Who owns offshore real estate? Evidence from Dubai cross-border real estate investments

Hide-seek-hide? The effects of financial secrecy on cross-border financial assets

Janský et al. assess how the various financial transparency measures implemented in the past decade impacted the location of cross-border financial assets across countries. Rather than analysing the effect of individual policies, they test whether changes in secrecy scores of the Financial Secrecy Index can explain the location of cross-border portfolio investment and bank deposits between 2011-2020. These secrecy scores combine 20 indicators that measure the opportunities for hiding an investor’s identity, e.g. due to loopholes in a jurisdiction’s ownership registration or a lack of international cooperation.

The authors suggest that an investor’s locational decision between two secrecy jurisdictions depends on the cost of establishing an offshore investment and the probability of being caught and sanctioned and make three theoretical predictions: First, only high-secrecy jurisdictions are used for tax evasion. Second, the impact of changes in secrecy on cross-border financial assets is highly non-linear (i.e. the impact of a unit change in secrecy is greater the larger the change in secrecy). Third, asset holders will only relocate their investment in response to a large-enough change in relative secrecy between two jurisdictions.

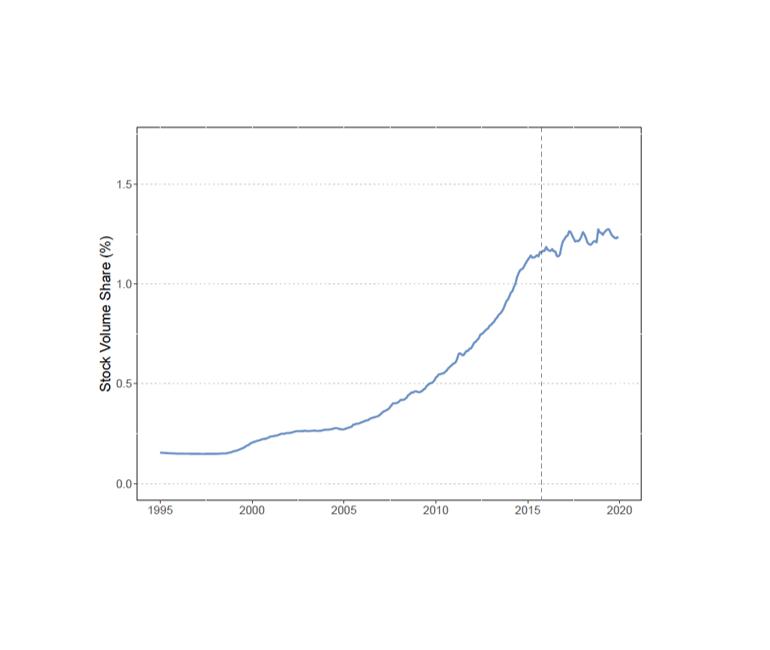

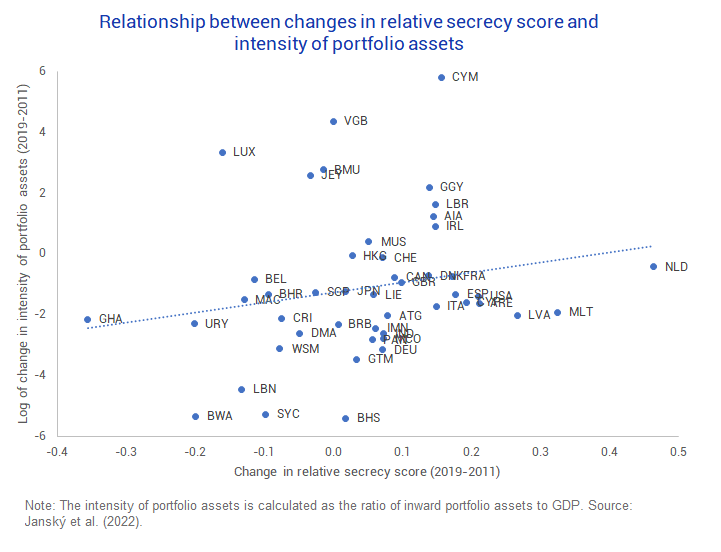

For their empirical analysis, the authors harmonise secrecy scores over the available years to obtain a panel dataset for 71 countries. They assess whether a relative change in secrecy between two jurisdictions modified the investment location decisions made by asset holders from third countries. In accordance with their theoretical predictions, they find that investors react to changes in financial secrecy by relocating their assets to high-secrecy jurisdictions becoming relatively more financially secretive. The results suggest that this effect increases with the size of the change in relative secrecy and is stronger for portfolio investment than for bank deposits. Furthermore, the relocation effect seems to be stronger for cross-border financial assets originating from lower-income countries which might indicate a larger illicit component.

Key results

- Investors relocate their cross-border assets in response to changes in financial secrecy. Jurisdictions remaining highly secretive attract relatively more assets.

- The effect of a unit change in relative secrecy on relocated cross-border financial assets increases with the size of the change in relative secrecy.

- A significantly stronger relocation effect is observed for assets originating from lower-income countries.

Data

- The authors combine five editions of the qualitative secrecy scores from the Financial Secrecy Index published by the Tax Justice Network and harmonize them to make the indicators comparable over time. The resulting panel dataset allows them to track the relative development of financial secrecy in jurisdictions from 2011 to 2020.

- To measure cross-border assets, Janský et al. use data on bank account deposits from the Locational Banking Statistics (LBS) from the Bank for International Settlements and data on portfolio investment from the International Monetary Fund’s Coordinated Portfolio Investment Survey (CPIS). (read more about these data sources)

Methodology

- Janský et al. set up a model of the locational decision between two secrecy jurisdictions of an investor from a third jurisdiction given the cost of establishing an offshore investment and the probability of being caught and sanctioned.

- To test empirically the predictions of the model, they use a trilateral panel setting where the unit of observation is a triad of countries. For each country triad, they compute the difference between two jurisdictions’ cross-border financial assets held by investors from the third jurisdiction. They then regress this variable on the difference in relative secrecy between the two first jurisdictions and add country triad-level fixed effects, and a vector of country-pair controls. The coefficient for the difference in relative secrecy gives the semi-elasticity of investment decisions between two jurisdictions of investors from third jurisdictions with respect to changes in the relative secrecy between the two former jurisdictions.

- The authors interact the relative secrecy term and its square with dummy variables indicating whether jurisdictions are high-secrecy jurisdictions and whether the difference in relative secrecy is higher than a given threshold. This allows them to test the non-linearity of the effects.

Go to the original paper

The working paper can be downloaded from the website of the Social Science Research Network. [PDF]

This might also interest you

Hidden in plain sight: Offshore ownership of Norwegian real estate

The role of anonymous property owners in the German real estate market: First results of a systematic data analysis

Homes incorporated: Offshore ownership of real estate in the U.K.