Tax evasion and Swiss bank deposits

Transparency and Tax Evasion: Evidence from the Foreign Account Tax Compliance Act (FATCA)

Summary

In this article, the authors analyse the effectiveness of the Foreign Account Tax Compliance Act (FATCA), implemented by the US government in 2010 in order to tackle US individual offshore tax evasion. This regulation represented a significant shift from self-reporting to automatic and mandatory reporting by foreign financial institutions. The authors examine whether the implementation of FATCA led U.S. investors to move their financial assets out of tax havens by comparing the development of haven-sourced foreign portfolio investment (FPI) into the U.S. before and after the implementation of FATCA.

They find that equity investments from tax havens into the US declined by 21% from 2012 to 2015 which would be consistent with a decrease in “round-tripping” investment activity attributable to U.S. investors’ offshore tax evasion activities. Under the assumption that individuals have a preference for investments in their home country and that foreign investors were not affected by FATCA, the authors impute these “abnormal” changes in Foreign Portfolio Investments (FPIs) since 2012 to the impact of the regulation.

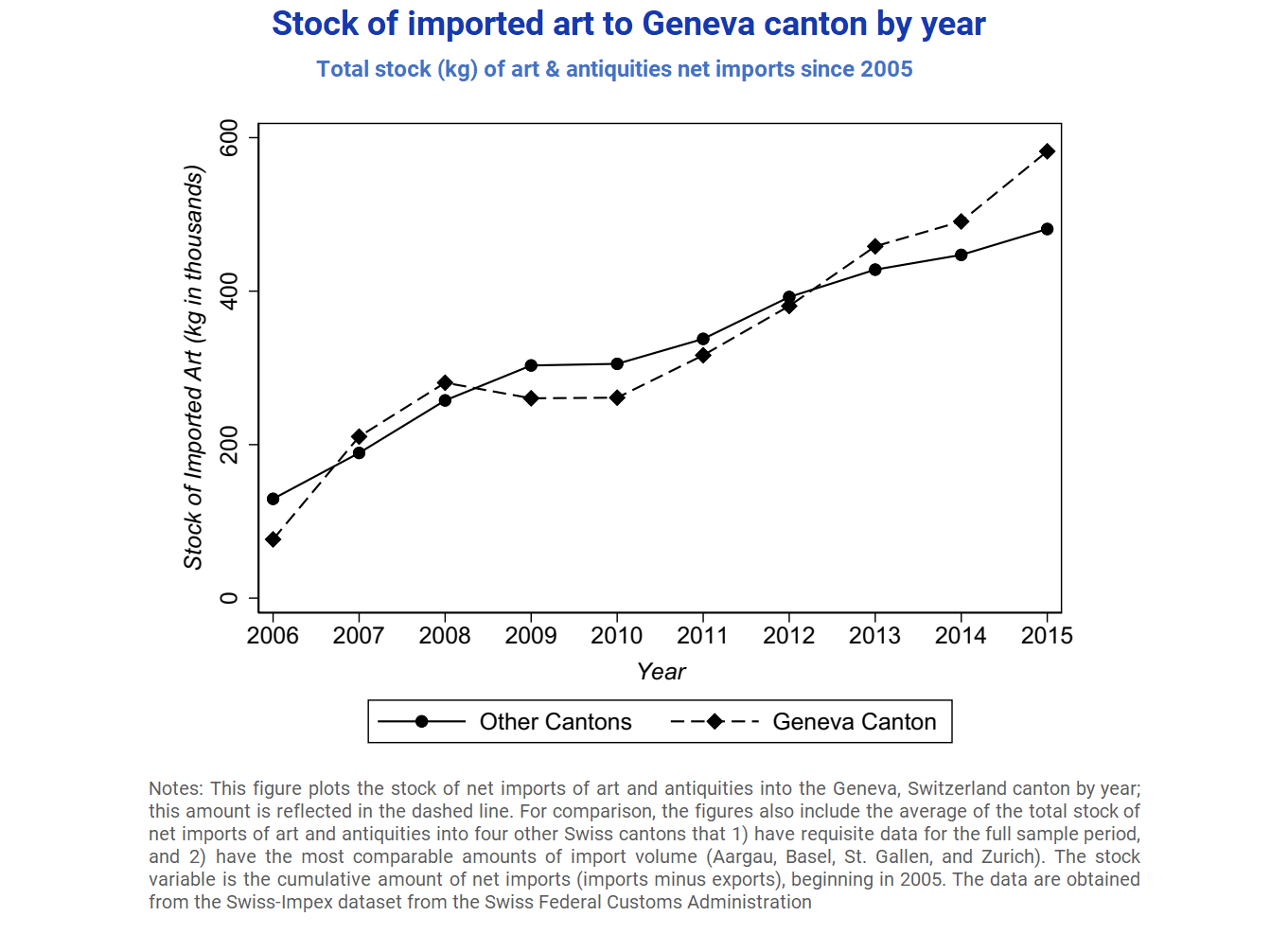

However, they find evidence of additional consequences and negative externalities of the regulation, including a surge in expatriations and increased investments in alternative asset classes not covered by FATCA reporting requirements. For instance, the authors suspect a shift from financial assets to real estate because, in the post-FATCA period, they observe a sharp increase in the house price index of countries without foreign buyer restrictions as compared to countries with such restrictions. In addition, they observe that imports of art works in Geneva – where one of the largest freeports in the world is located – increased with respect to art imports in other Swiss cantons without freeports.

Key Results

- Equity investments from tax havens into the US declined by 21% from 2012 to 2015 which would be consistent with a decrease in “round-tripping” investment activity by U.S. tax evaders.

- Global equity FPIs from tax havens were reduced by 21-29% since 2012, which would be consistent with U.S. citizens altering also their worldwide (not just U.S.) investment strategies.

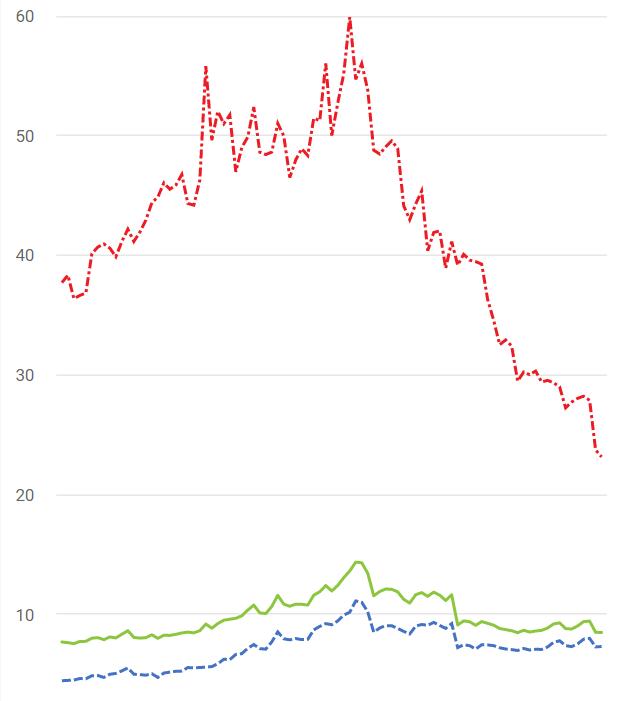

- The number of expatriations from the US in 2015 was over six times the number in 2006.

- The authors find evidence of a shift from financial assets to real estate and art works which are not covered by FATCA.

Policy Implications

- The results suggest that US government managed to curb individual tax evasion based on foreign financial accounts but changes in the investment behaviour of tax may mitigate the achievements of FATCA. The authors therefore stress the need for the introducing broader reporting requirements, that would not be limited to financial assets.

- The authors call for further investigations on alternative tax evasion opportunities (such as real estate or artworks) and on the effectiveness of regulatory interventions aiming at these.

Data & Methodology Used

The authors use various data sources including:

- Information on US securities positions (both equity and debt) held by foreign investors from the US Treasury International Capital (TIC) System

- Data from the IMF’s Coordinated Investment Portfolio Surveys (CPIS)

- The list of US individuals expatriating between 2006 and 2015 from IRS quarterly publications

- Data on the European domiciles of UCITS assets as reported in the Quarterly Statistical Releases of The European Fund and Asset Management Association (EFAMA).

- Data from the Swiss Federal Customs Administration Swiss-Impex website that presents the amount of imports to and exports from each Swiss canton by asset class, the asset class 14 corresponding to “Works of art and antiquities”.

Methodology

Various regression analyses. Most regressions relate the dependent variable of interest to a post-FATCA dummy variable interacted with other dummies in order to identify diverging trends between sub-groups of variables more or less affected by FATCA.

Go to the Original Article

This article has been published in the Journal of Accounting Research 58(1) in 2019. The published version of the paper can be found at the journal’s website.

A working paper version can be downloaded from the website of the Stanford Graduate School of Business. [pdf]

This might also interest you

Cross-border tax evasion after the Common Reporting Standard: Game over?

Hidden treasures: The impact of Automatic Exchange of Information on cross-border tax evasion

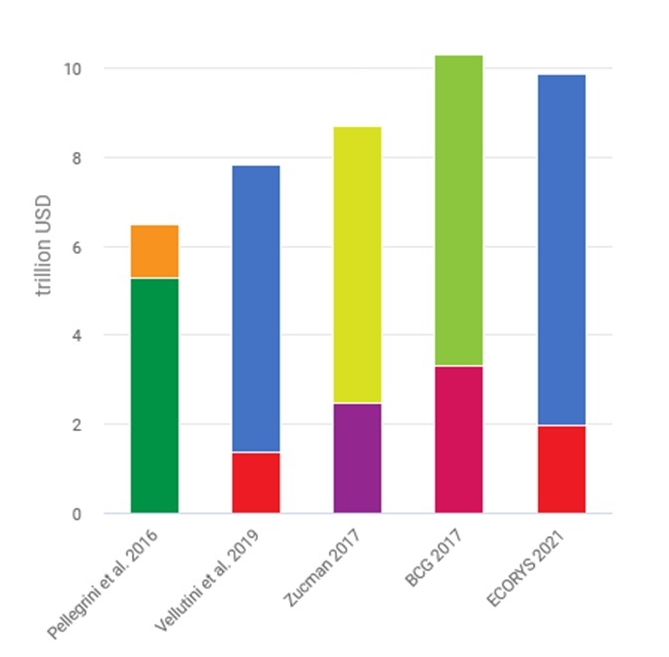

The scale of tax evasion by individuals