEs’ affiliates. The impact of the judgement appears to be larger on EBT. The author concludes that most of the increased profit shifting is related to transfer pricing because, unlike the EBIT, the EBT accounts for both transfer pricing-based and debt-based profit shifting.

Go to the original article

Find the published version of the article on the website of the International Tax and Public Finance Review.

A working paper version from 2015 can be downloaded from the website of the Social Science Research Network. [pdf]

This might also interest you

How large is corporate tax base erosion and profit shifting? A general equilibrium approach

Ending Corporate Tax Avoidance and Tax Competition: A Plan to Collect the Tax Deficit of Multinationals

Real Responses to Anti-tax Avoidance: Evidence from the UK Worldwide Debt Cap