Hidden in plain sight: Offshore ownership of Norwegian real estate

The effect of foreign investors on local housing markets: Evidence from the UK

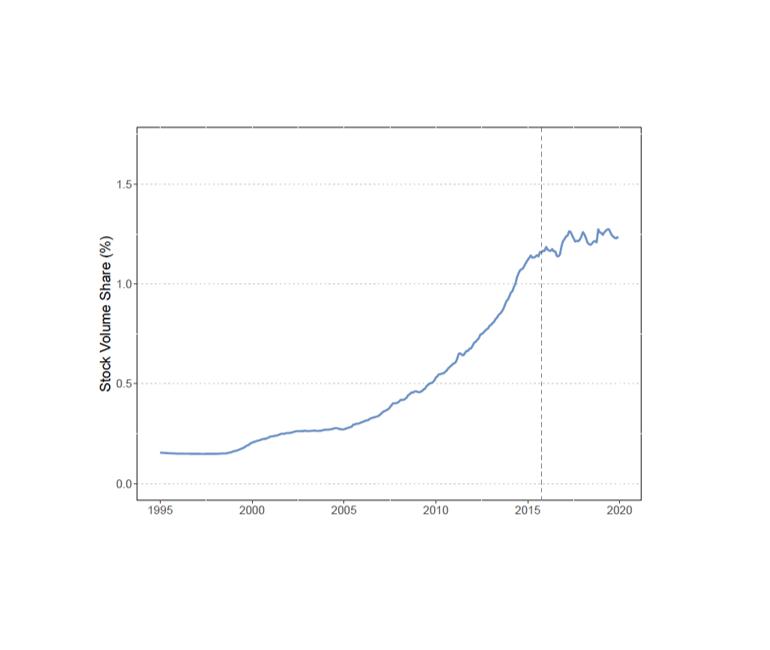

In this paper, Sá analyzes the effect of foreign investment by overseas companies on the housing market in England and Wales. Results suggest that foreign investment has a positive effect on house price growth: An increase of one percentage point in the share of property transactions registered to foreign companies leads to an increase of 2.1–2.3 % in house prices. Based on this finding she estimates that the average house prices in England and Wales in 2014 would have been about 19% lower in the absence of foreign investment.

Furthermore, the positive effect of foreign investment is present at different percentiles of the distribution of house prices. It is stronger in local authorities where the housing supply is less elastic. Thus, the results suggest that foreign investment in the housing market not only drives up the prices of expensive homes but also has a “trickle-down” effect on less expensive properties.

Beyond the impact on prices, Sá finds no evidence that foreign investment has encouraged the construction of new housing or that more homes are left vacant in local areas where foreign buyers are more active. However, her findings suggest that the rate of homeownership declines due to foreign investment.

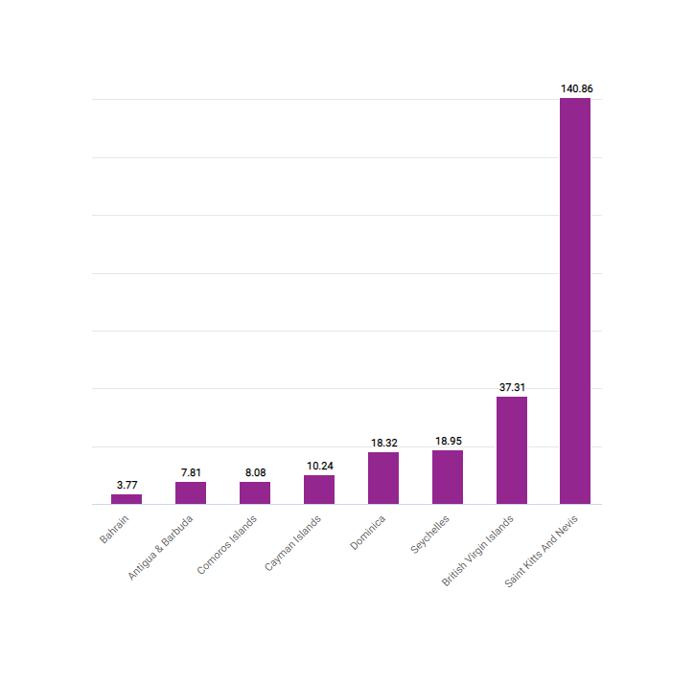

Although tax havens are a minor issue in this study, a breakdown of investment shares by country of incorporation reveals their important role: 33.5% of purchases of property by foreign companies in 2014 were done by companies incorporated in the British Virgin Islands, 19.4% in Guernsey and 11.5% in Jersey.

Key results

- An increase of one percentage point in the share of property transactions registered to foreign companies is associated with an increase of 2.1–2.3 % in house prices.

- Among the property transactions involving a foreign company, most of them were incorporated in tax havens such as British Virgin Islands (33.5%), Guernsey (19.4%), and Jersey (11.5%).

Data

Several data sources are being used in this paper. The two main data sources for real estate in the UK (England and Wales) are the Land Registry House Price Index and the Land Registry Price Paid Data (PPD). For foreign transactions, the Land Registry Overseas Companies Dataset (OCD) is used. The dataset includes the records of overseas companies only and does not cover properties owned by private individuals, UK companies, or charities. It only contains information on the country of incorporation but does not reveal the country of ultimate ownership of the companies that invest in UK property.

Methodology

The effect of foreign investment on house prices is identified from spatial correlations between the share of foreign transactions and changes in house prices across local authorities. Sá constructs an instrument for foreign investment based on economic shocks abroad.

Go to the original article

The working paper, released in November 2016, can be downloaded from the SSRN website. [PDF]

This might also interest you

Homes incorporated: Offshore ownership of real estate in the U.K.

Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis