Offshore tax evasion and wealth inequality: Evidence from a tax amnesty in the Netherlands

The scale of tax evasion by individuals

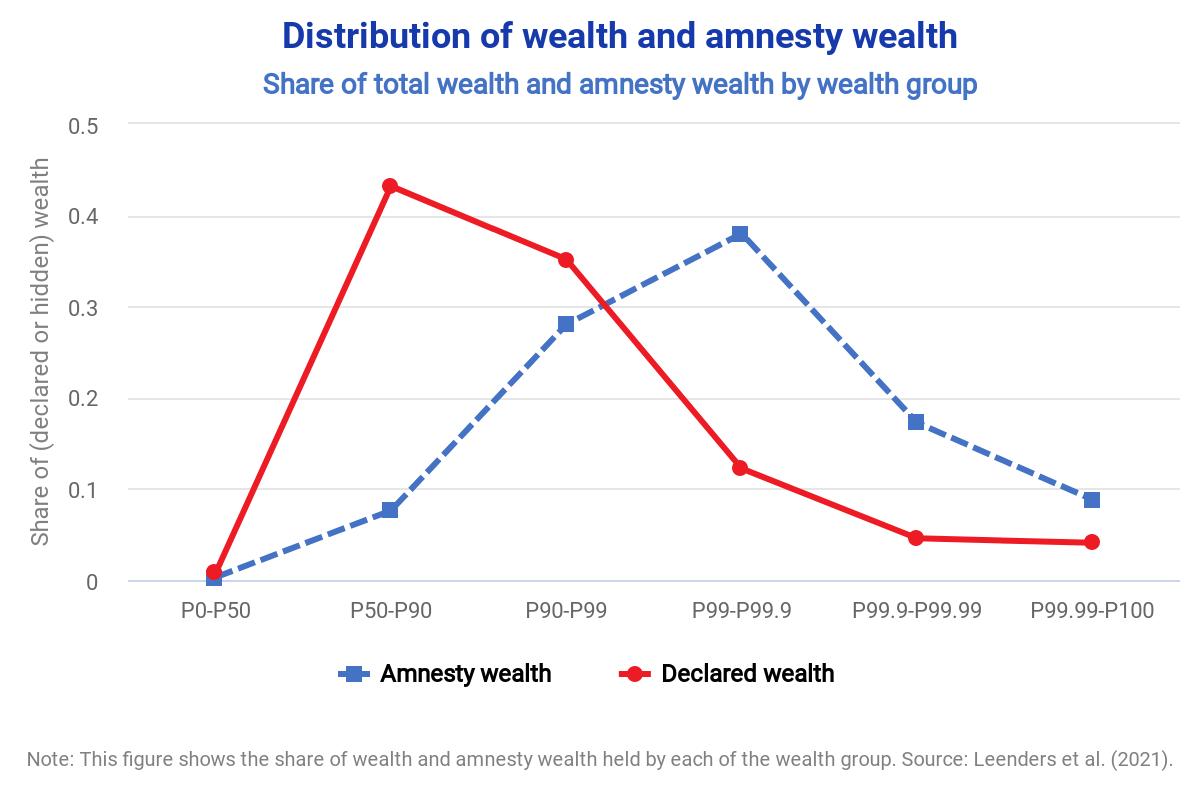

How much wealth is hidden in financial secrecy jurisdictions? Who owns it? And how much tax revenue is lost due to wealth-related tax evasion? The secretive nature of tax evasion impedes definitive answers to these questions. Still, researchers have found ways to estimate hidden wealth globally and by country of origin. Increasing international financial transparency and availability of administrative data are key to research progress in this field. This page presents a selection of recent studies.

Choose an estimate

- Global wealth hidden offshore

- Offshore wealth by country of ownership

- Estimated tax revenue loss by country

Download data and explanatory notes

- Estimates of offshore wealth and tax revenue losses. [data table]

Read more about the estimates

- Pellegrini et al. (2016). What do external statistics tell us about undeclared assets held abroad and tax evasion? [research summary]

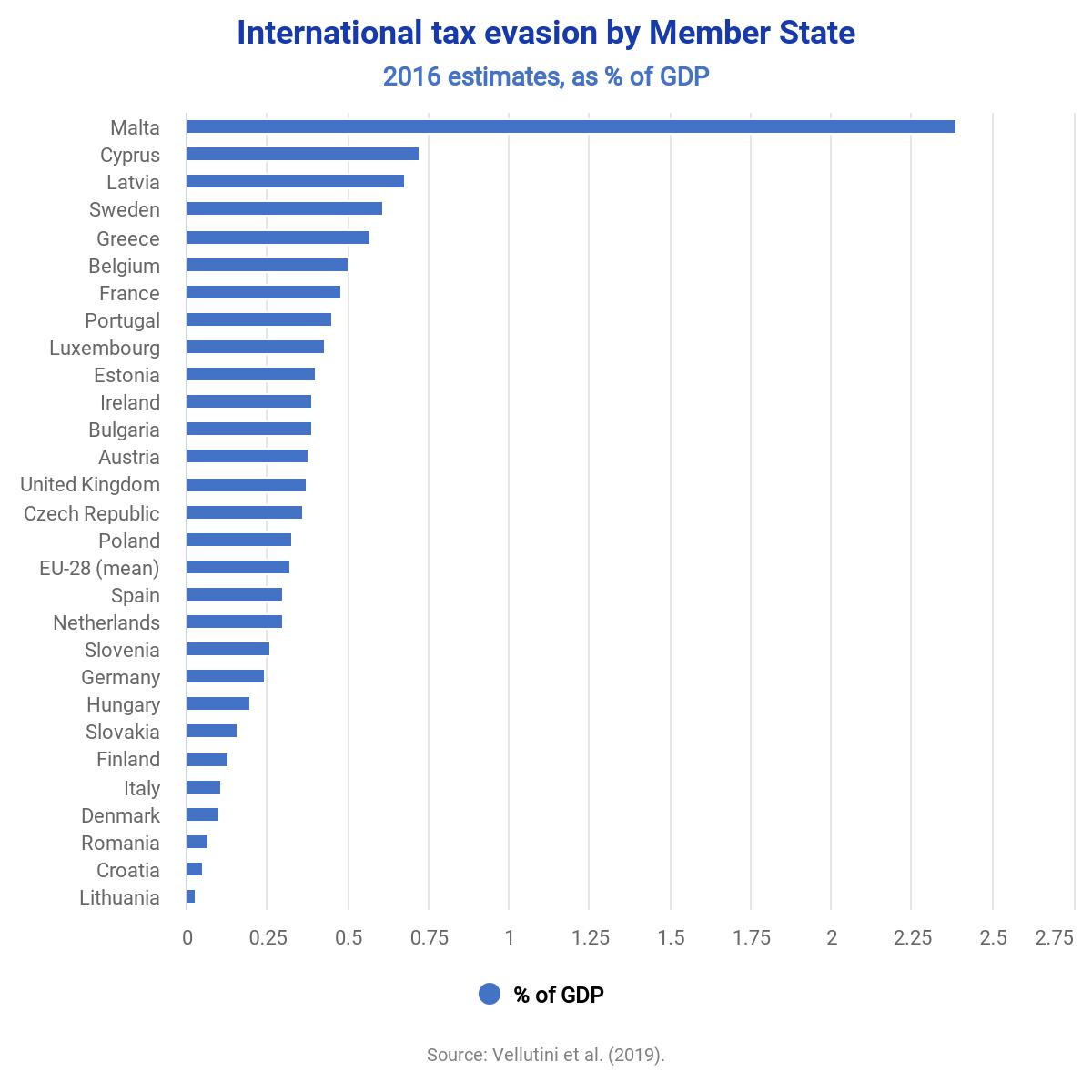

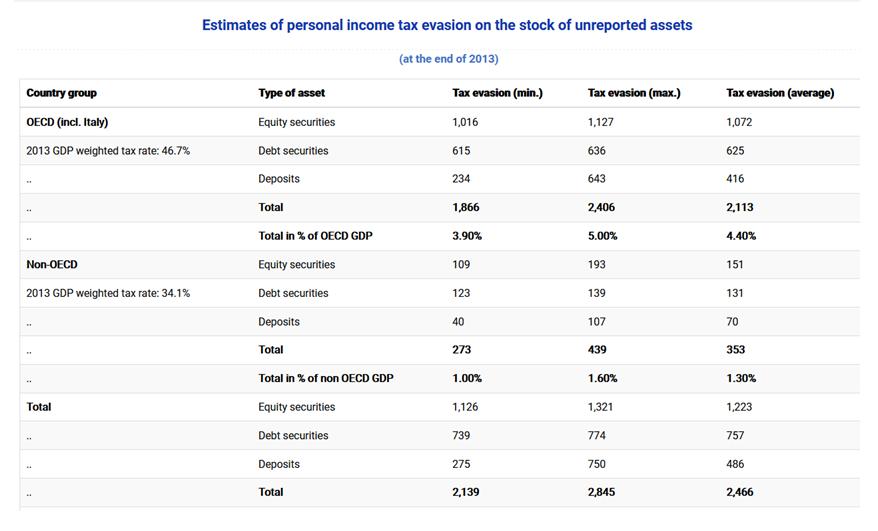

- Vellutini et al. (2019). Estimating International Tax Evasion by Individuals. [research summary]

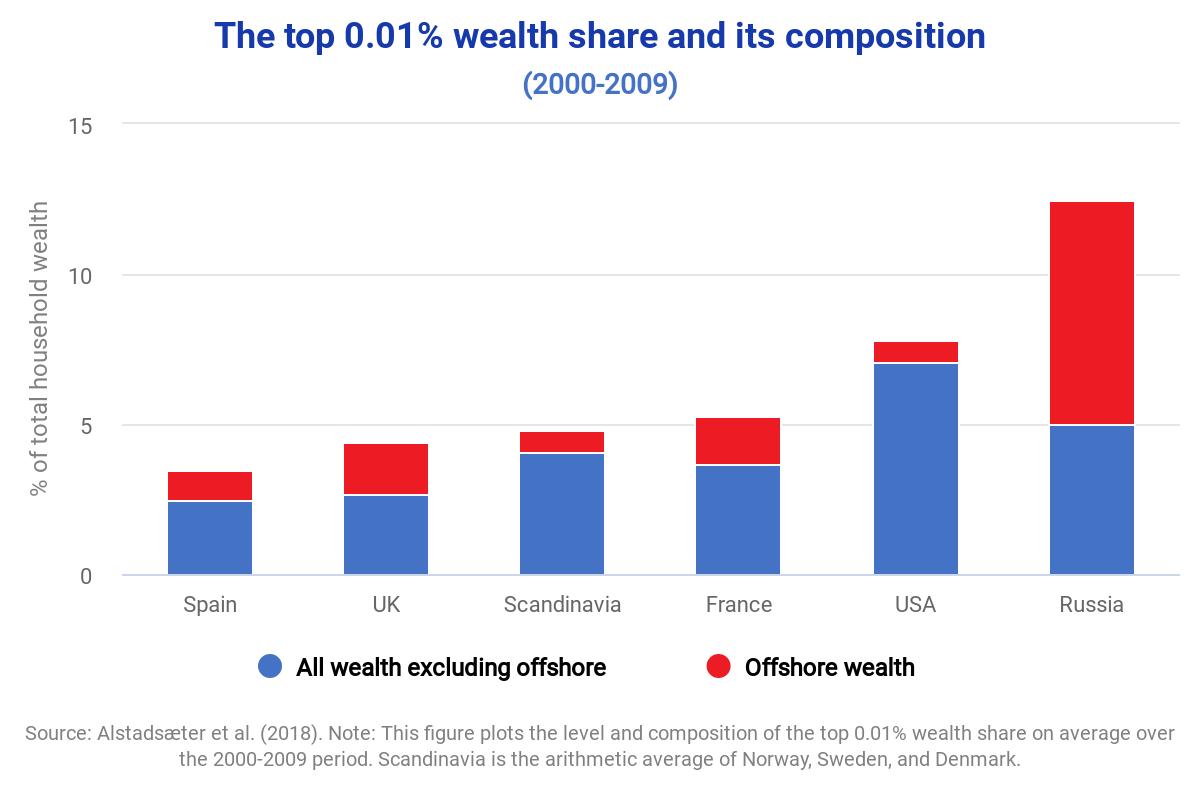

- Alstadsaeter (2018). Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality. [research summary]

- ECORYS (2021): Monitoring the amount of wealth hidden by individuals in international financial centres. [research summary]

- Tax Justice Network (2021). The State of Tax Justice 2021. [research summary]

More research on the scale of tax evasion

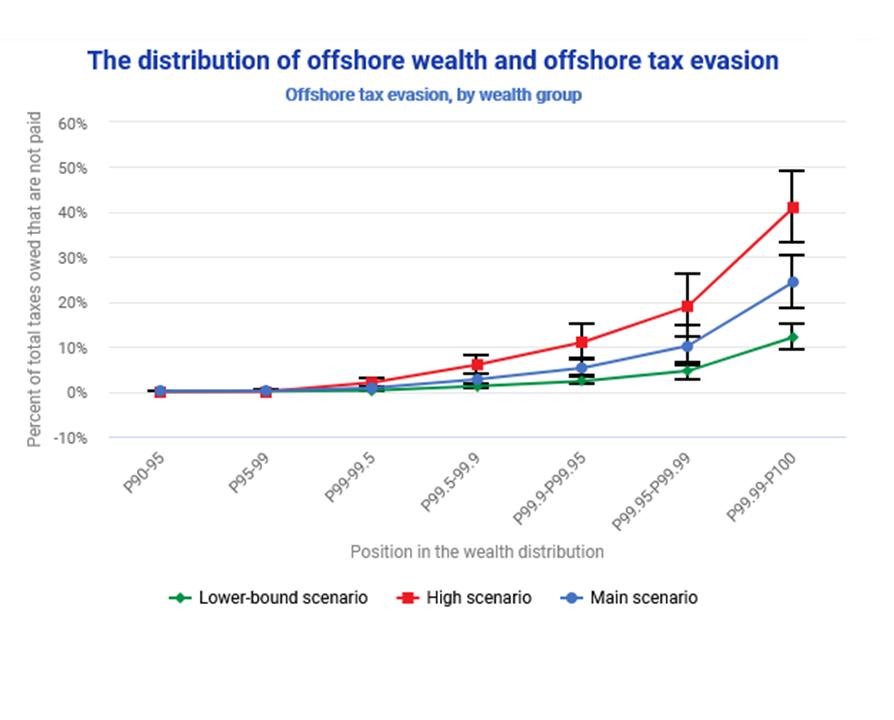

Tax Evasion at the Top of the Income Distribution: Theory and Evidence

Estimating International Tax Evasion by Individuals

Who Owns the Wealth in Tax Havens? Macro Evidence and Implications for Global Inequality

What do external statistics tell us about undeclared assets held abroad and tax evasion?

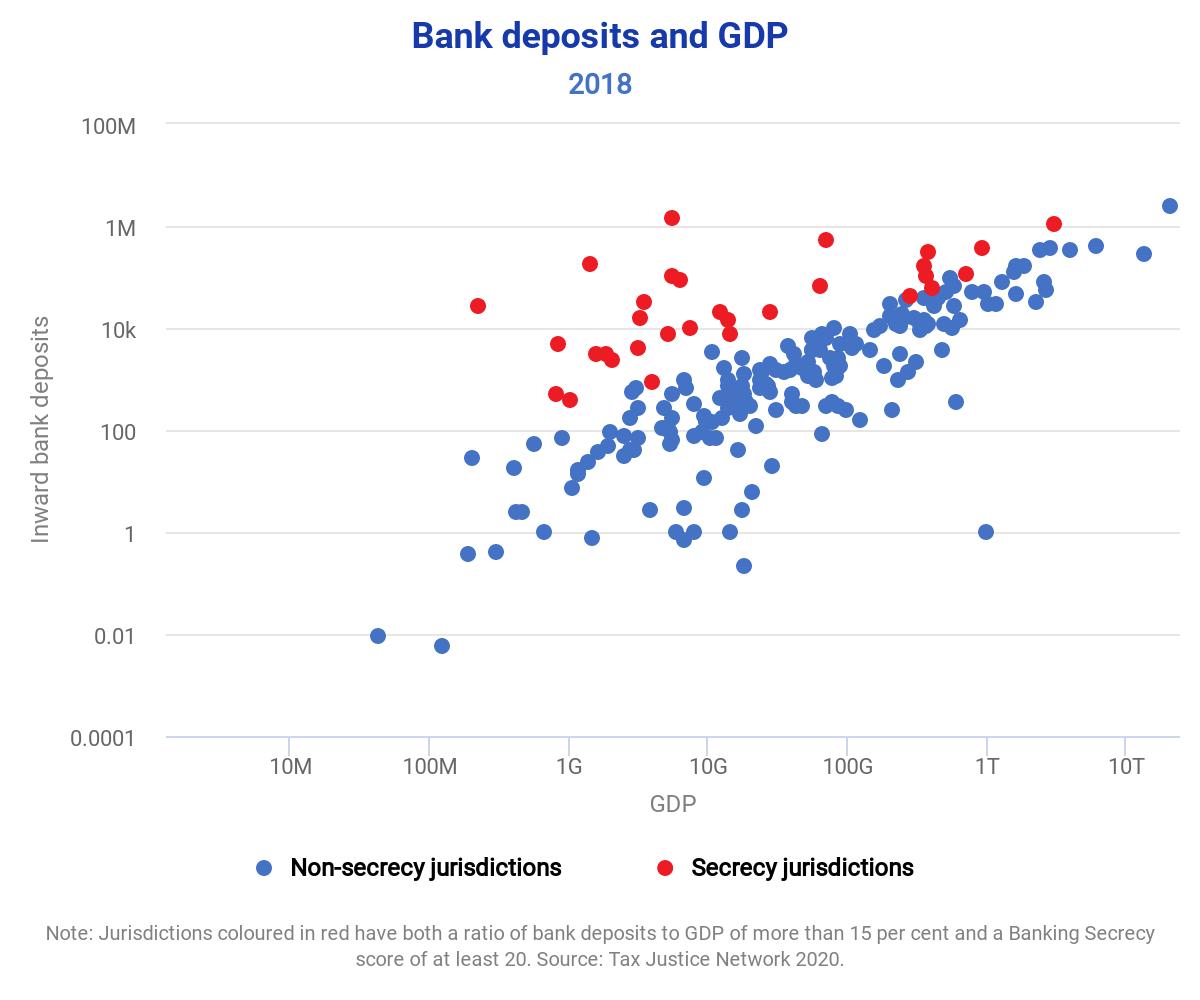

The State of Tax Justice 2020: Tax Justice in the time of COVID-19

Tax Evasion and Inequality