The scale of tax evasion by individuals

Welfare effect of closing loopholes in the dividend-withholding tax: The case of Cum-Cum and Cum-Ex transactions

Summary

This paper studies the impact of a reform aimed at closing loopholes in the enforcement of the dividend-withholding tax (DWT), implemented in Denmark in 2016.

DWT is a tax companies have to withhold from the distributed dividends on behalf of the government. Loopholes in the tax code gave rise to arbitrage opportunities for investors through two main schemes known as “cum-cum” and “cum-ex” transactions, allowing them to benefit from undue DWT reimbursement. Both schemes involve transferring dividend rights between several investors around the dividend record date: using stock lending with attached dividend rights, investors can exploit differences in tax treatment between domestic and foreign investors (cum-cum), or play on the time lag between the conclusion of a transaction and the actual delivery of the shares (cum-ex).* The Danish reform introduced new documentation requirements to ensure that only the true beneficial owner of the traded shares can receive a tax refund.

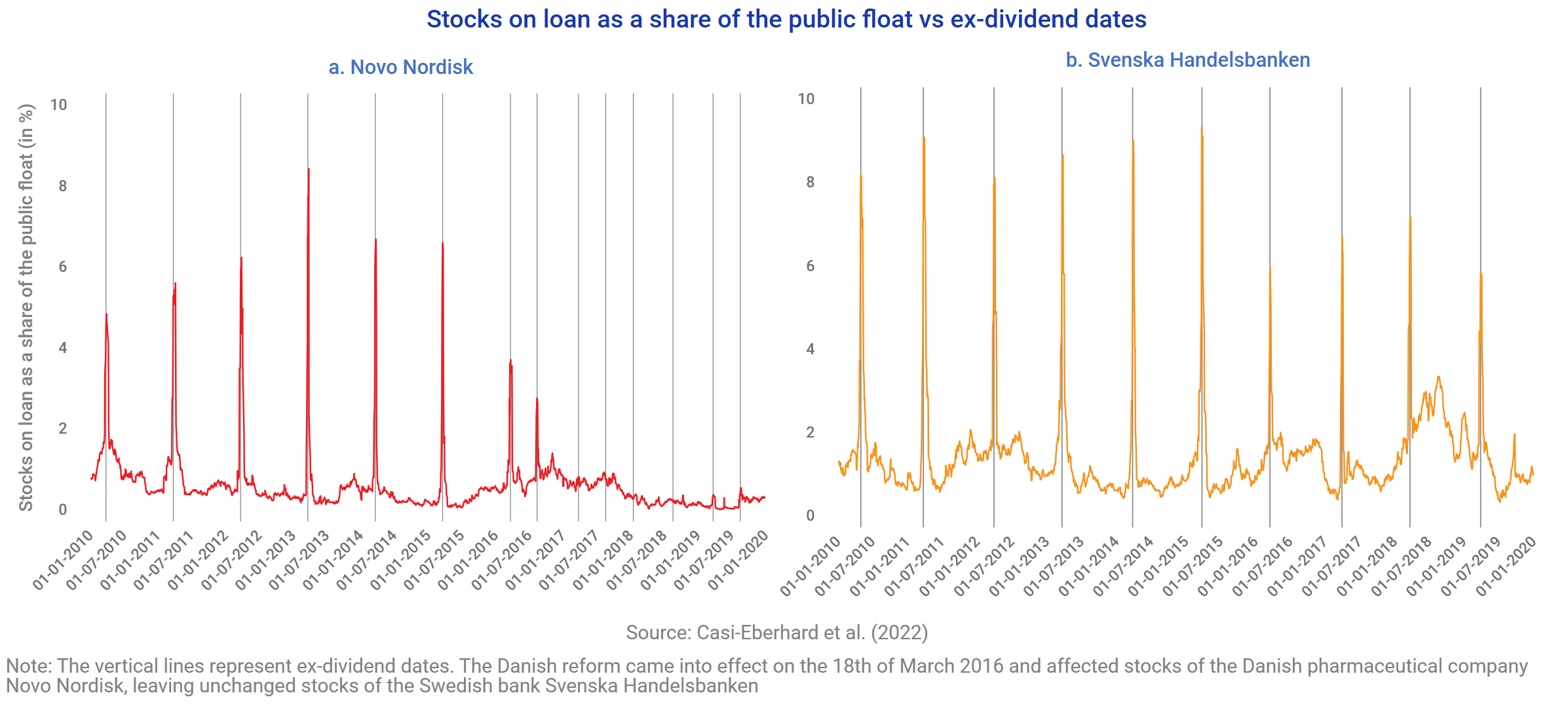

The authors identify the presence of DWT arbitrage documenting the sharp spikes in stocks on loan around ex-dividend dates. After the Danish reform, these spikes disappeared while they persisted in other Nordic countries, indicating that the reform was successful at eliminating DWT arbitrage in Denmark. Consistently, the authors find that a similar reform implemented in Germany also completely eliminated the spikes in security-lending.

Results for Denmark suggest that DWT revenue increased by 130 percent (or 1.3 billion USD) after the reform, while the measures had no significant effect on foreign portfolio investment (FPI) nor on dividend policy by companies. The authors conclude that the reform resulted in a welfare increase for Denmark.

Considering the incidence of cum-cum and cum-ex in 15 Western-European countries between 2010 and 2019, the authors find evidence of arbitrage in all countries levying a DWT. In contrast, no evidence is found in the UK, where no DWT is levied.

Key Results

- After the reform, spikes in stocks on loan disappear in Denmark, while they persist in the other three Nordic countries.

- Spikes in stocks on loan also disappeared in Austria and Germany after similar reforms. Stricter DWT enforcement led to an increase in DWT revenue by 130% without significant changes in foreign portfolio investment or dividend policy.

- The authors do not find evidence of DWT arbitrage in the UK, where no DWT is levied, but observe DWT arbitrage in all of the 15 studied European countries levying a DWT.

Policy recommendation

This paper emphasises the need for a closer supervision of cum-cum and cum-ex transactions, as there remain strong incentives to develop new financial tools to avoid DWT.

Data

To analyse the impact of the reform, the authors use data from Markit on security-lending and borrowing in over-the-counter transactions. They merge the latter with daily securities data from Compustat Global. Their resulting panel covers the period 2010-2019.

For the welfare analysis, the authors accessed unique data on DWT receipts and reimbursement from the four Nordic countries, which they combine with FPI data from the IMF Coordinated Portfolio Investment Survey and dividend yields calculated based on their daily securities data.

Methodology

To assess the impact of the Danish reform, the authors employ a triple difference-in-difference event study comparing stocks on loan as a percentage of the public float 1) between regular trading days and days lying within a 31-day window centred around the ex-dividend date, 2) both before and after the 2016 Danish reform, 3) and between Denmark and the other three Nordic countries serving as counterfactuals.

The authors analyse the reform’s effect on tax revenue and FPI through a synthetic difference-in-difference using a weighted average of Finland, Norway and Sweden as a control group. The impact on dividend yields is estimated with a regression-based event study using company-level data.

Go to the original article

The working paper, released in February 2022, can be downloaded from the CESifo website.

* Leveraging the feature that the DWT is applied only to foreign investors, whereas domestic investors get a full tax refund, foreign investors loan their stock to domestic banks around the repayment date, in order to benefit from the tax refund and effectively escape DWT (cum-cum scheme). In a cum-ex scheme, several investors exploit the two-days lag between the agreement and the actual delivery of stock in a short-selling transaction, and the legal equivalence between dividend payment and dividend compensation, so that different investors can claim a DWT refund on the same stock, thus costing the state more than it raises in tax revenue.

This might also interest you

Cross-border wealth

What lies beneath: Evidence from leaked account data on how elites use offshore banking

The new luxury freeports: Offshore storage, tax avoidance, and ‘invisible’ art