Monitoring the amount of wealth hidden by individuals in international financial centres

The new luxury freeports: Offshore storage, tax avoidance, and ‘invisible’ art

Summary

In this article, Oddný Helgadóttir analyses the emergence of “luxury freeports”, i.e. high-security storage spaces where artworks and luxury items can be traded and detained for an unlimited period of time. These freeports allow high net worth individuals to trade valuable goods without paying value added tax. In addition, they may serve as a new form of “offshore” as beneficial ownership information of assets held in freeports is not subject to automatic information exchange between tax authorities. Pointing at the rapid growth in the high-end of the art market and the physical expansion of these storage spaces, the author suggests that luxury freeports are establishing themselves as new players in the global system of tax avoidance and discusses the trends that may explain this development.

Helgadóttir first describes the evolution of the traditional Swiss freeports, used since the 19th century for grain and other goods in transit. In the wake of the creation of the WTO in 1995, traditional freeports were challenged by Open Customs Warehouses (OCWs), a new kind of tax and duty-free storage option promoted to facilitate free trade and harmonizing trade practices across borders. With a more flexible administration, standardized licensing processes, and better suiting the new technological requirements of logistics, OCWs took off at the expense of freeports. In reaction to these competitive pressures, the Geneva Freeport reinvented its business model. It exploited several specificities of its legal status, such as limited inventory requirements and limited legal liability if customers failed to comply with laws and regulations and became a blueprint for other luxury freeports.

Furthermore, the author relates the rise of luxury freeports to the international crack down on banking secrecy. While Zucman (2015) underlines that from 2009 to early 2015, foreign wealth held in Switzerland increased by 18%, Helgadóttir notices that the Geneva Freeport expanded by 10,000 m2 in 2014. Additionally, she stresses the pattern of diffusion of luxury freeports, which spread alongside known financial hubs or tax havens such as Singapore (2010), Monaco (2013), Luxembourg (2014), Beijing (2014), Delaware (2014), and New York City (2018).

Following several scandals that questioned the legality of the sourcing of the Geneva Freeport’s artworks and shed light on the use of shell companies to obscure ultimate beneficial ownership, the Swiss authorities strengthened the legal requirements imposed upon freeports. According to the author, the luxury freeports created outside of Switzerland responded to these setbacks by engaging in transparency initiatives to fight money laundering but leaving the issue of aggressive tax planning widely untouched.

Key results

- Helgadóttir suggests that the Luxury Freeport model was spurred by competition from Open Customs Warehouses and increasing demand for alternative ways to avoid taxation on investment income in times of rising international financial transparency.

- According to estimates from Deloitte’s 2017 Art & Finance Report high net worth individuals dedicated 1.62 trillion USD to art and collectibles in 2016 with a projected increase to 2.7 trillion USD by 2026.

- The physical space occupied by luxury freeports has rapidly increased over the last decade from 46,722 m2 of dedicated storage in 2010 to more than 178,800 m2

- According to anti-money-laundering regulation, freeports may be required to report suspicious activity and keep records of ultimate beneficial ownership but information is not exchanged automatically between tax authorities which seriously limits transparency for tax purposes.

Data & Methodology

Helgadóttir gathers insights from several studies on the links between finance and the artwork market or on individual luxury freeports. Additionally, the author relies on 7 semi-structured interviews and 1 email-based interview with regulators, experts and service providers in Switzerland.

Go to the original article

This article was published in Environment and Planning A: Economy and Space in 2020. It is available under restricted access on the SAGE Journals website.

A manuscript version is available at the website of the Copenhagen Business School [pdf]

This might also interest you

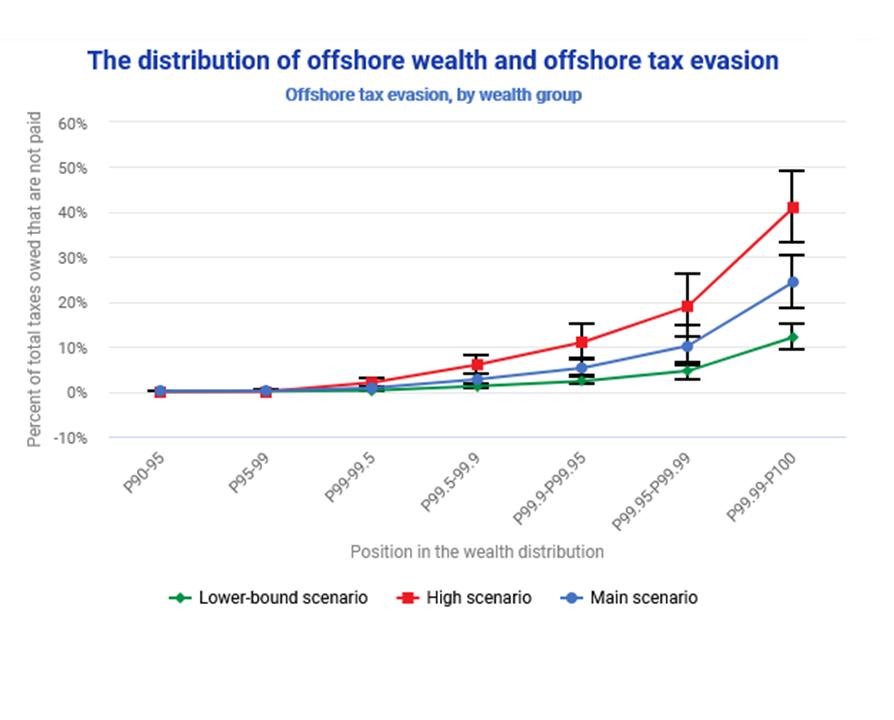

Tax Evasion and Inequality

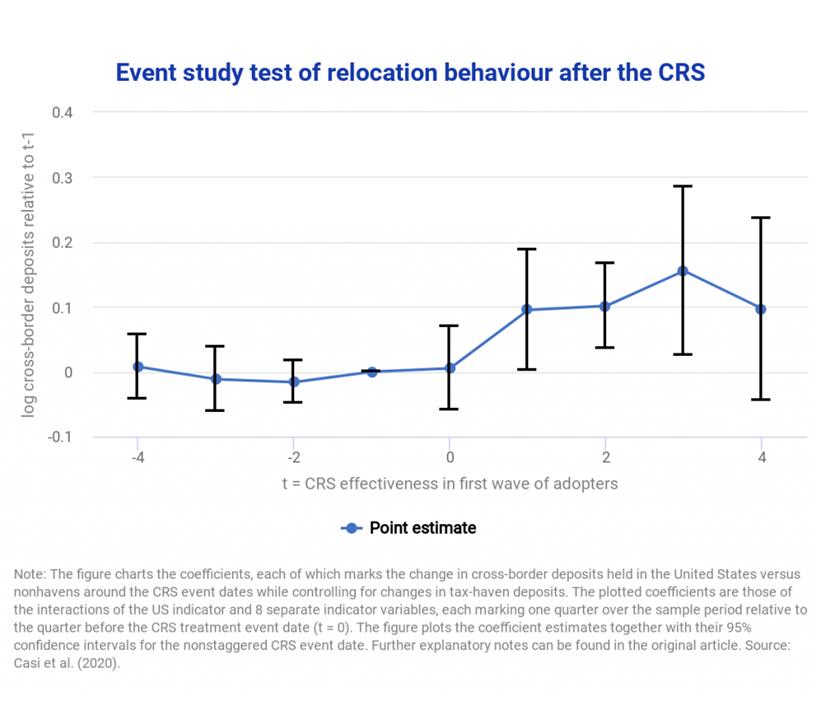

Cross-border tax evasion after the Common Reporting Standard: Game over?

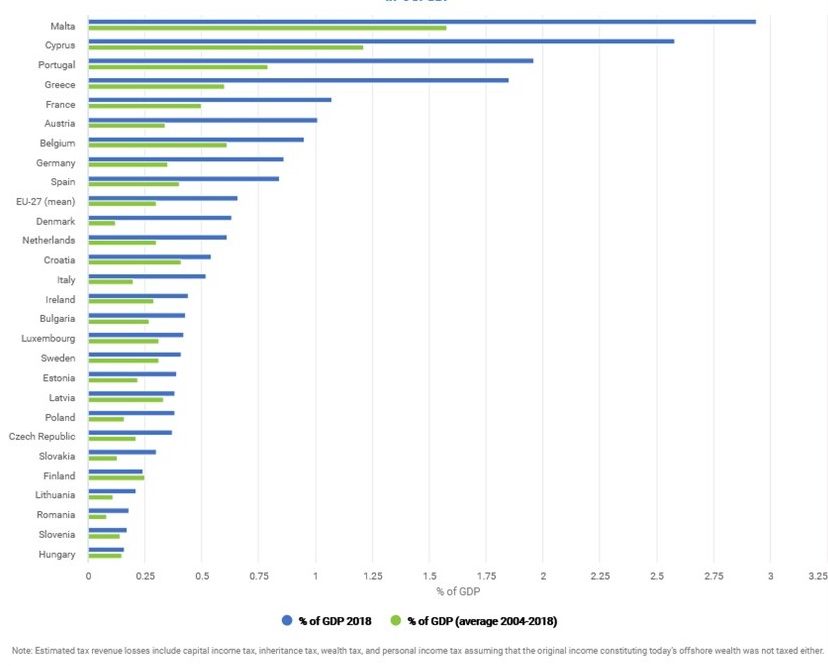

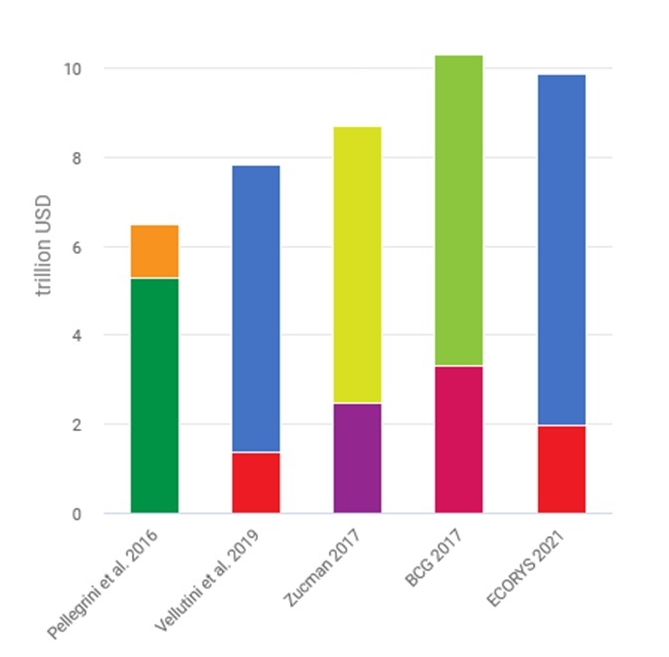

The scale of tax evasion by individuals